When a borrower defaults on an auto loan, lenders often turn to ACES auto collateral recovery services to repossess the vehicle. While it’s a situation no one wants to be in, understanding how these services work can be helpful for both borrowers and lenders.

ACES Repossession Process

ACES Repossession Process

How ACES Auto Collateral Recovery Services Work

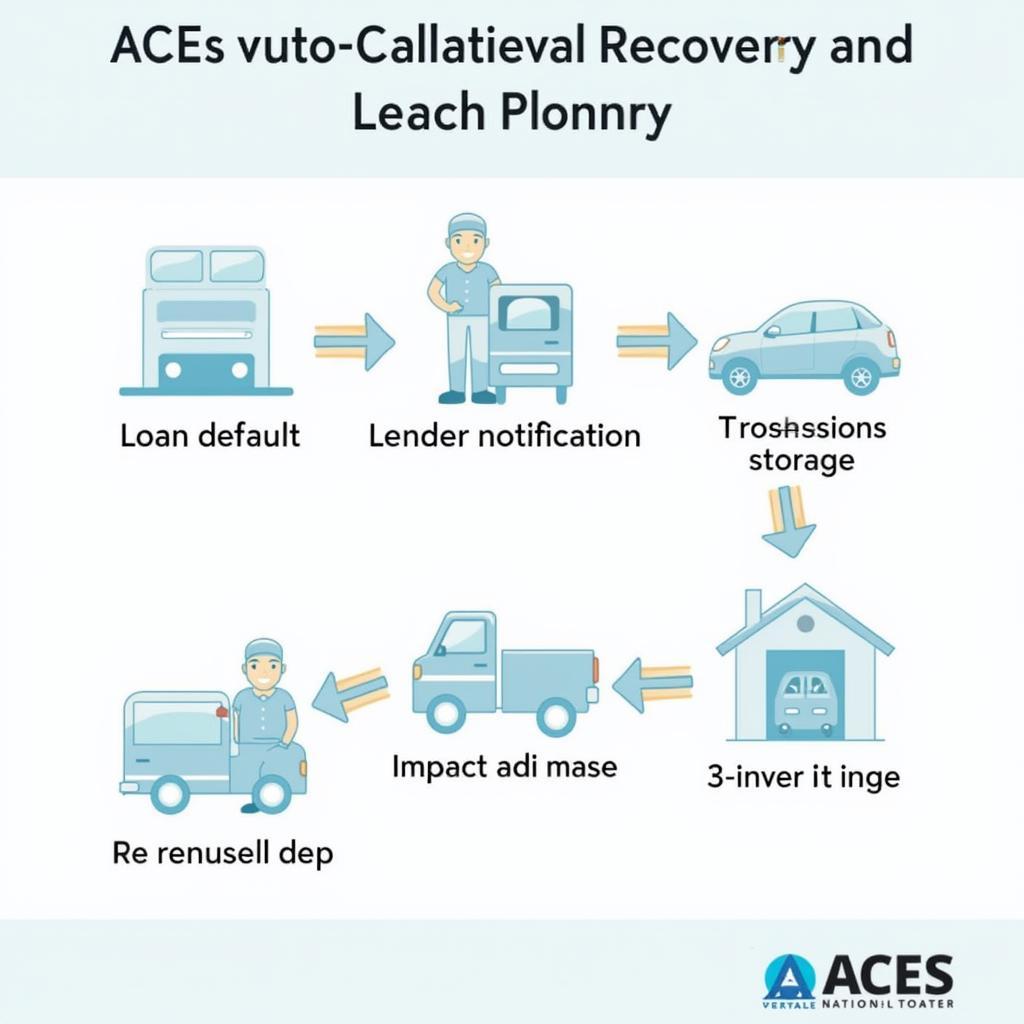

ACES, the Asset Management and Collateral Evaluation System, is a widely used platform for managing collateral recovery. Here’s a breakdown of the typical process:

- Loan Default: When a borrower misses a certain number of payments, the loan is considered in default.

- Lender Notification: The lender notifies ACES and initiates the repossession process.

- Vehicle Location: ACES uses various methods to locate the vehicle, including license plate recognition software and skip tracing techniques.

- Repossession: Once the vehicle is located, a licensed recovery agent repossesses it. It’s important to note that repossession agents must follow specific legal guidelines.

- Storage: The recovered vehicle is taken to a secure storage facility.

Rights and Responsibilities During Repossession

Both borrowers and lenders have certain rights and responsibilities during the repossession process:

Borrower Rights:

- Breach of Peace: Repossession agents cannot “breach the peace” when taking a vehicle. This means they cannot use physical force, threats, or enter private property without permission.

- Personal Property: Borrowers have the right to remove personal belongings from the vehicle before it is towed away.

- Redemption Rights: In some cases, borrowers may have the opportunity to reclaim the vehicle by paying off the loan balance and any associated fees.

Lender Responsibilities:

- Legal Compliance: Lenders are responsible for ensuring that repossession agents operate within the law.

- Notification: Lenders are often required to notify borrowers of the impending repossession, although specific laws vary by state.

- Sale of Vehicle: After repossession, lenders are typically required to sell the vehicle in a commercially reasonable manner.

Understanding Repossession Laws

Understanding Repossession Laws

Minimizing the Risk of Repossession

Facing repossession is stressful, but there are steps borrowers can take to prevent it or mitigate the consequences:

- Communication is Key: If you anticipate difficulty making a payment, reach out to your lender immediately. They may be willing to work with you on a payment plan or loan modification.

- Explore Alternatives: Consider refinancing the loan, selling the vehicle privately, or voluntarily surrendering it to the lender to avoid the negative impact of repossession on your credit score.

- Know Your Rights: Familiarize yourself with your state’s laws regarding repossession to ensure your rights are protected.

FAQs about ACES Auto Collateral Recovery Services

1. Can my car be repossessed if it’s parked in my garage?

Laws vary by state, but generally, if the garage is attached to your home and the door is closed, repossession agents cannot enter without a court order.

2. What happens to my belongings if my car is repossessed?

You have the right to remove personal belongings from your vehicle before it’s towed. However, if items are left behind, the lender is typically responsible for storing them for a reasonable time period.

3. Can I get my car back after it’s been repossessed?

You may have the option to “redeem” the vehicle by paying the full loan balance, along with any repossession and storage fees.

4. How does repossession affect my credit score?

Repossession will have a negative impact on your credit score, making it harder to secure future loans.

5. How can I find a reputable auto collateral recovery company?

Look for a company with a proven track record, certified and experienced recovery agents, and a commitment to ethical and legal practices. You can also check for online reviews and ratings.

Need Assistance?

Navigating the complexities of auto collateral recovery can be challenging. For 24/7 support and expert guidance, reach out to our team via WhatsApp: +1(641)206-8880 or Email: [email protected].