Navigating the complexities of AAA auto insurance claims in Mt Laurel, NJ, can be daunting. This guide provides valuable insights into AAA auto insurance claim service in Mt Laurel, NJ, helping you understand the process, your rights, and how to ensure a smooth experience.

Understanding AAA Auto Insurance Claims in Mt Laurel, NJ

AAA is a trusted name in auto insurance, and their claim service in Mt Laurel, NJ, aims to provide efficient and fair settlements. Whether you’ve experienced a minor fender bender or a major collision, understanding the claims process is crucial. This includes knowing what information to gather, what steps to take immediately after an accident, and how to interact with AAA representatives.

What to Do After an Accident in Mt Laurel, NJ

After an accident, your priority should be safety. Check for injuries and call 911 if necessary. Gather information from the other driver(s) involved, including their insurance details and contact information. Document the scene with photos and videos, if possible. Then, promptly contact AAA to report the accident and initiate the claim process.

Filing Your AAA Auto Insurance Claim in Mt Laurel, NJ

Filing a claim with AAA is generally straightforward. You can file online, through their mobile app, or by calling their claims hotline. Provide accurate and detailed information about the accident. This includes the date, time, location, description of the incident, and the names and contact information of all parties involved.

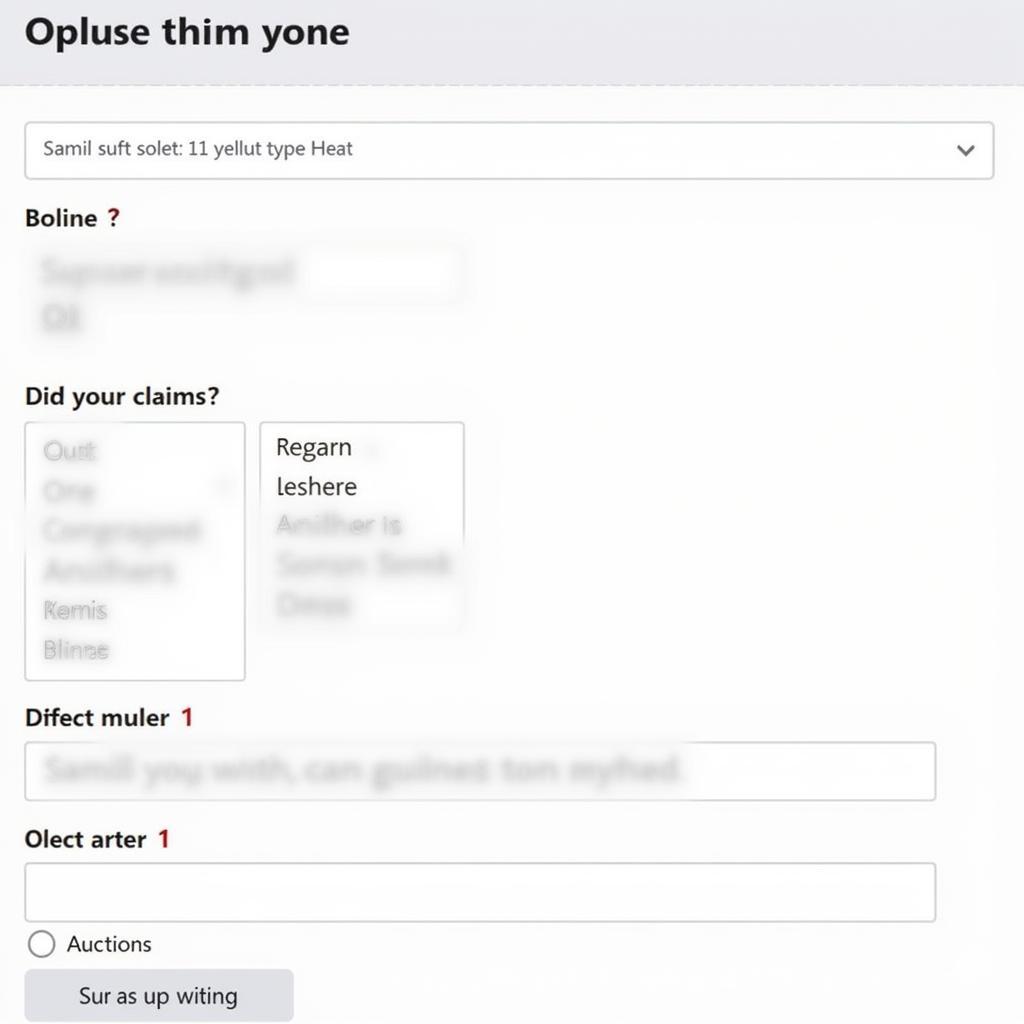

Filing an Auto Insurance Claim Online with AAA

Filing an Auto Insurance Claim Online with AAA

Navigating the AAA Claims Process in Mt Laurel, NJ

Once your claim is filed, AAA will assign a claims adjuster. The adjuster will investigate the accident, assess the damages, and determine liability. They may contact you for additional information or documentation. Be prepared to answer their questions thoroughly and honestly.

Working with Your AAA Claims Adjuster

Maintaining open communication with your adjuster is crucial. Ask questions if you are unsure about anything. Understand the estimated timeline for processing your claim and the factors that might influence it.

Tips for a Smooth AAA Auto Insurance Claim Experience

- Gather Thorough Documentation: Detailed documentation of the accident scene and damages strengthens your claim.

- Report the Accident Promptly: Timely reporting helps expedite the claims process.

- Be Honest and Cooperative: Provide accurate information to your claims adjuster.

- Keep Records of Communication: Document all interactions with AAA representatives.

- Understand Your Policy: Familiarize yourself with your coverage details and limitations.

Frequently Asked Questions (FAQ) about AAA Auto Insurance Claims in Mt Laurel, NJ

- How long does it take to process a AAA auto insurance claim? Claim processing times vary based on the complexity of the accident.

- What if I disagree with the settlement offer? You can negotiate with the adjuster or seek legal advice.

- How do I contact AAA customer service? You can contact AAA by phone, email, or through their website.

- Can I choose my own repair shop? Generally, yes, although AAA may have preferred providers.

- What if the other driver is uninsured? Your uninsured motorist coverage will apply.

- How do I file a claim for rental car reimbursement? Contact your AAA adjuster for information on rental car coverage.

- What if I have additional questions about my claim? You can contact your assigned claims adjuster directly.

Conclusion

Navigating AAA auto insurance claim service in Mt Laurel, NJ, requires understanding the process and being proactive. By following these tips and staying informed, you can ensure a smoother claims experience. Remember to gather thorough documentation, report the accident promptly, and maintain open communication with your AAA adjuster. Contact us if you need further assistance with your AAA auto insurance claim in Mt Laurel, NJ.

For support, contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 321 Birch Drive, Seattle, WA 98101, USA. We offer 24/7 customer support.