Auto loan servicing companies play a crucial role in the auto finance landscape. They manage the day-to-day administrative tasks associated with your car loan, from collecting payments to handling escrow accounts and answering customer inquiries. Choosing the right company can significantly impact your borrowing experience. Let’s delve into the world of auto loan servicing and explore how these companies operate.

What is an Auto Loan Servicing Company?

An Auto Loan Servicing Company acts as an intermediary between the lender (who provides the funds for your car loan) and the borrower (you). They handle the administrative aspects of your loan, ensuring timely payments, accurate record-keeping, and efficient customer service. Think of them as the administrative engine that keeps your loan running smoothly. They may be a separate entity or a department within the lending institution itself. You’ll interact with the servicing company for most of your loan’s lifespan, making their role crucial for a positive borrowing experience. Check out our information about auto loan servicing for a more in-depth understanding.

How Do Auto Loan Servicing Companies Work?

Once you secure your auto loan, the servicing company takes over the ongoing management. They send you monthly statements, collect your payments, and manage your escrow account (if applicable) for property taxes and insurance. They’re also your point of contact for any questions or concerns about your loan, from payment changes to payoff information.

Key Responsibilities of an Auto Loan Servicing Company:

- Payment Processing: Collecting your monthly payments and applying them to your loan balance, interest, and any additional fees.

- Escrow Account Management: If your loan requires an escrow account, they manage payments for property taxes, insurance, and other related expenses.

- Customer Service: Answering your questions, addressing concerns, and providing assistance with loan-related matters.

- Delinquency Management: Following up on missed payments and working with borrowers to prevent loan default.

- Payoff Processing: Providing payoff quotes and processing final payments.

