Auto service finance often involves a credit check, a crucial step in determining your eligibility for loans and financing options. This process allows lenders to assess your creditworthiness and the risk associated with lending you money for auto repairs or purchases. Understanding this process can empower you to navigate auto service financing with confidence.

Applying for an auto service loan or financing often triggers a credit check. Lenders use this information to gauge your financial responsibility and determine the terms of your loan, including interest rates and repayment periods. A good credit score can unlock more favorable loan terms, saving you money in the long run. This is especially important when considering larger repairs or purchasing a used vehicle through a dealership offering financing. Having a pre-approved loan can give you more negotiating power.

What Factors Influence Auto Service Finance Credit Checks?

Several factors play a key role in how your credit score is evaluated during the auto service finance process. Your payment history, the amount of debt you currently have, the length of your credit history, and the types of credit you utilize all contribute to your overall credit score. Understanding these factors can help you improve your creditworthiness and secure better financing terms. For instance, consistently paying bills on time and keeping credit card balances low can positively impact your credit score.

After this introductory paragraph, let’s delve into the specifics of US Bank Auto Dealer Services. Understanding how different lenders operate can be beneficial in finding the right financing option for you. Check out our article on us bank auto dealer services.

Decoding Your Credit Report for Auto Service Finance

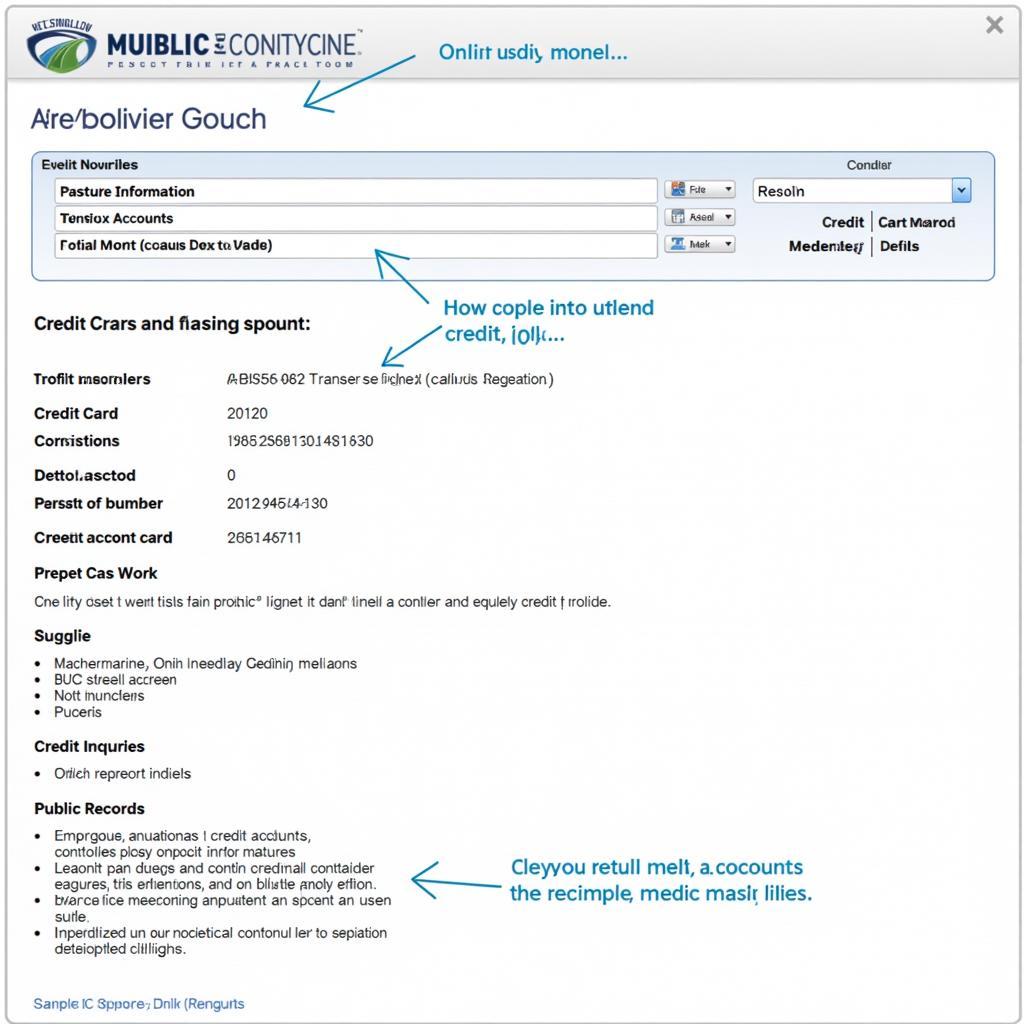

Your credit report contains detailed information about your credit history, including accounts, payment activity, and public records. Reviewing your credit report before applying for auto service financing can help you identify any errors or discrepancies that might negatively impact your score. It also allows you to understand the factors influencing your creditworthiness from the lender’s perspective.

Key Components of a Credit Report

A typical credit report includes personally identifiable information, credit accounts, credit inquiries, and public records. Each of these components provides lenders with a different piece of the puzzle regarding your financial responsibility. For example, multiple recent credit inquiries might suggest you’re over-extending yourself financially.

Understanding the Key Components of a Credit Report

Understanding the Key Components of a Credit Report

How to Improve Your Credit Score for Auto Service Loans

Improving your credit score requires consistent effort and responsible financial management. Paying bills on time, keeping credit utilization low, and addressing any errors on your credit report are crucial steps. While improving your credit takes time, even small improvements can make a significant difference in the financing options available to you. Remember, a higher credit score translates to better loan terms and lower interest rates.

