The Auto Loan Servicing Industry plays a crucial role in the automotive landscape, connecting lenders and borrowers throughout the loan lifecycle. This article delves into the intricacies of auto loan servicing, providing valuable insights for both consumers and businesses involved in this dynamic sector. We’ll explore key aspects of the industry, from understanding your rights as a borrower to the evolving technologies shaping the future of auto loan management. faster auto service offers insights into streamlining your auto service processes, which can be indirectly helpful when managing your auto loan budget.

Understanding the Auto Loan Servicing Landscape

Auto loan servicing encompasses a wide range of activities, including collecting payments, managing escrow accounts, handling customer inquiries, and processing loan modifications. Essentially, the servicer acts as the primary point of contact for borrowers after the loan originates. This complex process requires specialized expertise and robust systems to ensure efficiency and accuracy. Choosing the right auto loan servicer can significantly impact your overall borrowing experience.

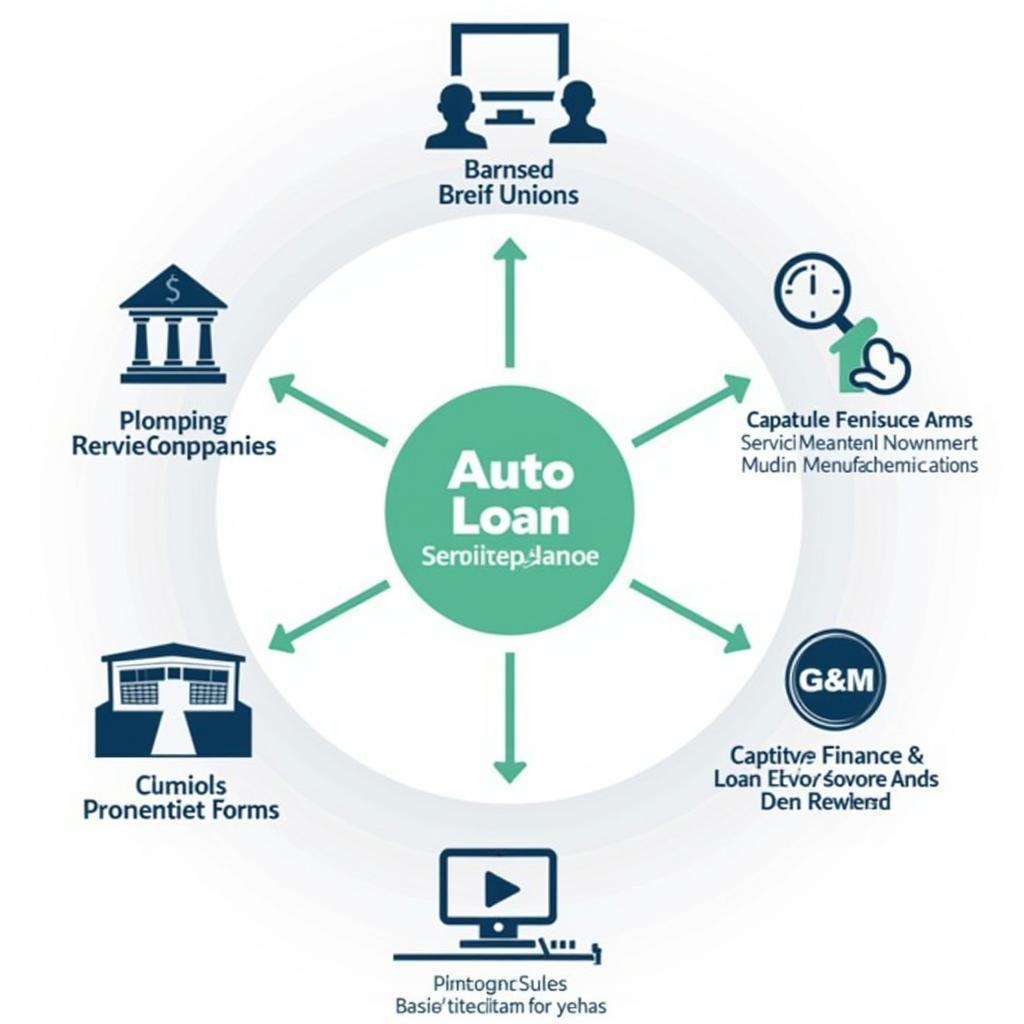

Key Players in Auto Loan Servicing

The auto loan servicing industry comprises various players, including banks, credit unions, independent servicing companies, and even auto manufacturers’ captive finance arms. Understanding the roles and responsibilities of each entity is crucial for navigating this complex landscape. For instance, while a bank might originate your loan, an independent servicing company could ultimately manage your account.

Key Players in the Auto Loan Servicing Industry

Key Players in the Auto Loan Servicing Industry

Consumers often interact directly with the loan servicer, making it essential to choose a reputable and responsive company. Factors to consider include customer service ratings, online account management tools, and the servicer’s track record in handling loan modifications and other requests.

What to Expect from Your Auto Loan Servicer

Once your auto loan is finalized, the servicing process begins. You’ll receive regular statements outlining your payment due dates, outstanding balance, and other relevant information. Your servicer should provide clear and accessible communication channels for addressing any questions or concerns.

Common Auto Loan Servicing Issues and Solutions

While the majority of auto loan servicing interactions are smooth, borrowers may occasionally encounter challenges. These can range from payment processing errors to difficulties in obtaining loan modifications. Understanding your rights as a borrower and knowing how to effectively communicate with your servicer can help resolve these issues promptly.

Common Issues in Auto Loan Servicing

Common Issues in Auto Loan Servicing