Choosing the Right Auto Loan Servicing Company

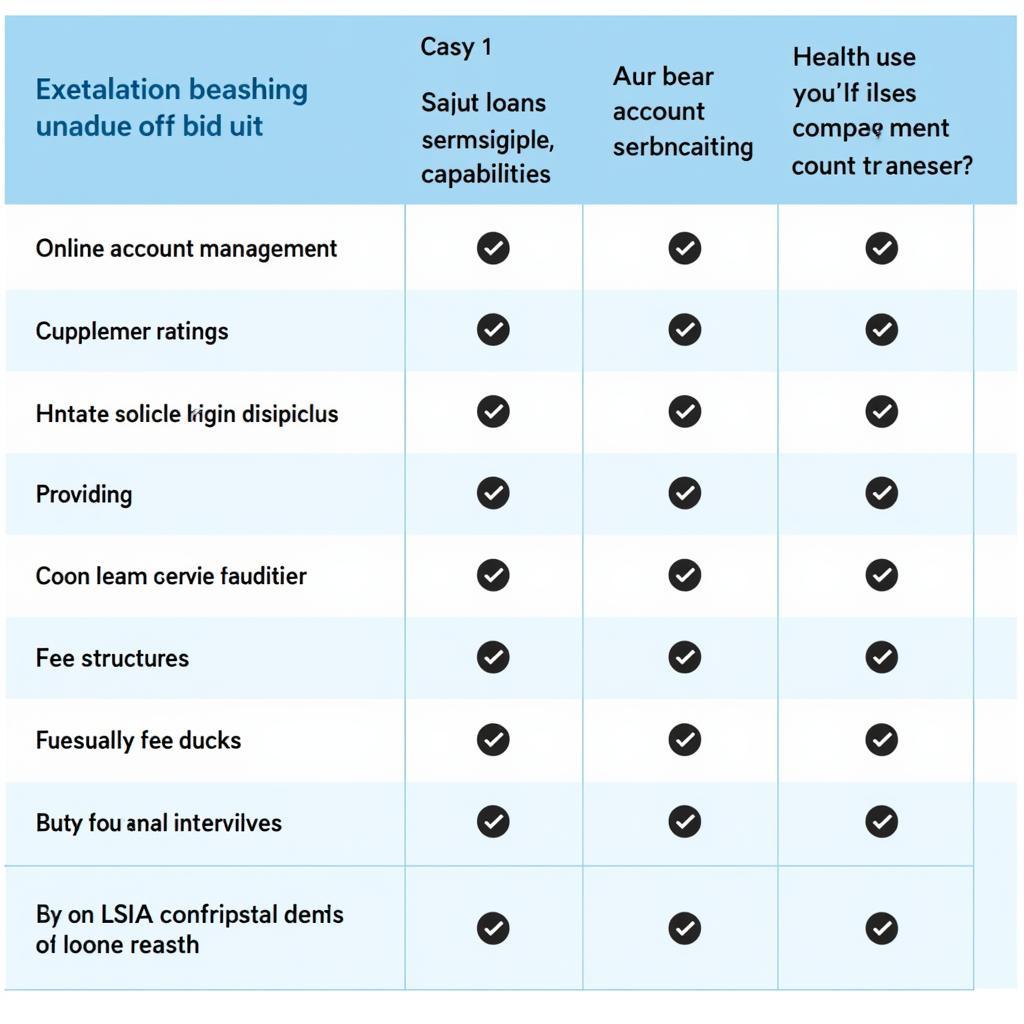

While you often don’t get to choose which company services your loan, understanding their role and qualities to look for can be beneficial. A good servicing company offers:

- Excellent Customer Service: Responsive, helpful, and easily accessible customer support channels.

- Online Account Management: A convenient online portal to access loan information, make payments, and manage account details.

- Transparent Communication: Clear and concise communication regarding loan terms, payments, and any changes.

- Efficient Processes: Streamlined procedures for payments, escrow management, and other loan-related tasks.

You can find information on specific auto services in Boynton Beach on our website.

Why is Understanding Auto Loan Servicing Important?

A thorough understanding of auto loan servicing empowers you as a borrower. It helps you navigate the loan process confidently, manage your finances effectively, and maintain a positive relationship with the servicing company. This knowledge can prevent misunderstandings, facilitate smooth communication, and ensure a hassle-free loan experience. Learn more about the details of the auto loan servicing process.

Benefits of understanding auto loan servicing:

- Avoid Late Payment Penalties: Knowing how and when to make payments prevents costly penalties.

- Manage Your Escrow Account Effectively: Understand how your escrow account is managed and how it impacts your overall loan cost.

- Resolve Issues Quickly: Knowing who to contact and how to communicate effectively can expedite issue resolution.

Choosing the Right Auto Loan Servicing Company

Choosing the Right Auto Loan Servicing Company

Common Questions About Auto Loan Servicing Companies

What if I have a dispute with my auto loan servicing company?

How do I change my payment due date?

Can I pay off my auto loan early?

What happens if my auto loan servicing company goes out of business?

Who do I contact if I have questions about my escrow account?

How do I request a payoff quote?

What if I can’t afford my monthly payments?

Auto Loan Servicing Companies: A Key Component of Auto Finance

Auto loan servicing companies are integral to the auto finance ecosystem. They ensure the efficient administration of your loan, facilitating a smooth borrowing experience for both lenders and borrowers. Understanding their role and functions is essential for anyone navigating the world of auto finance. Learn more about auto service finance companies house for a broader perspective.

For further assistance, you can explore our auto help line service provider application.

In conclusion, understanding auto loan servicing companies is crucial for a successful borrowing experience. By understanding their role and responsibilities, you can effectively manage your auto loan and avoid potential pitfalls.

FAQ

- What is the primary function of an auto loan servicing company? They manage the administrative tasks associated with your car loan.

- Who do I contact with questions about my loan payments? Your auto loan servicing company.

- What is an escrow account? An account managed by the servicing company to pay property taxes and insurance.

- Can I choose my auto loan servicing company? Often not, as it’s typically determined by the lender.

- How can I access my loan information? Usually through an online portal provided by the servicing company.

- What happens if I miss a payment? Contact your auto loan servicing company immediately to discuss options.

- How do I get a payoff quote? Contact your auto loan servicing company and request a payoff quote.

For any further questions or assistance, feel free to reach out to us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our customer service team is available 24/7.

Leave a Reply