Auto Dealer Merchant Processing Services are essential for any modern car dealership looking to thrive. These services facilitate smooth and efficient transactions, allowing your customers to purchase vehicles and services with ease using various payment methods. Choosing the right provider can significantly impact your bottom line, customer satisfaction, and overall operational efficiency.

As a leading auto service expert, I understand the importance of seamless payment processing in today’s fast-paced automotive industry. This article will delve into the intricacies of auto dealer merchant processing services, exploring their benefits, key features, and how to choose the right solution for your dealership. We’ll also discuss the crucial role these services play in enhancing customer experience and driving business growth. After the introduction, you can find more information about auto dealer merchant processing services auto dealer merchant processing services.

Understanding Auto Dealer Merchant Processing Services

Auto dealer merchant processing services are specifically tailored to meet the unique needs of car dealerships. They handle various transaction types, including credit and debit card payments, financing options, and even online transactions. These services streamline the payment process, reducing paperwork, minimizing errors, and accelerating the sales cycle.

Key Features of Effective Merchant Processing Solutions

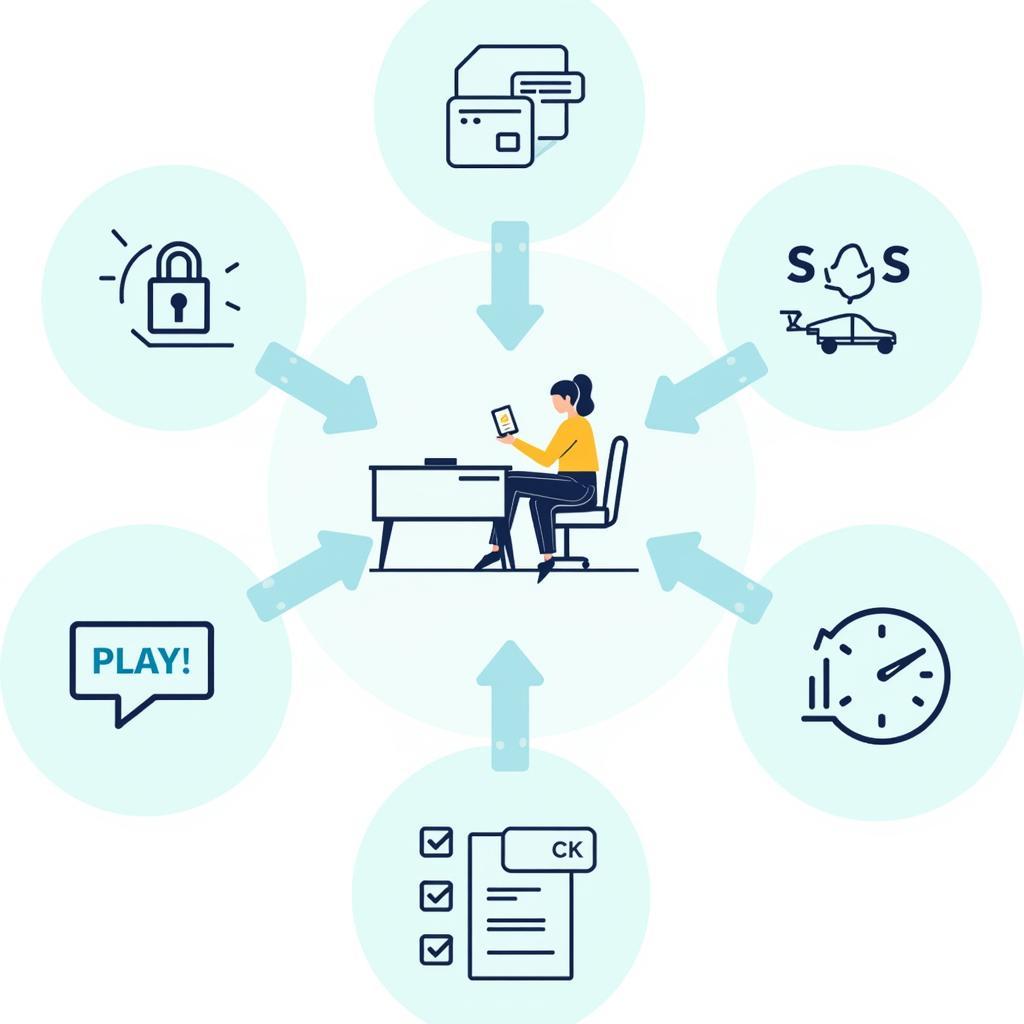

A robust auto dealer merchant processing service should offer a range of features, including:

- Multiple Payment Options: Accepting all major credit and debit cards, as well as alternative payment methods like mobile wallets, is crucial for catering to a diverse customer base.

