When it comes to your vehicle, proactive maintenance is key. But what about “Auto Service Protection”? This often-overlooked aspect of car ownership can save you significant money and stress in the long run.

Auto Service Protection Plans

Auto Service Protection Plans

Understanding Auto Service Protection

Auto service protection, often referred to as an extended warranty or vehicle service contract, goes beyond your manufacturer’s warranty. It acts as a safety net, covering the costs of unexpected repairs that can put a dent in your wallet. From engine failure to electrical issues, these plans provide peace of mind knowing you won’t be shouldering hefty repair bills alone.

Why is Auto Service Protection Important?

Today’s vehicles are increasingly complex, packed with sophisticated technology. While this advances the driving experience, it also means repairs can be more expensive.

- Financial Security: Auto service protection acts as a buffer against unexpected repair costs, helping you avoid dipping into your savings or accruing debt.

- Peace of Mind: Knowing you have coverage for major repairs allows you to drive with confidence, free from the worry of unexpected breakdowns.

- Increased Resale Value: A vehicle with an active service plan is often seen as more desirable to potential buyers, potentially increasing its resale value.

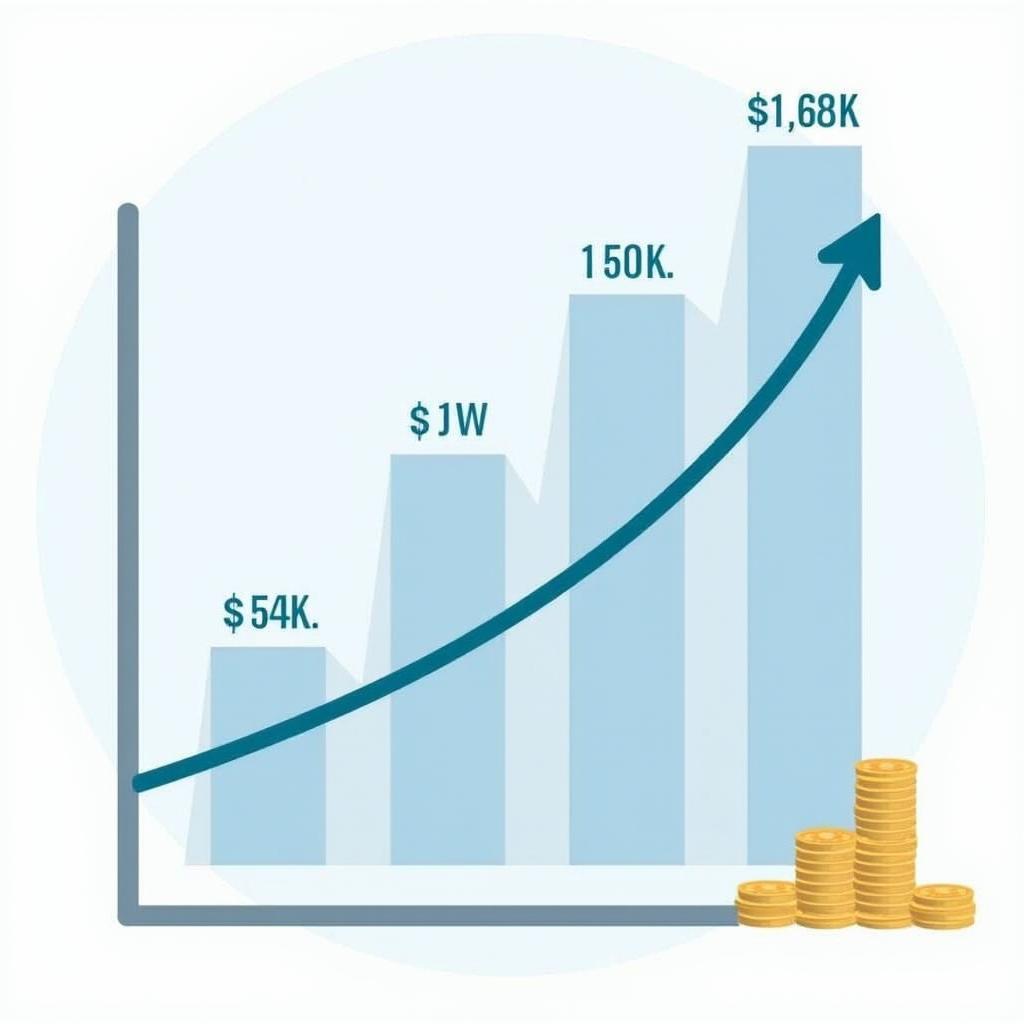

Rising Car Repair Costs

Rising Car Repair Costs

Types of Auto Service Protection

Choosing the right plan depends on your individual needs and driving habits. Here’s a breakdown of the most common types:

- Powertrain Coverage: This basic plan typically covers the engine, transmission, and drive axles – the core components that keep your car running.

- Bumper-to-Bumper Coverage: This comprehensive option offers the most extensive protection, covering most vehicle systems and components, excluding routine maintenance and wear-and-tear items.

- Named Component Coverage: This plan allows you to customize your coverage, selecting specific systems or components to protect.

auto protect customer services number

Factors to Consider When Choosing a Plan

- Coverage Details: Thoroughly review what systems and components are covered, as well as any exclusions or limitations.

- Deductible Options: Choose a deductible amount you’re comfortable paying if you need to utilize the plan.

- Term Length and Mileage Limits: Select a plan that aligns with your driving habits and anticipated vehicle ownership duration.

- Provider Reputation: Research the reputation and financial stability of the provider, opting for reputable companies with positive customer reviews.

Comparing Auto Service Protection Plans

Comparing Auto Service Protection Plans

Auto Service Protection: Not Just for New Cars