One common issue is escrow account discrepancies. It’s essential to review your escrow statements carefully and contact your servicer immediately if you notice any errors. ally auto finance dealer services provides a good example of the resources and support available to dealers and potentially borrowers in navigating auto financing, which can be helpful when understanding the intricacies of loan servicing.

The Future of Auto Loan Servicing

The auto loan servicing industry is constantly evolving, driven by technological advancements and changing consumer expectations. Digital platforms and automated processes are streamlining operations, enhancing efficiency, and improving the borrower experience.

Technology’s Impact on Auto Loan Servicing

From online payment portals to mobile apps, technology is transforming how borrowers interact with their loan servicers. These digital tools provide greater transparency, convenience, and control over the loan management process. america auto care customer service demonstrates the importance of robust customer service in the auto industry, which is increasingly important in the context of digital auto loan servicing.

Technology’s Impact on Auto Loan Servicing

Technology’s Impact on Auto Loan Servicing

Furthermore, data analytics and machine learning are enabling servicers to better assess risk, personalize communication, and proactively address potential borrower challenges. This personalized approach can improve customer satisfaction and reduce delinquencies. global auto services highlights the global nature of the auto industry, and technology is playing a crucial role in connecting borrowers and servicers across geographical boundaries.

Conclusion

The auto loan servicing industry is a vital component of the automotive ecosystem. Understanding its complexities, your rights as a borrower, and the evolving technological landscape can empower you to make informed decisions and navigate the loan process effectively. Choosing the right servicer and utilizing available resources can ensure a smooth and positive borrowing experience. Remember, staying informed and proactive is key to successfully managing your auto loan.

FAQ

- What is an auto loan servicer?

- How do I choose the right auto loan servicer?

- What should I do if I have a problem with my auto loan servicer?

- How is technology changing the auto loan servicing industry?

- What are my rights as an auto loan borrower?

- How can I access my auto loan information online?

- What is an escrow account and how does it work?

Common Scenarios

- Missed Payment: Contact your servicer immediately to discuss options and avoid further penalties.

- Escrow Shortage: Review your escrow statement and contact your servicer to understand the reason for the shortage and explore payment options.

- Loan Modification Request: Gather necessary documentation and communicate clearly with your servicer about your financial situation and the requested modification.

Further Reading

- Explore our article on auto crane service body for sale for insights into specialized vehicle financing.

Need support? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.

Leave a Reply