- Integrated Payment Gateway: A seamless integration with your dealership management system (DMS) simplifies accounting, reporting, and reconciliation.

- Advanced Fraud Protection: Security is paramount. Look for services with robust fraud detection and prevention tools to protect your business and your customers.

- Recurring Billing: This feature is essential for managing service contracts, subscription-based services, and loan repayments.

- Detailed Reporting and Analytics: Access to comprehensive transaction data provides valuable insights into sales trends, customer behavior, and overall business performance.

Benefits of Auto Dealer Merchant Processing

Benefits of Auto Dealer Merchant Processing

Choosing the Right Auto Dealer Merchant Processing Service

Selecting the ideal merchant processing service requires careful consideration of your dealership’s specific requirements. Factors to consider include transaction volume, average transaction value, and the types of payment methods you need to accept. Evaluating different providers based on their fees, features, and customer support is critical. For in-depth reviews and comparisons, check out our auto merchant services credit card processing reviews auto merchant services credit card processing reviews.

Questions to Ask Potential Providers

When evaluating potential providers, ask the following questions:

- What are your transaction fees and other associated costs?

- What level of security do you offer against fraud?

- How does your service integrate with my existing DMS?

- What kind of customer support do you provide?

- What are your contract terms and cancellation policies?

Enhancing Customer Experience with Seamless Transactions

Providing a smooth and convenient payment experience is essential for customer satisfaction. Auto dealer merchant processing services play a vital role in achieving this by:

- Reducing Wait Times: Faster transactions mean less time spent at the checkout counter, improving customer satisfaction and allowing your staff to focus on other tasks.

- Offering Flexible Payment Options: Catering to customer preferences by accepting various payment methods demonstrates a commitment to convenience and accessibility.

- Improving Security: Robust security measures protect customer data and build trust in your dealership.

“A streamlined payment process reflects positively on the dealership’s image, conveying professionalism and efficiency,” says John Miller, Senior Automotive Consultant at Auto Solutions Inc. “It shows customers that you value their time and prioritize their convenience.”

Boosting Your Bottom Line

Beyond customer satisfaction, auto dealer merchant services can also positively impact your bottom line:

- Increased Sales: Offering convenient payment options can lead to higher conversion rates and increased sales.

- Reduced Processing Costs: Choosing the right provider can help you optimize transaction fees and minimize processing expenses.

- Improved Cash Flow: Faster processing times mean quicker access to funds, improving your overall cash flow management. If you are looking for an auto service contracts app auto service contracts app, this website is for you.

“In the competitive auto industry, every advantage counts,” states Maria Sanchez, Financial Analyst at CarDealership Insights. “Optimizing payment processing can be a game-changer for dealerships looking to improve profitability and stay ahead of the curve.”

Boosting Dealership Profits with Merchant Services

Boosting Dealership Profits with Merchant Services

Conclusion

Auto dealer merchant processing services are no longer a luxury but a necessity for modern dealerships. Investing in the right solution can streamline your operations, enhance customer satisfaction, and ultimately boost your bottom line. Choosing a service that meets your specific needs is crucial for maximizing efficiency and achieving your business goals. By understanding the key features and benefits of auto dealer merchant processing services, you can make informed decisions that drive growth and success for your dealership. Don’t underestimate the power of seamless transactions in today’s competitive automotive market. For more resources on optimizing your dealership operations, consider exploring JC Auto Service Inc jc auto service inc. Also, find more about auto dealer merchant services auto dealer merchant services.

FAQ

- What is the average cost of auto dealer merchant processing services? Costs vary depending on the provider and transaction volume.

- Are there different pricing models for merchant processing? Yes, common models include interchange-plus, tiered, and flat-rate pricing.

- How can I protect my dealership from payment fraud? Choose a provider with robust fraud detection and prevention tools.

- What is PCI compliance, and why is it important? PCI compliance ensures secure handling of cardholder data, protecting both your customers and your business.

- Can I integrate my existing CRM with a merchant processing service? Most providers offer integrations with various CRM and DMS platforms.

- What types of reporting can I expect from a merchant processing service? You should expect detailed reports on transaction volume, fees, and other key metrics.

7.. How can I improve the customer experience during the payment process? Offer multiple payment options, ensure fast transaction speeds, and provide clear communication about fees.

Common Situations and Questions

Scenario: A customer wants to pay for a vehicle with a combination of financing and a credit card.

Question: Can your merchant processing service handle split payments?

Scenario: A customer is experiencing issues with a recurring payment for their service contract.

Question: What kind of customer support do you offer for resolving payment issues?

Further Resources

For more information on payment processing solutions and dealership management best practices, explore other articles on our website.

Contact Us

Need help optimizing your payment processing? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 321 Birch Drive, Seattle, WA 98101, USA. Our 24/7 customer support team is ready to assist you.

Leave a Reply