Auto Insurance Replacement Services are crucial when your vehicle is damaged beyond repair or stolen. Understanding how these services work can save you time, money, and stress during a difficult situation. This guide will explore everything you need to know about auto insurance replacement services, helping you navigate the process with confidence.  Auto Insurance Replacement Services Process

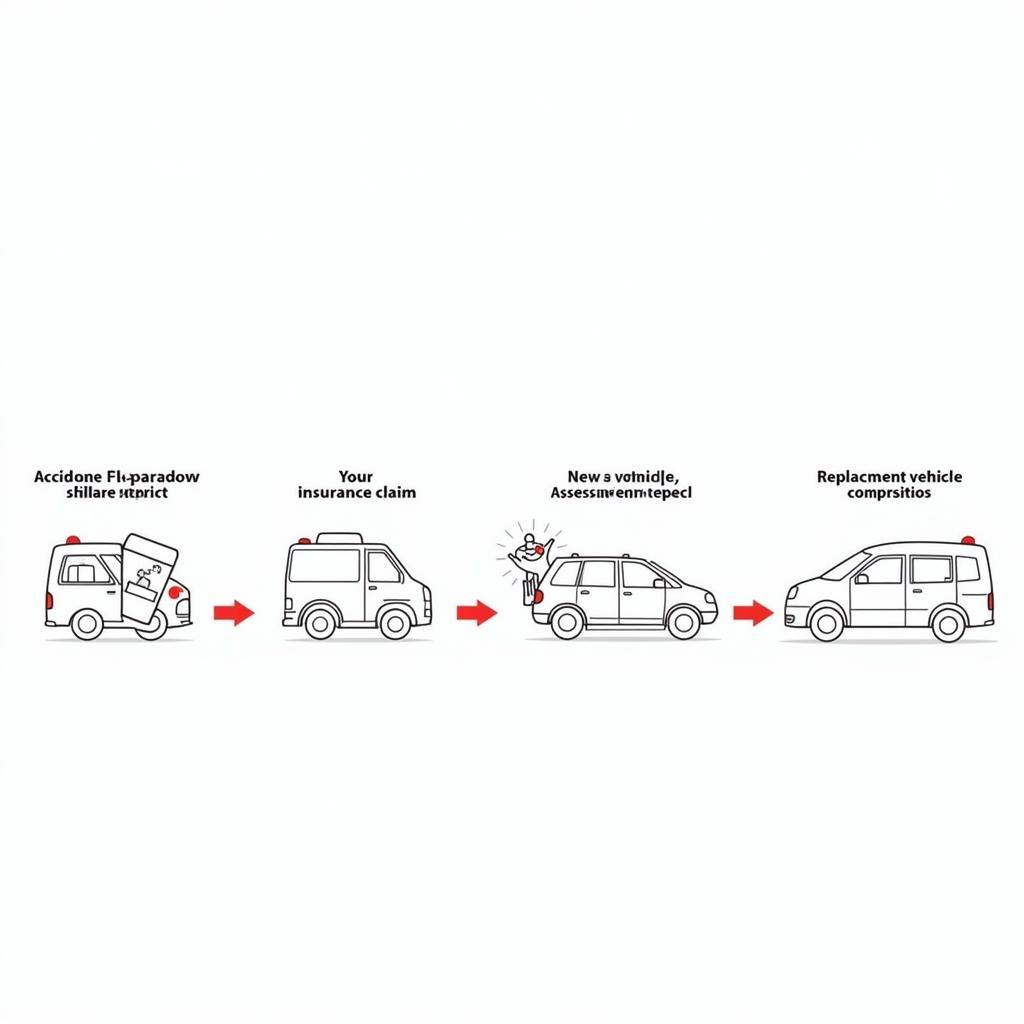

Auto Insurance Replacement Services Process

What are Auto Insurance Replacement Services?

Auto insurance replacement services encompass the support provided by your insurance company to replace your vehicle after a covered incident, such as a total loss accident or theft. This can involve a cash settlement equivalent to the vehicle’s actual cash value (ACV) or assistance in locating and purchasing a replacement vehicle. These services vary based on your specific policy and coverage. Do you have the right coverage? Let’s explore what factors are at play.

Factors Influencing Replacement Services

Several factors influence the type of auto insurance replacement services you’ll receive. Your policy’s coverage level plays a significant role. For example, some policies only cover the ACV of your vehicle, while others might offer “new car replacement” coverage, especially for newer vehicles. auto owners service line coverage can be an important factor to consider. The extent of the damage to your vehicle is another key factor. If your car is deemed a total loss, meaning the cost of repairs exceeds its value, replacement services will be triggered. Finally, the availability of comparable vehicles in the market can also influence the process.

How do Auto Insurance Replacement Services Work?

The process typically begins with filing a claim with your insurance company after the incident. The insurer will then assess the damage to your vehicle and determine whether it’s a total loss. If it is, they’ll calculate the ACV, factoring in depreciation, mileage, and the vehicle’s condition before the incident. You’ll then have the option to accept a cash settlement or work with the insurance company to find a replacement vehicle. Sometimes, partnering with an auto body service near me can be helpful during the assessment process. Remember, clear communication with your insurance provider is key throughout this process.

Navigating the Claims Process

Navigating the claims process can feel daunting, but understanding the steps involved can make it smoother. First, document the damage with photos and videos. Then, gather all necessary information, including your policy number, vehicle identification number (VIN), and accident report. Promptly file your claim with your insurance company and be prepared to answer their questions thoroughly. Keep records of all communication and documents exchanged during the process.

Choosing a Replacement Vehicle

Once your claim is approved, you can begin the process of choosing a replacement vehicle. If you opt for a cash settlement, you can use the funds to purchase any vehicle you choose. If you work with your insurance company, they may provide a list of comparable vehicles available at dealerships in your area. Consider factors like make, model, year, mileage, and features when selecting a replacement. auto glass services littleton co and auto glass mobile service savannah can be important when inspecting potential replacements. What if you need specialized help with the electrical systems? An auto electrician mobile service can be invaluable.

Tips for Choosing the Right Replacement

Finding the right replacement vehicle requires careful consideration. Research different makes and models, comparing their features, reliability, and safety ratings. Get pre-approved for financing to understand your budget and negotiate the best deal. Don’t be afraid to walk away if you’re not satisfied with the terms offered.

Conclusion

Auto insurance replacement services play a vital role in helping you get back on the road after a covered incident. Understanding the process and your policy’s coverage can empower you to make informed decisions and minimize stress during a challenging time. Remember to communicate effectively with your insurance provider and thoroughly research your replacement vehicle options to ensure a smooth transition. Auto insurance replacement services can make the recovery process significantly easier.

FAQs

- What is the difference between actual cash value (ACV) and replacement cost?

- How long does the replacement process typically take?

- Can I choose any vehicle I want as a replacement?

- What if I disagree with the insurance company’s valuation of my vehicle?

- What happens if my vehicle is stolen and not recovered?

- Can I use the cash settlement for something other than buying a replacement car?

- What if I can’t find a comparable vehicle in the market?

Need assistance with auto insurance replacement services? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected], or visit our office at 321 Birch Drive, Seattle, WA 98101, USA. Our 24/7 customer service team is ready to help.

Leave a Reply