Auto Services Tax Rates can be a confusing topic for both consumers and business owners. Understanding how these taxes are calculated and applied is crucial for budgeting, financial planning, and ensuring compliance with local regulations. This comprehensive guide will delve into the intricacies of auto services tax rates, providing valuable insights and practical advice. It will explore the various factors influencing these rates and offer clear explanations to help you navigate this complex landscape. Let’s get started!

alma auto service and sales offers a variety of services, and understanding their associated tax rates is essential.

Decoding the Components of Auto Services Tax Rates

Auto services tax rates are typically composed of several different taxes, including state and local sales taxes, excise taxes, and in some cases, even environmental fees. These rates vary significantly depending on geographical location, the specific service provided, and even the value of the vehicle being serviced. For instance, a simple oil change might be subject to a different tax rate compared to a major engine repair.

State and Local Sales Taxes on Auto Services

Most states levy a sales tax on auto services, which is a percentage of the total cost of labor and parts. These rates can differ considerably from state to state, impacting the final bill significantly. Local municipalities can also add their own sales taxes on top of the state rate, further complicating calculations. Understanding these variations is key to accurately estimating the overall cost of auto services.

What factors influence state and local auto service tax rates? Several elements play a role, including local economic conditions, infrastructure needs, and legislative priorities.

Excise Taxes and Their Impact on Auto Services

Excise taxes are levied on specific goods and services, often including auto-related items like tires, batteries, and even gasoline. These taxes can be incorporated into the overall cost of auto services, especially when these items are replaced during a repair or maintenance visit. It’s important to be aware of these hidden costs, as they can add up quickly.

Understanding the Application of Excise Taxes

Excise taxes are often implemented to generate revenue for specific purposes, such as highway maintenance or environmental protection programs. Their impact on auto services varies depending on the type of service and the materials used. For instance, a tire rotation might not involve excise taxes, but replacing all four tires certainly would. Therefore, it’s crucial to inquire about potential excise taxes when obtaining an estimate for auto services.

Are there exemptions to excise taxes on auto services? Some states offer exemptions for certain types of vehicles or services, typically for agricultural or commercial purposes.

Navigating Auto Service Taxes as a Business Owner

For auto service business owners, understanding and correctly applying tax rates is paramount for legal compliance. Failure to do so can result in penalties, fines, and damage to your business reputation. Maintaining accurate records and staying informed about any changes in tax regulations is essential for successful business operation.

auto entrepreneur prestation de service and other businesses must accurately apply auto service tax rates.

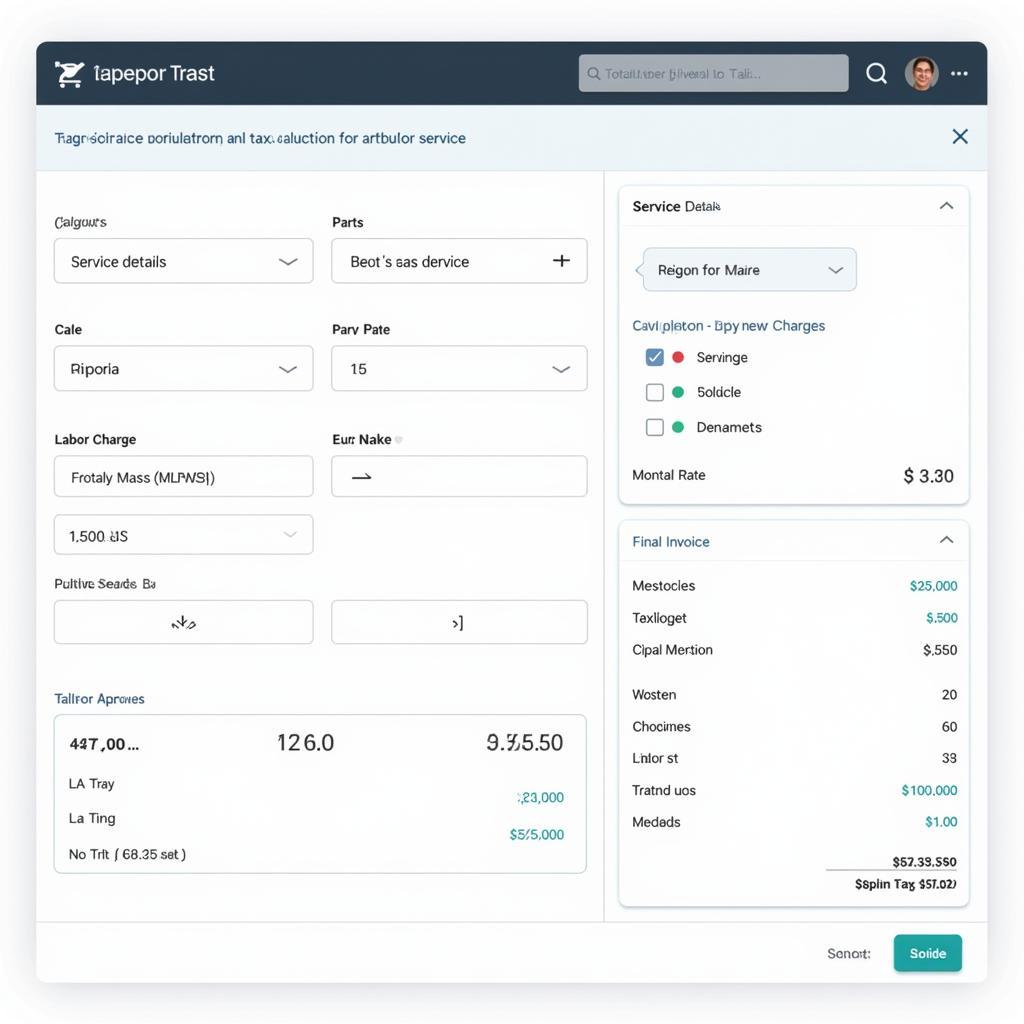

Strategies for Accurate Tax Calculation and Compliance

Several tools and resources are available to help auto service businesses navigate the complexities of tax regulations. Specialized software can automate tax calculations, ensuring accuracy and minimizing the risk of errors. Consulting with a tax professional can also provide valuable guidance and support.

auto service invoice template can be helpful for accurate invoicing.

Screenshot of auto service tax calculation software interface

Screenshot of auto service tax calculation software interface

Conclusion

Understanding auto services tax rates is crucial for both consumers and businesses in the automotive industry. By being aware of the various components of these rates, including state and local sales taxes and excise taxes, you can make informed decisions and avoid unexpected costs. Staying informed about changes in tax regulations and utilizing available resources can ensure compliance and contribute to a smoother auto service experience. Keep these factors in mind when considering your next auto service.

FAQ

- What are the average auto services tax rates in my state?

- How are excise taxes calculated on auto parts?

- Are there any tax deductions related to auto services for businesses?

- What are the penalties for incorrect application of auto service taxes?

- Where can I find updated information on auto services tax rates?

- How do auto services tax rates impact my overall car maintenance budget?

- Can I claim back overpaid auto services taxes?

auto entrepreneur facture prestation de service has information about invoicing for auto services, which can help with understanding tax rates.

Need more help with auto titles? Check out auto title services harris county tx.

For any assistance, feel free to reach out via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our customer service team is available 24/7.