Understanding the ins and outs of auto refinancing can save you significant money over the life of your loan. 1st Investors Financial Services is a prominent name in the auto refinance landscape, and this article dives deep into 1st Investors Financial Services Auto Refinance Reviews, examining their offerings, benefits, and potential drawbacks to help you make an informed decision.

Understanding Auto Refinancing and 1st Investors Financial Services

Auto refinancing involves replacing your existing car loan with a new one, often with a lower interest rate or better terms. This can translate to lower monthly payments, significant interest savings over the life of the loan, or even shortening your loan term. 1st Investors Financial Services offers a platform for auto refinancing, connecting borrowers with potential lenders. But what do the reviews say? Let’s explore.

Examining 1st Investors Financial Services Auto Refinance Reviews

When considering refinancing, it’s crucial to research potential lenders and platforms. Looking at 1st investors financial services auto refinance reviews provides valuable insights into the customer experience. These reviews often highlight various aspects, including:

- Interest rates and loan terms: Reviews can offer insight into the competitiveness of 1st Investors Financial Services’ interest rates and loan terms compared to other lenders.

- Customer service: Reviews frequently discuss the quality of customer service, addressing responsiveness, helpfulness, and overall experience.

- Application process: The ease and efficiency of the application process are often key points in customer reviews.

- Approval process: Reviews can shed light on the speed and transparency of the loan approval process.

“Finding a trustworthy auto refinance provider can be challenging,” says John Miller, Senior Financial Advisor at Millennial Wealth Management. “Looking into reviews is an essential step in due diligence.”

Navigating the Auto Refinance Process with 1st Investors Financial Services

1st investors financial services auto can simplify the refinancing process. Here’s a general overview:

- Check your credit score: A strong credit score can help you secure a lower interest rate.

- Gather necessary documents: This typically includes information about your current loan and vehicle.

- Apply online: 1st Investors Financial Services offers a convenient online application process.

- Compare offers: Once approved, you’ll likely receive multiple loan offers. Compare them carefully to choose the best fit.

- Finalize the loan: Once you select a loan, you’ll complete the necessary paperwork to finalize the refinancing process.

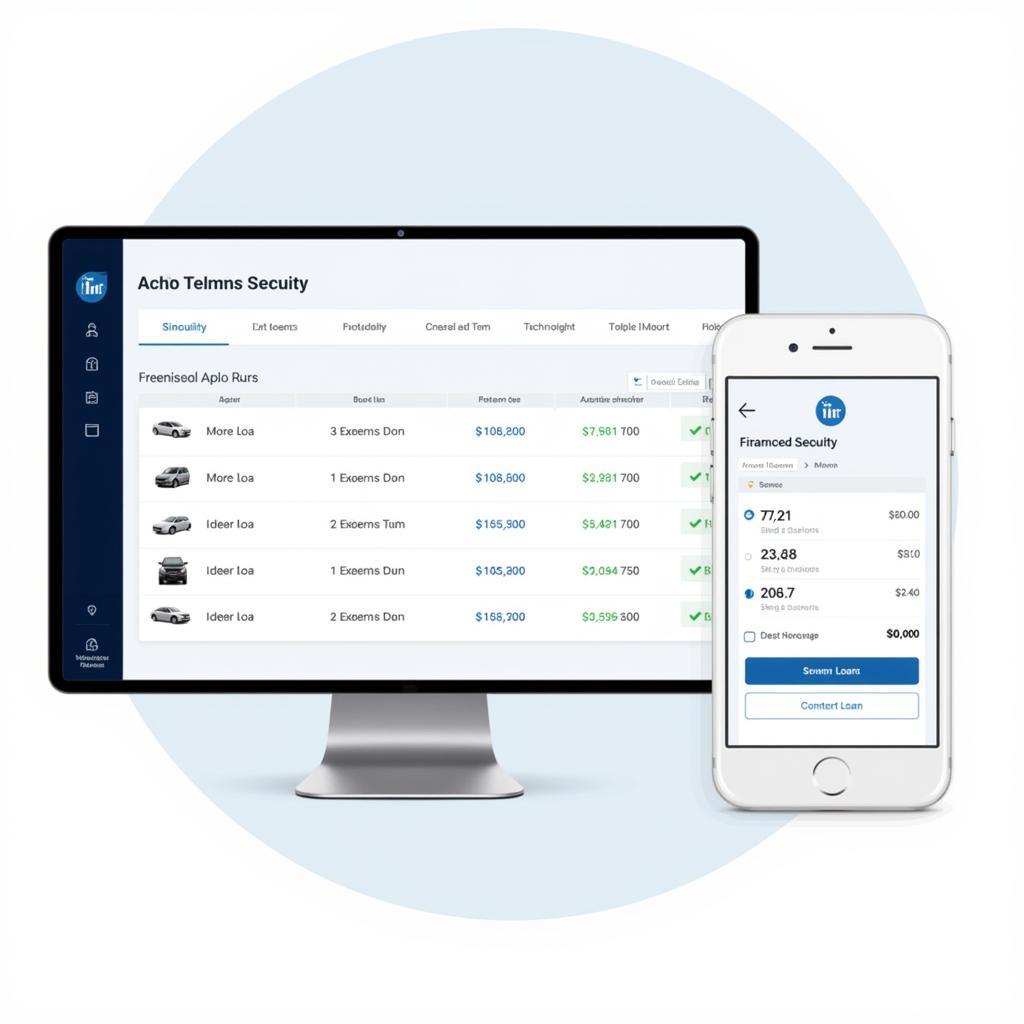

Comparing Auto Loan Offers on 1st Investors Financial Services

Comparing Auto Loan Offers on 1st Investors Financial Services

Benefits and Drawbacks: What to Consider

Like any financial decision, auto refinancing with 1st Investors Financial Services has potential benefits and drawbacks. Understanding these can help you make a well-informed choice.

Benefits:

- Potential for lower interest rates: This translates to lower monthly payments and overall savings.

- Improved loan terms: You might be able to shorten your loan term or adjust other aspects to better suit your financial goals.

- Simplified process: 1st Investors Financial Services streamlines the process, making it easier to compare offers and refinance.

Drawbacks:

- Impact on credit score: Applying for multiple loans can potentially lower your credit score.

- Potential fees: Some lenders may charge fees for refinancing. Carefully review the terms and conditions.

“It’s crucial to weigh the pros and cons based on your individual circumstances,” advises Maria Sanchez, Lead Auto Finance Specialist at Auto Loans Direct. “Consider your financial goals and existing loan terms before making a decision.”

Conclusion: Making Informed Decisions with 1st Investors Financial Services Auto Refinance Reviews

1st investors financial services auto can be a viable option for auto refinancing. By carefully considering 1st investors financial services auto refinance reviews, understanding the process, and weighing the potential benefits and drawbacks, you can make an informed decision that aligns with your financial goals. Thoroughly research and compare offers to secure the best possible terms for your auto loan.

FAQ

- What is auto refinancing?

- How does 1st Investors Financial Services work?

- How can I check my credit score?

- What documents do I need to refinance my car?

- What are the potential benefits of refinancing?

When you need support, please contact WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.

Leave a Reply