Western Financial Services Auto Loan offers a convenient way to finance your dream car. This guide will explore the ins and outs of securing an auto loan through Western Financial Services, helping you navigate the process with confidence and make informed decisions. We’ll cover everything from understanding interest rates to managing your loan effectively.

Understanding Western Financial Services Auto Loans

Western Financial Services provides a range of auto loan options designed to cater to diverse financial situations. They offer competitive interest rates and flexible repayment terms, making car ownership accessible to a wider audience. Whether you’re looking to buy a new or used vehicle, understanding the specifics of their loan programs is crucial. One of the key benefits of choosing Western Financial Services is their commitment to customer service. They strive to provide a personalized experience, guiding you through each step of the loan process.

What are the Benefits of a Western Financial Services Auto Loan?

Choosing the right auto loan can significantly impact your financial well-being. Western Financial Services offers several advantages, including competitive interest rates, flexible loan terms, and a streamlined application process. Their online platform allows you to pre-qualify for a loan without impacting your credit score, giving you a clear idea of what you can afford before visiting a dealership. They also offer various resources to help you understand the loan process and manage your finances effectively.

Western Financial Services Auto Loan Application Process

Western Financial Services Auto Loan Application Process

What are the Eligibility Requirements?

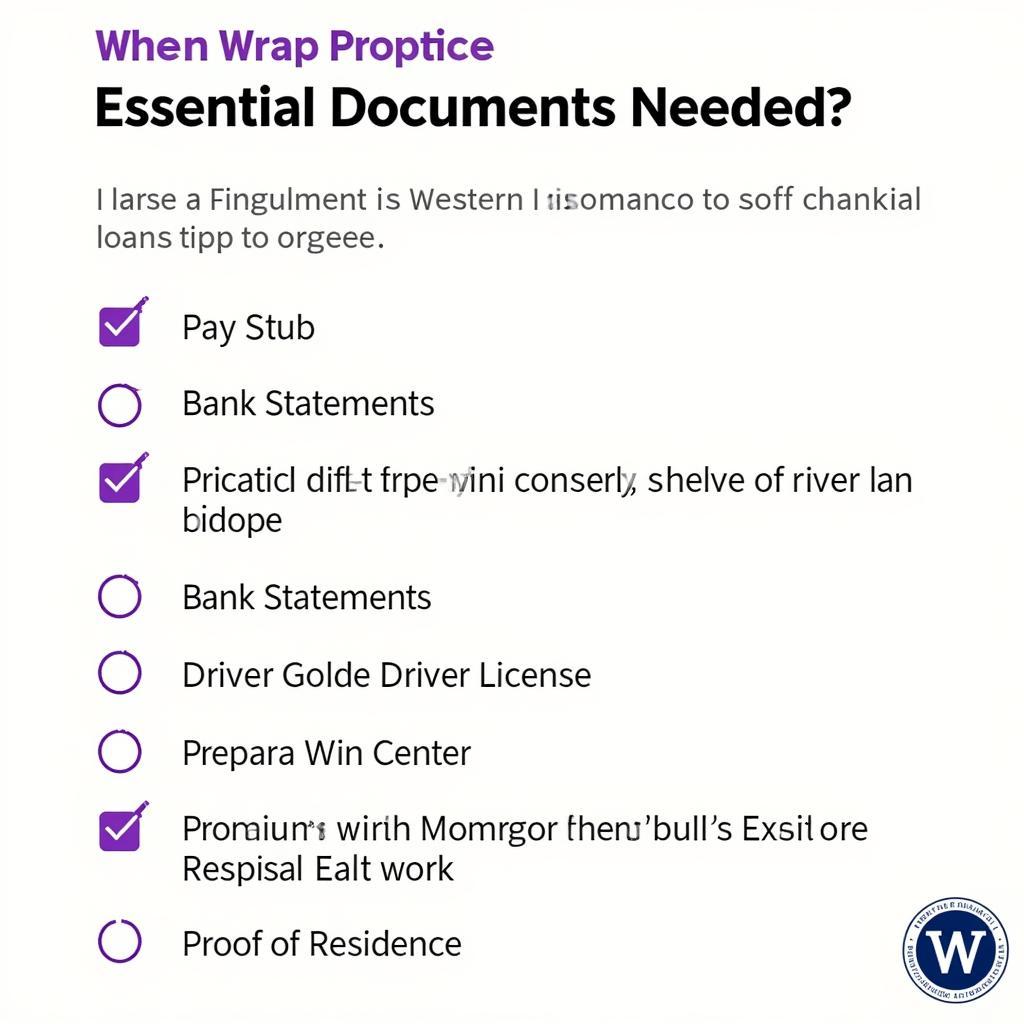

Like most lenders, Western Financial Services has specific eligibility requirements for their auto loans. These typically include a minimum credit score, proof of income, and a valid driver’s license. The specific criteria may vary depending on the loan amount and the type of vehicle you are purchasing. It’s important to review their guidelines carefully before applying to ensure you meet their requirements.

Navigating the Application Process for a Western Financial Services Auto Loan

Applying for a western financial services auto loan is designed to be straightforward. You can begin the process online by pre-qualifying, which allows you to check potential loan terms without affecting your credit score. Once pre-qualified, you can complete the full application, providing the necessary documentation. Western Financial Services aims to provide quick loan decisions, helping you move forward with your car purchase efficiently.

Tips for a Smooth Application Process

Preparing in advance can streamline the application process. Gather all necessary documents, including proof of income, residence, and identification. Having these readily available will expedite the review process. Additionally, review your credit report beforehand and address any potential issues. A strong credit score can improve your chances of securing favorable loan terms.

Western Financial Services Auto Loan Required Documents

Western Financial Services Auto Loan Required Documents

How to Manage Your Western Financial Services Auto Loan

Once you’ve secured your western financial services auto loan, managing it effectively is essential. Set up automatic payments to avoid late fees and ensure timely payments. Review your loan agreement carefully and understand the terms and conditions. If you encounter any financial difficulties, communicate with Western Financial Services promptly. They may offer options to help you manage your payments.

Western Financial Services Auto Loan FAQs

Here are some frequently asked questions regarding western financial services auto loans:

-

What types of vehicles does Western Financial Services finance? They finance both new and used cars, trucks, and SUVs.

-

Can I pre-qualify for a loan online? Yes, you can pre-qualify without impacting your credit score.

-

How long does the application process take? They strive to provide quick decisions, often within a few business days.

-

What are the typical loan terms? Loan terms vary but typically range from 36 to 72 months.

-

Can I make extra payments on my loan? Yes, extra payments are allowed and can help you pay off your loan faster and save on interest.

-

What if I have bad credit? While a good credit score is preferred, they may offer options for individuals with less perfect credit. Contact them directly to discuss your specific situation.

-

How do I contact customer service? You can reach their customer service department through their website or by phone.

Western Financial Services Auto Loan Customer Support

Western Financial Services Auto Loan Customer Support

Conclusion

A western financial services auto loan can be a viable option for financing your next vehicle. By understanding the application process, loan terms, and management strategies, you can confidently navigate the process and make informed decisions that align with your financial goals. Remember to compare their offerings with other lenders to ensure you are getting the best possible deal.

For further assistance and inquiries, please don’t hesitate to contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our 24/7 customer support team is ready to help.

You might also be interested in our other articles on auto financing and car maintenance. Check out our resources on choosing the right car insurance and negotiating car prices. We are committed to providing you with the information you need to make informed decisions throughout your car ownership journey.

Leave a Reply