Auto refinancing services in Englewood, CO can help you secure a better interest rate and lower your monthly car payments. Whether you’re looking to shorten the term of your loan, lower your monthly payment, or access cash equity, refinancing your car loan can be a smart financial move. This comprehensive guide will help you understand everything you need to know about auto refinancing in Englewood, CO.

Understanding Auto Refinancing in Englewood, CO

Auto refinancing involves replacing your existing car loan with a new one from a different lender. This new loan may offer a lower interest rate, a different loan term, or both. The primary goal of auto refinancing is to save money by reducing the overall cost of your vehicle financing.

Benefits of Auto Refinancing Services Englewood CO

Refinancing your auto loan in Englewood, CO can provide several advantages:

- Lower Monthly Payments: A lower interest rate can significantly reduce your monthly car payment, freeing up cash flow for other expenses.

- Reduced Interest Costs: Over the life of the loan, a lower interest rate translates to less money paid in interest overall.

- Shorter Loan Term: You can opt for a shorter loan term to pay off your car faster and build equity more quickly.

- Cash-Out Refinancing: If you have significant equity in your vehicle, you can refinance for a larger amount and receive the difference in cash.

How Auto Refinancing Works in Englewood, CO

The auto refinancing process is relatively straightforward:

- Check Your Credit Score: A good credit score is crucial for securing favorable refinancing terms.

- Research Lenders: Compare interest rates, loan terms, and fees from various lenders in Englewood, CO.

- Apply for Pre-Approval: Get pre-approved by multiple lenders to compare offers without impacting your credit score.

- Choose a Lender: Select the lender that offers the best terms and conditions.

- Finalize the Loan: Complete the necessary paperwork and transfer your car title to the new lender.

Finding the Best Auto Refinancing Services Englewood CO

When searching for auto refinancing services in Englewood, CO, consider the following:

- Interest Rates: Look for competitive interest rates that are lower than your current rate.

- Loan Terms: Choose a loan term that aligns with your financial goals.

- Fees: Be aware of any fees associated with refinancing, such as application fees or prepayment penalties.

- Customer Service: Select a lender with a reputation for excellent customer service.

