When you get your car repaired in Georgia, the last thing you want is a surprise on your bill. Understanding sales tax on auto repair services can save you from any unexpected costs. Let’s break down whether you pay sales tax on labor costs for auto repairs in Georgia.

Understanding Sales Tax on Auto Repair in Georgia

In Georgia, sales tax applies to the sale of tangible personal property, including car parts. This means when you purchase parts for your car repair, you will pay sales tax. However, labor costs for auto repair services are generally not subject to sales tax in Georgia.

What Does This Mean for Your Auto Repair Bill?

Let’s say your car needs a new alternator. The alternator itself is considered tangible personal property and will be taxed. However, the labor cost for the mechanic to install the alternator is not taxed.

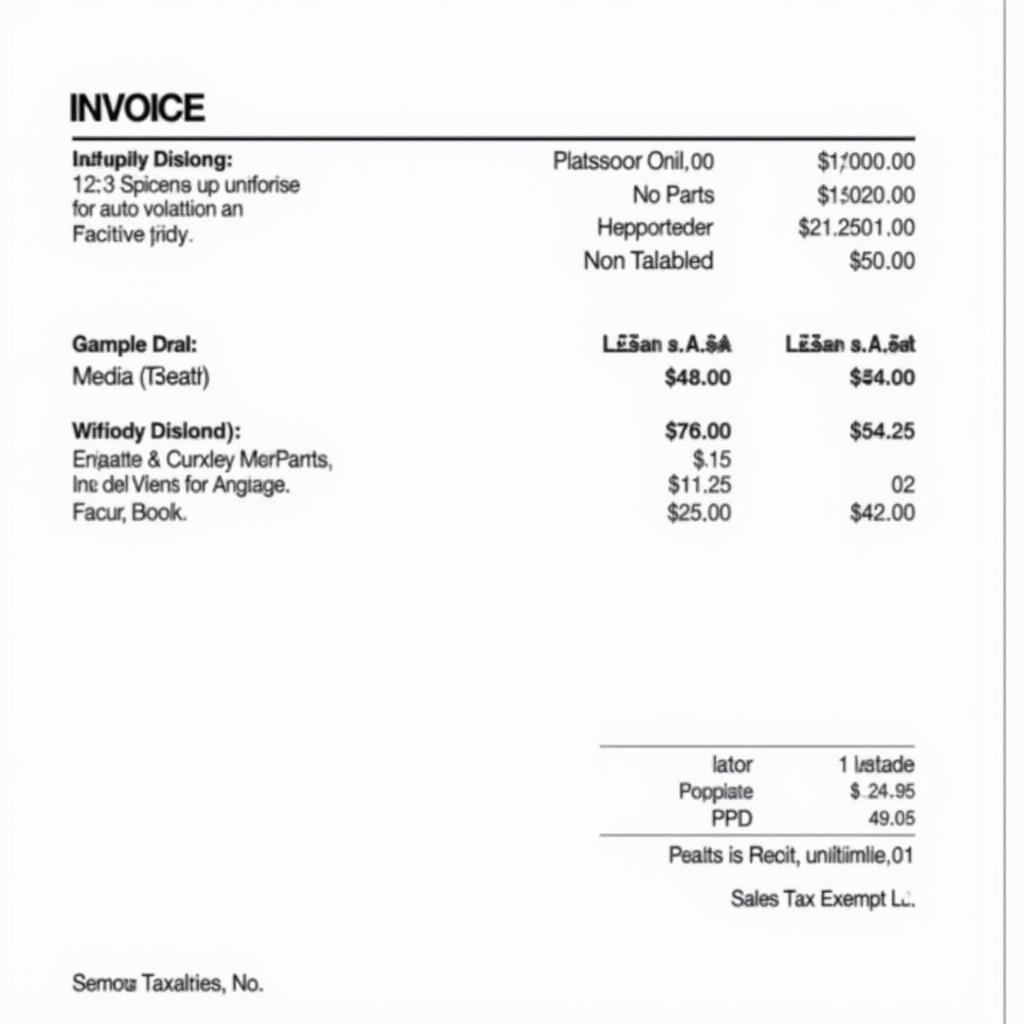

Auto Repair Invoice in Georgia

Auto Repair Invoice in Georgia

Are There Any Exceptions?

While labor for auto repair is generally not taxed in Georgia, some exceptions might apply:

- Parts and Labor Bundled: If a repair shop bundles its parts and labor costs into a single, non-itemized price, sales tax may apply to the entire amount. Always ask for an itemized invoice to see the separate charges.

- Specific Services: Certain services provided by auto repair shops, such as tire disposal fees or hazardous waste removal, might be subject to sales tax.

Tips for Avoiding Sales Tax Surprises

- Ask for an Itemized Invoice: Always request a detailed invoice that separates the cost of parts, labor, and any additional services.

- Inquire About Bundled Services: If you see a bundled price for parts and labor, ask for clarification on how sales tax is applied.

- Check with the Georgia Department of Revenue: If you have specific questions about sales tax on auto repair services, contact the Georgia Department of Revenue directly for the most up-to-date information.

Conclusion

Understanding how sales tax applies to auto repair services in Georgia can help you avoid surprises on your next repair bill. By knowing what to expect and asking the right questions, you can ensure you are only paying the taxes you are legally obligated to pay.

Leave a Reply