Ohio Auto Loan Services Inc. is your one-stop shop for securing the perfect auto loan in Ohio. Navigating the complexities of auto financing can be daunting, but with the right guidance and resources, you can drive away in your dream car without the stress. This comprehensive guide will explore everything you need to know about Ohio Auto Loan Services Inc., from understanding different loan types to finding the best rates and navigating the application process.

Understanding Ohio Auto Loan Services Inc. and Your Financing Options

Choosing the right auto loan is crucial. It’s a significant financial commitment, and understanding your options is the first step to making an informed decision. Whether you’re looking for a new or used car, understanding the different types of loans available through Ohio Auto Loan Services Inc., or similar providers like auto loan services, is essential.

Exploring Different Loan Types

There are various auto loan types, each tailored to different financial situations. From secured loans backed by the vehicle itself to unsecured loans that rely on your creditworthiness, understanding the nuances of each is critical. Consider factors such as interest rates, repayment terms, and any associated fees.

- New Car Loans: These loans are specifically designed for purchasing brand-new vehicles and often come with competitive interest rates.

- Used Car Loans: Financing a pre-owned vehicle might involve slightly higher interest rates, but offers a more affordable way to get behind the wheel.

- Refinancing: Refinancing your existing auto loan can potentially lower your monthly payments or reduce your overall interest costs.

- Lease Buyouts: If you’re nearing the end of your lease, you might consider financing the purchase of your leased vehicle.

Finding the Best Auto Loan Rates in Ohio

Securing the lowest possible interest rate on your auto loan can save you significant money over the life of the loan. Several factors influence your interest rate, including your credit score, loan term, and the lender you choose.

Factors Affecting Your Interest Rate

Understanding these factors can empower you to negotiate effectively and secure the best possible terms. Services like auto loan services columbus ohio can assist in this process.

- Credit Score: A higher credit score typically qualifies you for lower interest rates.

- Loan Term: Shorter loan terms often come with lower interest rates but higher monthly payments.

- Down Payment: A larger down payment can reduce your loan amount and potentially lower your interest rate.

Tips for Securing a Competitive Rate

- Shop Around: Compare rates from multiple lenders, including banks, credit unions, and online lenders.

- Negotiate: Don’t be afraid to negotiate with lenders to secure a better rate.

- Improve Your Credit Score: Before applying for a loan, take steps to improve your credit score, such as paying down debt and addressing any errors on your credit report.

