Choosing the right tax regime is crucial for auto entrepreneurs offering personal services in France. Whether you should opt for the régime micro-BIC (Bénéfices Industriels et Commerciaux) or the régime BNC (Bénéfices Non Commerciaux) depends on the specific services you provide. Understanding the nuances of “Auto Entrepreneur Service à La Personne Bic Ou Bnc” can significantly impact your financial bottom line.

Deciphering the Difference: BIC vs. BNC for Auto Entrepreneurs

For auto entrepreneurs in the service à la personne sector, the choice between BIC and BNC boils down to the nature of the service. Are you providing a commercial service, like car cleaning or minor repairs? That falls under BIC. Alternatively, if you offer non-commercial services, such as driving assistance or childcare related to vehicle transport, you’d likely be under BNC. This distinction is key to determining your tax obligations and available benefits.

Advantages and Disadvantages of Each Regime

Both BIC and BNC offer simplified tax procedures for auto entrepreneurs, but they have distinct advantages and disadvantages. BIC typically involves a lower tax rate and simpler accounting. BNC, while potentially having a higher tax rate, can allow for deductions of certain professional expenses that BIC doesn’t cover. Choosing the correct regime – BIC or BNC – within the context of “auto entrepreneur service à la personne bic ou bnc” requires a careful evaluation of your specific business activities.

Which Services Qualify as Service à la Personne?

The “service à la personne” category encompasses a wide range of activities. These can include everything from home cleaning and gardening to childcare and assistance with daily tasks. For auto entrepreneurs, this might involve transportation for elderly individuals, childcare related to school runs, or even specialized vehicle adaptations for people with disabilities. Understanding what qualifies under “auto entrepreneur service à la personne bic ou bnc” allows you to leverage the associated tax benefits.

How to Determine the Right Regime for Your Auto Enterprise

Figuring out whether your services fall under BIC or BNC requires a careful examination of your activities. Are your services primarily commercial in nature, involving the sale or provision of goods related to vehicles? This would typically indicate BIC. If your services are more focused on personal assistance related to vehicles, without a direct commercial element, then BNC is likely the appropriate regime.

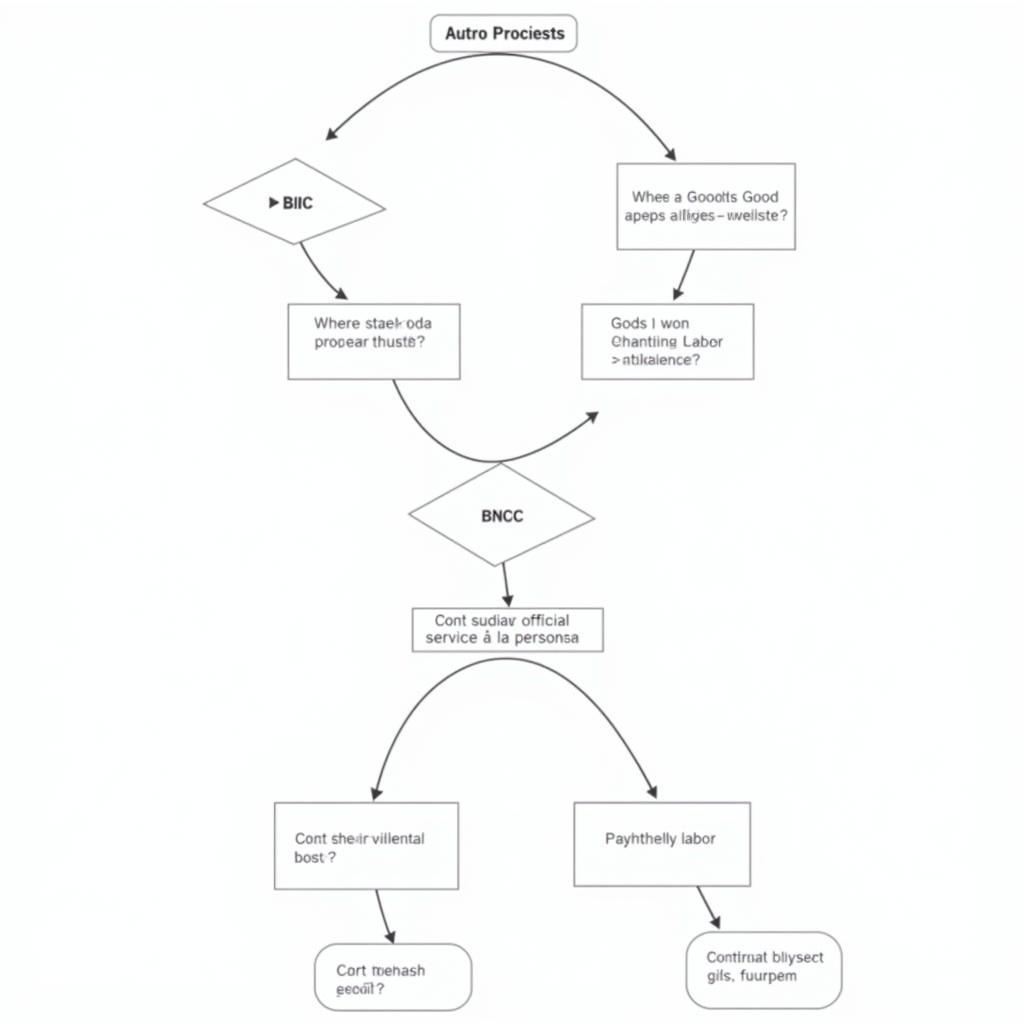

Flowchart for Determining BIC or BNC for Auto Entrepreneurs

Flowchart for Determining BIC or BNC for Auto Entrepreneurs

Impact of Choosing the Wrong Regime

Selecting the incorrect tax regime can lead to penalties and back taxes. It can also complicate your accounting and make it difficult to take advantage of specific benefits designed for auto entrepreneurs in the “service à la personne” sector. Proper classification is paramount for long-term financial stability and compliance.

Expert Advice on Navigating BIC and BNC

“Choosing the right regime is crucial for auto entrepreneurs. Misclassification can lead to significant financial repercussions,” cautions Marie Dubois, a seasoned financial advisor specializing in small business taxation in France. “Understanding the specific criteria for BIC and BNC is essential for operating legally and maximizing profitability.”

Expert Consultation on BIC and BNC for Auto Entrepreneurs

Expert Consultation on BIC and BNC for Auto Entrepreneurs

Conclusion

Navigating the complexities of “auto entrepreneur service à la personne bic ou bnc” requires careful consideration. By understanding the differences between BIC and BNC and seeking professional guidance when needed, you can ensure you’re operating under the correct tax regime and maximizing the benefits of being an auto entrepreneur in France.

FAQ

- What is the main difference between BIC and BNC?

- What are the tax rates for BIC and BNC?

- Can I switch between BIC and BNC?

- What are the penalties for choosing the wrong regime?

- Where can I find more information on BIC and BNC?

- What services are considered “service à la personne”?

- How do I register as an auto entrepreneur under the correct regime?

If you need assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.

Leave a Reply