Auto Now Financial Services Photos – these keywords suggest someone is searching for visual aids to understand auto financing options. Perhaps they’re looking for infographics, charts, or images that break down complex loan terms, interest rates, or different financing providers. They might also be searching for photos of vehicles they can finance. Let’s explore the world of auto financing and provide the information you need to make informed decisions. auto services insurance mga helps you navigate the complex world of auto insurance.

Decoding Auto Financing

Auto financing can be a daunting process. Understanding the various options available, such as loans from banks, credit unions, and dealerships, is crucial. Each option comes with its own set of terms and conditions, including interest rates, loan duration, and down payment requirements. Choosing the right financing plan requires careful consideration of your budget, financial goals, and the type of vehicle you’re looking to purchase.

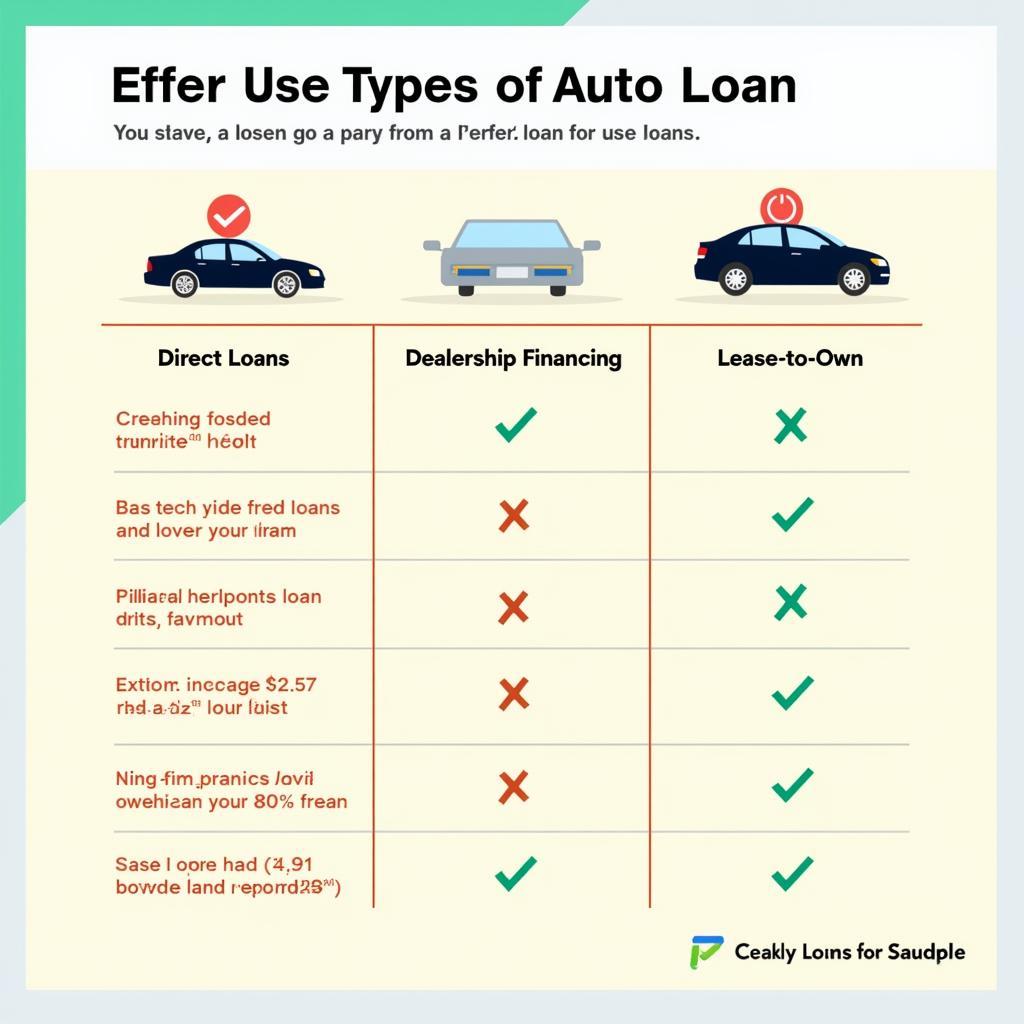

Types of Auto Loans

- Direct Loans: These loans are obtained directly from financial institutions like banks or credit unions. They often offer competitive interest rates and pre-approval options, allowing you to shop for a car with a set budget.

- Dealership Financing: Dealerships often partner with lenders to offer financing options on-site. This can be a convenient option, but it’s essential to compare rates with other lenders to ensure you’re getting the best deal.

- Lease-to-Own: This option allows you to lease a vehicle for a specific period, with the option to purchase it at the end of the lease term.

Auto Loan Types Comparison Chart

Auto Loan Types Comparison Chart

The Role of Photos in Auto Financing

Visual aids can significantly simplify the auto financing process. Images and infographics can illustrate complex concepts like amortization schedules, loan calculations, and the impact of different interest rates on monthly payments. Photos of vehicles available for financing can also inspire and help potential buyers visualize themselves behind the wheel.

Using Photos to Compare Vehicles

Photos play a vital role in helping buyers compare different vehicle models. They allow you to examine the exterior and interior features, assess the overall condition of the car, and determine if it meets your needs and preferences.

Car Financing Interest Rate Calculator

Car Financing Interest Rate Calculator

Tips for Securing the Best Auto Financing Deal

- Check Your Credit Score: A good credit score can help you qualify for lower interest rates. Before applying for financing, obtain a copy of your credit report and address any errors.

- Shop Around for Rates: Compare loan offers from multiple lenders to find the most competitive rates and terms. Don’t be afraid to negotiate.

- Calculate Affordability: Determine how much you can comfortably afford to spend on car payments each month. Consider factors like your income, expenses, and existing debt.

“Understanding your financial situation is the first step in securing a favorable auto loan,” says John Miller, a Senior Financial Advisor at Apex Financial Solutions. “Knowing your budget and credit score empowers you to negotiate effectively and secure the best possible terms.”

alpha auto services provides comprehensive auto repair and maintenance services.

Understanding Loan Documents

Before signing any loan documents, carefully review all the terms and conditions, including the interest rate, loan term, and fees. Ensure you understand everything before committing to the loan.

Sample Auto Loan Agreement

Sample Auto Loan Agreement

usaa auto insurance customer service provides excellent customer service and comprehensive coverage options.

Conclusion

Finding the right auto now financial services photos can be a valuable tool in your car buying journey. Utilizing visual resources can help you understand complex financial concepts and make informed decisions about your auto loan. By carefully considering your options, comparing offers, and understanding the terms of your loan, you can drive away in the car of your dreams without breaking the bank.

FAQ

- What is the average interest rate for an auto loan?

- How long are typical auto loan terms?

- What is the difference between APR and interest rate?

- How does my credit score affect my auto loan rate?

- Can I get pre-approved for an auto loan?

- What documents do I need to apply for auto financing?

- What is GAP insurance?

Common Scenarios and Questions

- Scenario: A young professional is looking to finance their first car. Question: What type of auto loan is best for someone with limited credit history?

- Scenario: A family is looking to upgrade their vehicle. Question: How can I trade in my current car as part of the financing for a new one?

- Scenario: Someone with bad credit is looking to finance a car. Question: What are my financing options with a poor credit score?

Further Reading and Resources

Check out our articles on auto mile services and mobile auto inspection service for more information related to auto services.

Contact Us

For assistance with any car diagnostics or repair needs, contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.

Leave a Reply