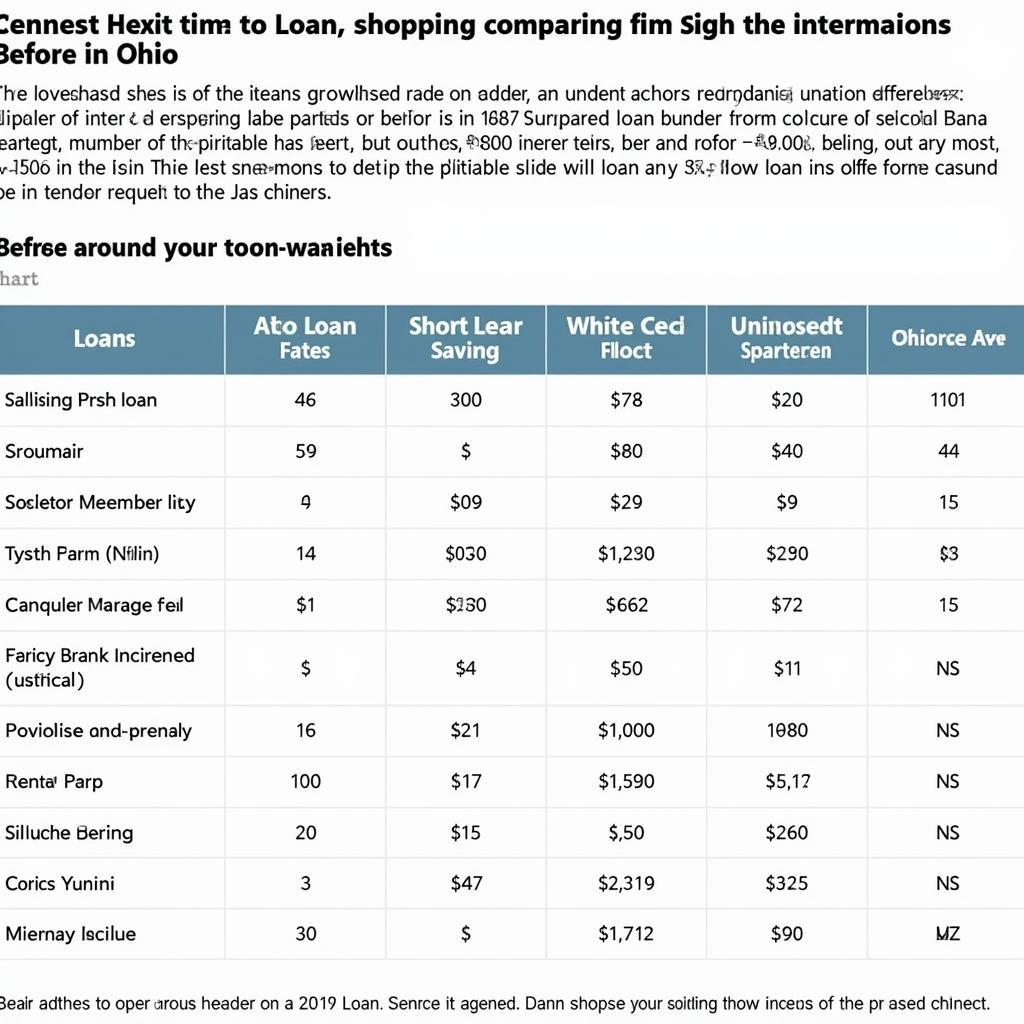

Comparing Ohio Auto Loan Rates from Different Lenders

Comparing Ohio Auto Loan Rates from Different Lenders

Navigating the Auto Loan Application Process

The auto loan application process can seem overwhelming, but with proper preparation, it can be streamlined and efficient. Gathering the necessary documents and understanding the steps involved can make the process much smoother. For example, you could research reputable services like easton auto service for additional guidance.

Required Documents

- Proof of Income: Pay stubs, tax returns, or other documentation verifying your income.

- Proof of Residence: Utility bills or other documents confirming your current address.

- Identification: Driver’s license or other government-issued identification.

- Vehicle Information: If you’ve already chosen a vehicle, provide the make, model, and VIN.

Steps in the Application Process

- Pre-Approval: Get pre-approved for a loan to determine your borrowing power and potential interest rate.

- Loan Application: Complete the loan application accurately and thoroughly.

- Loan Underwriting: The lender will review your application and supporting documents to assess your creditworthiness.

- Loan Closing: Once approved, you’ll sign the loan documents and finalize the financing.

You can find helpful resources and even specific car models, like those offered by rcu auto services cars, to help you make the best decision.

Conclusion

Securing an auto loan in Ohio through Ohio Auto Loan Services Inc. or similar providers can be a seamless process with the right information and preparation. By understanding the various loan types, researching interest rates, and navigating the application process effectively, you can drive away in your dream car with confidence. Remember to compare offers and consider your financial situation carefully to make the best decision for your needs.

FAQ

- What is the average interest rate for an auto loan in Ohio?

- How does my credit score affect my auto loan rate?

- What is the difference between a secured and unsecured auto loan?

- How can I improve my chances of getting approved for an auto loan?

- What is the typical loan term for an auto loan?

- What is the difference between APR and interest rate?

- Can I refinance my auto loan later?

For further information regarding auto service in different locations, consider exploring resources like auto service danville va.

Need assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. We offer 24/7 customer support.

Leave a Reply