Auto Service Center Financing can be a lifesaver when unexpected car repairs hit your wallet hard. Finding the right financing option can make all the difference in managing those costs, allowing you to get back on the road quickly and without breaking the bank. This article will explore the ins and outs of auto service center financing, helping you navigate the options and make informed decisions.

Understanding Your Options for Auto Service Center Financing

There are several ways to finance auto repairs, each with its pros and cons. Choosing the best option depends on your individual financial situation, the cost of the repairs, and the terms offered by the financing provider.

- Credit Cards: Using a credit card can be a convenient option for smaller repairs. However, high interest rates can make this a costly choice if you don’t pay off the balance quickly.

- Personal Loans: Personal loans offer fixed interest rates and predictable monthly payments. They can be a good option for larger repairs, offering a structured repayment plan.

- In-House Financing: Some auto service centers offer in-house financing plans, often with promotional offers like deferred interest or no payments for a certain period. Be sure to understand the terms and conditions thoroughly before opting for this type of financing.

- Third-Party Lenders: Several third-party lenders specialize in auto repair financing. These lenders may offer competitive rates and flexible terms, making them a viable alternative to traditional loans.

Auto Service Center Financing Options

Auto Service Center Financing Options

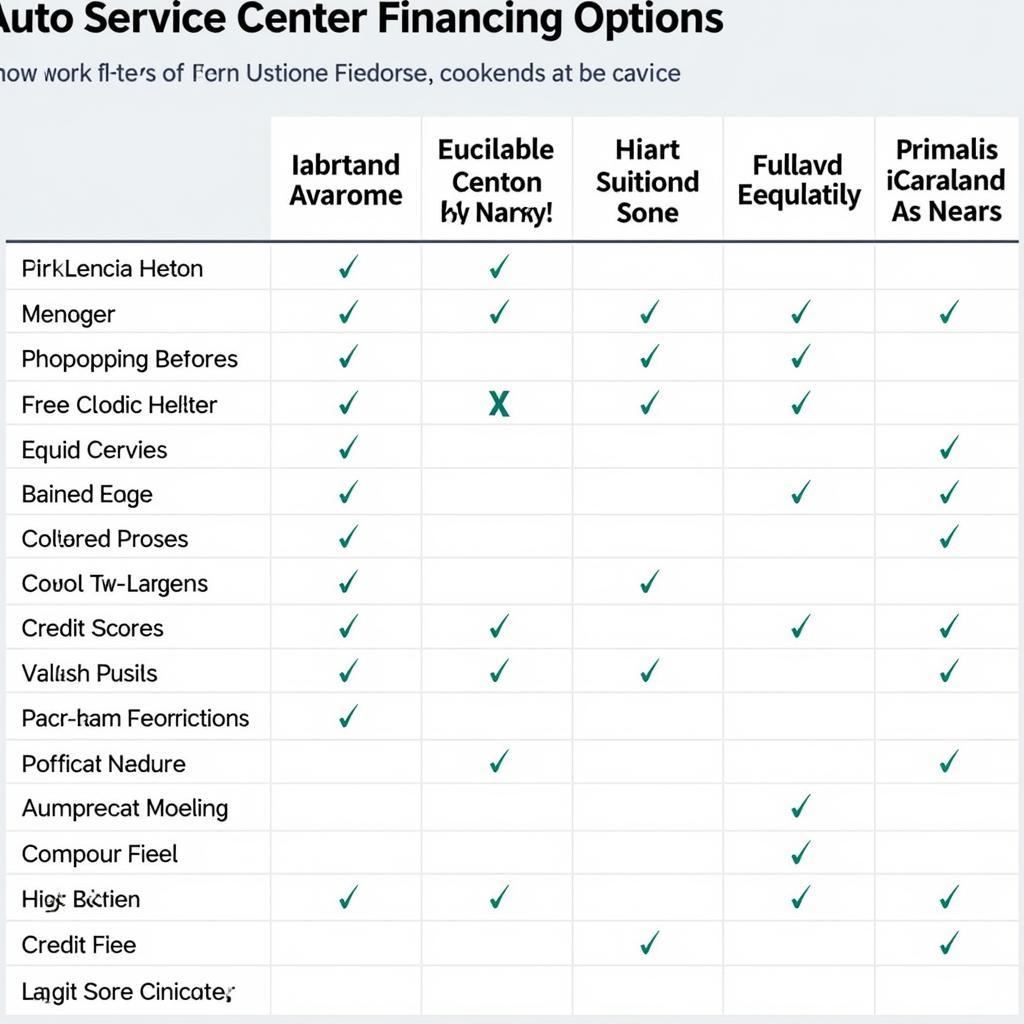

What to Consider When Choosing Auto Service Center Financing

Navigating the world of auto service center financing can seem daunting, but with a little research and planning, you can find the right solution for your needs. Here are some key factors to consider:

- Interest Rates: Compare interest rates from different lenders to find the most competitive offer. Lower interest rates translate to lower overall costs.

- Loan Terms: Consider the length of the loan term and the associated monthly payments. Shorter loan terms mean higher monthly payments but less interest paid overall. Longer loan terms result in lower monthly payments but more interest accrued over time.

- Fees: Be aware of any associated fees, such as origination fees, prepayment penalties, or late payment fees.

- Credit Score Requirements: Different lenders have different credit score requirements. If you have a lower credit score, you may need to explore options specifically designed for those with less-than-perfect credit.

Comparing Auto Service Center Financing Options

Comparing Auto Service Center Financing Options

How to Apply for Auto Service Center Financing

The application process for auto service center financing varies depending on the lender. Generally, you’ll need to provide information such as:

- Personal Information (name, address, contact information)

- Employment Information (employer, income)

- Vehicle Information (make, model, year)

- Repair Estimate (from the auto service center)