If you’re interested in learning more about general auto service loans and the different options available, we have a comprehensive guide available: auto service loan.

Tips for Building a Strong Credit History

Building a positive credit history is essential for securing favorable financing terms. Starting with a secured credit card, becoming an authorized user on someone else’s account, and taking out a small personal loan and repaying it diligently can all help establish credit. It’s important to remember that building credit is a marathon, not a sprint. Consistent responsible financial behavior is key.

“Regularly monitoring your credit report is like checking your car’s oil. It’s a preventative measure that can save you from major problems down the road,” says John Smith, Certified Financial Advisor at ABC Financial.

Navigating Auto Service Finance with a Less-Than-Perfect Credit Score

Even if you have a less-than-perfect credit score, there are still options available for financing auto services. Some lenders specialize in working with individuals with challenged credit histories. It’s important to research and compare different lenders to find the best terms and avoid predatory lending practices.

“Don’t be discouraged by a less-than-perfect credit score. There are resources available to help you secure the financing you need,” advises Maria Garcia, Senior Loan Officer at XYZ Credit Union.

Understanding the intricacies of auto financial services processes can be helpful when dealing with less-than-perfect credit. Learn more about these processes in our dedicated article: auto financial services processes.

Exploring Different Auto Service Financing Options

Exploring Different Auto Service Financing Options

Securing financing for auto service requires careful consideration of your credit score and financial situation. By understanding the credit check process and taking steps to improve your creditworthiness, you can navigate auto service finance with confidence and secure the best possible terms for your needs. Remember, responsible financial management is key to achieving your auto service goals. Don’t forget to check out the service hours of auto lenders in your area, like auto lenders toms river service hours, to ensure you can access their services conveniently. For those in Marietta, american financial services auto sales marietta might be a valuable resource.

FAQ

-

What is a credit check? A credit check is a review of your credit history used by lenders to assess your creditworthiness.

-

How does a credit check affect my credit score? A hard inquiry can slightly lower your credit score temporarily.

-

How can I improve my credit score? Pay bills on time, keep credit utilization low, and address errors on your credit report.

-

Can I get auto service financing with bad credit? Yes, some lenders specialize in working with individuals with challenged credit.

-

What factors influence auto service loan terms? Your credit score, income, and the amount of the loan requested.

-

How can I check my credit report? You can request a free credit report annually from each of the major credit bureaus.

-

What should I do if I find errors on my credit report? Dispute the errors with the credit bureau and the creditor.

For further assistance, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.

Leave a Reply