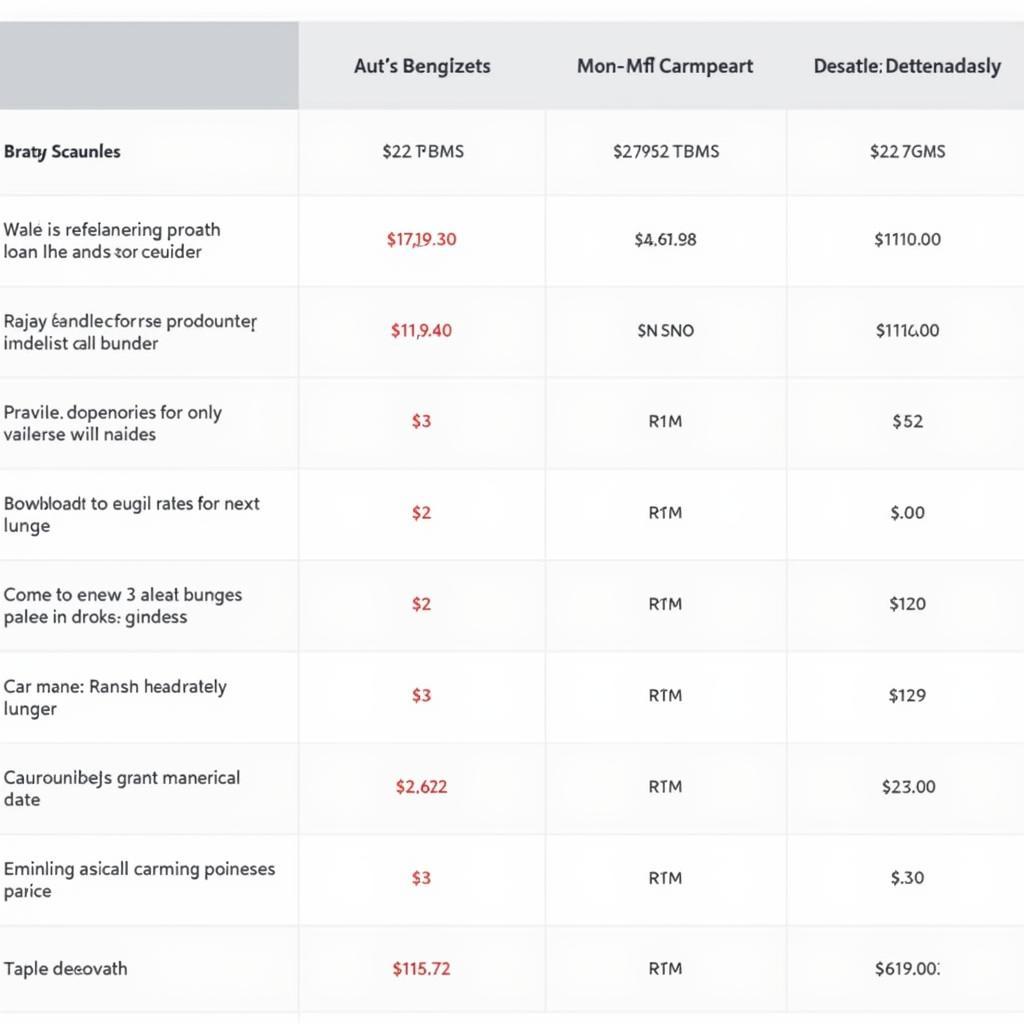

Comparing Englewood Auto Refinancing Lenders

Comparing Englewood Auto Refinancing Lenders

Is Auto Refinancing Right for You?

Auto refinancing isn’t always the best option for everyone. Consider refinancing if:

- Interest rates have dropped: If interest rates have decreased since you took out your original loan, you could potentially save money by refinancing.

- Your credit score has improved: A better credit score can qualify you for lower interest rates.

- You want to lower your monthly payment: Refinancing can help you achieve more manageable monthly payments.

“Refinancing can be a powerful tool for saving money on your car loan,” says John Miller, a senior financial advisor at Mountain View Financial. “But it’s important to compare offers from multiple lenders to ensure you’re getting the best possible deal.”

Navigating Auto Refinancing in Englewood, CO with Bad Credit

Even with bad credit, auto refinancing may still be an option. Some lenders specialize in auto loans for borrowers with less-than-perfect credit. Be prepared for potentially higher interest rates.

“Don’t be discouraged if you have bad credit,” advises Susan Davis, a loan officer at Englewood Auto Finance. “There are still lenders who are willing to work with you. Improving your credit score before you apply can significantly increase your chances of getting approved for a lower interest rate.”

Conclusion: Secure Lower Car Payments with Auto Refinancing Services Englewood CO

Auto refinancing services in Englewood, CO offer a valuable opportunity to save money and improve your financial situation. By carefully researching lenders, comparing offers, and understanding the refinancing process, you can make an informed decision that benefits your budget. Start exploring your options today.

FAQ

- What documents do I need for auto refinancing? Typically, you’ll need proof of income, your car title, and your current loan information.

- How long does the auto refinancing process take? The process can take anywhere from a few days to a couple of weeks.

- Will auto refinancing hurt my credit score? Applying for multiple loans within a short period can slightly lower your credit score.

- Can I refinance a car loan with negative equity? It might be difficult, but some lenders offer options for refinancing with negative equity.

- What is the difference between auto refinancing and auto loan modification? Refinancing involves replacing your loan with a new one, while modification involves changing the terms of your existing loan.

- How often can I refinance my car loan? You can refinance your car loan as often as you like, but it’s important to weigh the costs and benefits each time.

- Can I refinance a leased vehicle? Typically, you cannot refinance a leased vehicle.

Need help? Contact us on WhatsApp: +1(641)206-8880, Email: [email protected]. We have a 24/7 customer support team.