Auto Loan Service Remarketing is a crucial process for both lenders and borrowers. It involves selling off vehicles repossessed due to loan defaults. Understanding this process can help you navigate the complexities of auto financing and minimize potential losses. Let’s delve into the intricacies of auto loan service remarketing and learn how it impacts all parties involved. auto repossession & remarketing services

What is Auto Loan Service Remarketing?

Auto loan service remarketing refers to the process by which financial institutions resell vehicles repossessed from borrowers who have defaulted on their auto loans. This process aims to recover the outstanding loan balance and associated costs. It involves various stages, from vehicle recovery and inspection to marketing and final sale.

Why is Auto Loan Service Remarketing Important?

Remarketing helps lenders mitigate losses. By reselling repossessed vehicles, they can recoup some or all of the remaining loan balance. It also allows borrowers to move forward after a default.

- For lenders: Reduces financial losses and maintains asset liquidity.

- For borrowers: Minimizes the financial impact of default and helps rebuild credit over time.

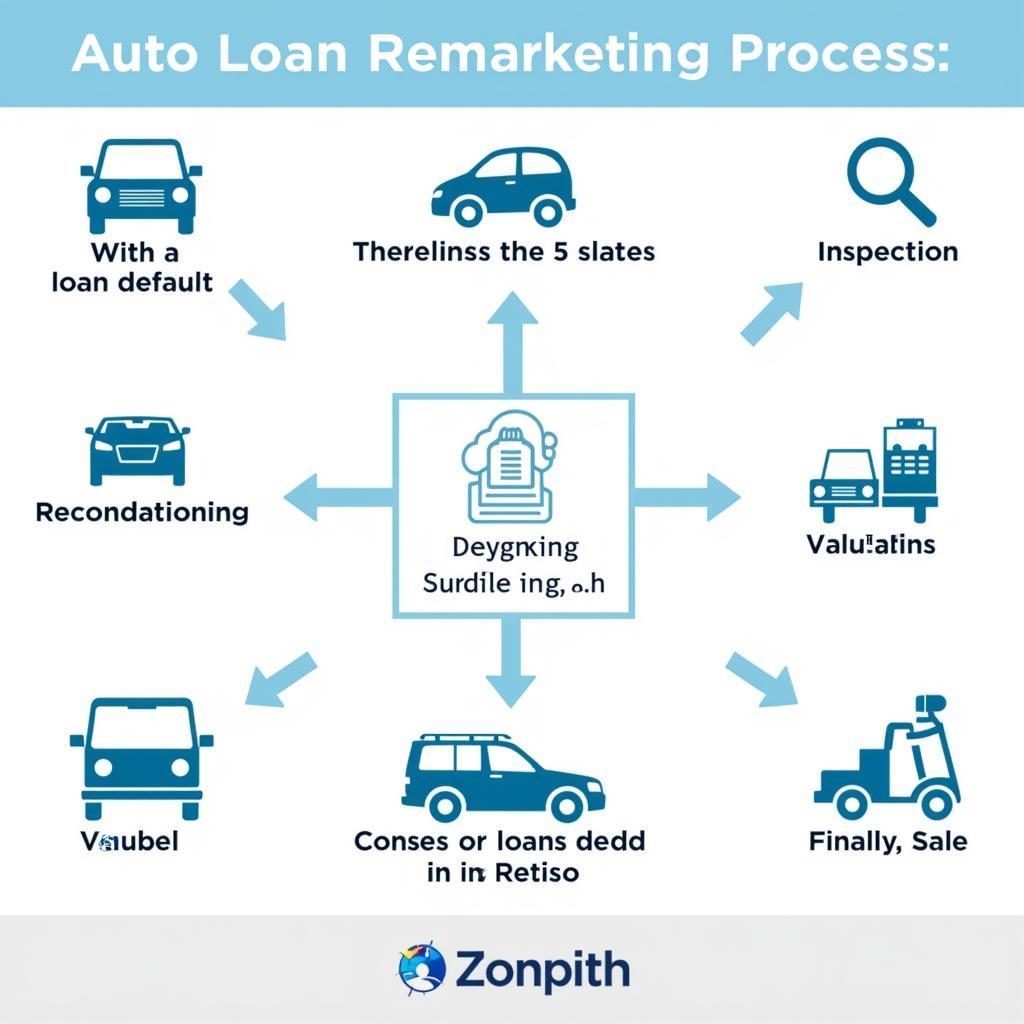

Auto Loan Remarketing Process

Auto Loan Remarketing Process

Understanding the Auto Loan Service Remarketing Process

The remarketing process involves several key steps:

- Repossession: The lender legally takes possession of the vehicle. This is typically done through auto repossession services.

- Inspection and Condition Report: The vehicle is thoroughly inspected to assess its condition and identify any necessary repairs.

- Reconditioning: Any repairs or maintenance required to make the vehicle marketable are performed.

- Valuation: The vehicle is appraised to determine its fair market value.

- Marketing: The vehicle is listed for sale through various channels, including auctions, online marketplaces, and dealerships.

- Sale: The vehicle is sold to the highest bidder or buyer.

How Does Auto Loan Service Remarketing Affect Your Credit Score?

A vehicle repossession significantly impacts your credit score. However, a successful remarketing process can slightly mitigate the negative impact by reducing the amount of debt owed.

“Remarketing doesn’t erase the repossession, but it can lessen the financial blow,” says John Smith, Senior Financial Advisor at ABC Finance. “A quicker sale and higher resale value can minimize the deficiency balance, which in turn, slightly lessens the negative impact on your credit report.”

Tips for Navigating Auto Loan Service Remarketing

- Understand your loan agreement: Be aware of the terms and conditions regarding default and repossession.

- Communicate with your lender: If you anticipate difficulty making payments, contact your lender immediately to explore options.

- Cooperate with the repossession process: While difficult, cooperating can help minimize additional fees and complications.

- Monitor the sale of your vehicle: Keep track of the remarketing process to ensure a fair sale price.

auto collateral enforcement services a.c.e.s can be a valuable resource in this process.

What happens after the vehicle is sold?

After the vehicle is sold, the proceeds are applied to the outstanding loan balance. If the sale price covers the balance and associated costs, the process is complete. However, if the sale price is less than the outstanding balance, you may be responsible for the deficiency balance. auto collateral recovery services can help lenders recover these vehicles efficiently.

Conclusion

Auto loan service remarketing is a complex yet essential part of the auto finance industry. Understanding its intricacies can empower both lenders and borrowers to navigate the challenges of loan defaults and repossessions. By being proactive and informed, you can minimize potential losses and work towards a more secure financial future. Remember to thoroughly research and understand your loan agreement.

FAQ

- What is a deficiency balance? The difference between the outstanding loan balance and the sale price of the repossessed vehicle.

- How can I avoid repossession? Communicate with your lender and explore options like loan modification or deferment.

- How long does the remarketing process take? It can vary depending on the vehicle’s condition and market demand but generally takes several weeks.

- Can I buy back my repossessed vehicle? It depends on the lender’s policies and the stage of the remarketing process.

- How does remarketing affect my chances of getting a future auto loan? Repossession negatively impacts your credit score, making it more challenging to secure future loans.

- Where are repossessed cars sold? Auctions, online marketplaces, and dealerships.

- What happens if the car sells for more than the loan balance? You may be entitled to the surplus.

Need further assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7. Explore more about auto service new hampshire on our website.

Leave a Reply