Is Auto Service Center Financing Right for Me?

When considering auto service center financing, ask yourself these questions:

- Can I afford the monthly payments? Be realistic about your budget and ensure the monthly payments fit comfortably within your expenses.

- What is the total cost of the loan, including interest and fees? Compare this to the cost of paying for the repairs outright to determine if financing is the most cost-effective option.

- Do I understand the loan terms and conditions? Read the fine print carefully and ask questions if anything is unclear.

“Choosing the right financing option can empower you to address necessary car repairs promptly and efficiently without undue financial strain,” says John Smith, Senior Automotive Finance Advisor at Auto Finance Solutions. “Don’t let unexpected repair costs derail your budget – explore the various financing options available and choose the one that best suits your needs.”

Benefits of Auto Service Center Financing

Auto service center financing offers several advantages:

- Convenience: It allows you to get your car repaired immediately without having to delay repairs due to lack of funds.

- Manageability: Spreading the cost of repairs over time makes them more budget-friendly.

- Flexibility: Various financing options cater to different credit profiles and financial situations.

“Financing car repairs allows you to maintain your vehicle’s safety and reliability without compromising your financial stability,” adds Jane Doe, Certified Automotive Technician at Expert Auto Repair. “It’s a proactive approach to car maintenance that can save you money in the long run by preventing more costly issues down the road.”

auto lenders lakewood service center

Conclusion: Making Informed Decisions about Auto Service Center Financing

Auto service center financing offers a viable solution for managing the cost of car repairs. By carefully considering your options and understanding the terms and conditions, you can choose the financing plan that best fits your needs and budget, allowing you to keep your car running smoothly without financial stress. Remember to compare interest rates, loan terms, and fees before making a decision. Auto service center financing can help you get back on the road quickly and affordably.

presidential auto sales service and leasing delray beach fl

FAQ

- What is the average interest rate for auto service center financing? Interest rates vary depending on the lender and your credit score.

- Can I finance repairs for any type of vehicle? Most financing options cover a wide range of vehicles.

- How long does it take to get approved for financing? Approval times vary depending on the lender.

Common Scenarios

- Scenario 1: A single parent needs to finance a major repair to their only vehicle.

- Scenario 2: A student needs to finance unexpected repairs after a minor accident.

Further Reading

- Auto Service Center Lending Options

- Understanding Auto Repair Loans

Need assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 321 Birch Drive, Seattle, WA 98101, USA. We have a 24/7 customer service team available to help.

Leave a Reply