While often associated with new car purchases, auto service protection can be valuable for used cars as well. It offers similar financial protection and peace of mind, particularly for vehicles no longer covered by a manufacturer’s warranty.

Making an Informed Decision

“Auto service protection is not a one-size-fits-all solution,” says John Smith, Senior Automotive Specialist at XYZ Auto Group. ” It’s about finding the right plan that complements your driving habits, budget, and overall peace of mind.”

auto repair protection services costa mesa ca

Carefully evaluate your driving needs, vehicle usage, and budget. Don’t hesitate to ask questions and compare quotes from different providers to secure the best possible coverage for your investment.

Conclusion

Auto service protection offers valuable financial security and peace of mind for car owners. By understanding the different types of plans, coverage options, and factors to consider when choosing a provider, you can make an informed decision that safeguards your investment and keeps you on the road with confidence.

FAQ

1. Is auto service protection the same as car insurance?

No, auto service protection is not a replacement for car insurance. Car insurance is mandatory and covers damages or injuries caused to others in an accident. Auto service protection, on the other hand, covers the cost of repairs to your vehicle due to mechanical breakdowns.

2. Can I transfer my auto service protection plan if I sell my car?

This depends on the terms of your specific plan. Some providers allow transfers, which can be a selling point for potential buyers.

3. Can I purchase auto service protection after I’ve bought my car?

Yes, you can typically purchase an auto service protection plan even after you’ve purchased your vehicle. However, it’s generally recommended to secure coverage sooner rather than later to avoid potential pre-existing condition exclusions.

auto paint protection services las vegas

4. What are common exclusions in auto service protection plans?

Common exclusions include routine maintenance (oil changes, tire rotations), wear-and-tear items (brakes, tires), and damage caused by accidents or negligence.

5. How do I file a claim with my auto service protection provider?

Contact your provider as soon as you experience a covered issue. They will guide you through the claims process, which usually involves taking your vehicle to a certified repair facility.

6. Can I negotiate the price of an auto service protection plan?

Yes, you can often negotiate the price of an auto service protection plan, similar to negotiating the price of a car. Don’t be afraid to shop around and compare offers from different providers.

7. Are there online resources to help me compare auto service protection plans?

Yes, several reputable websites and consumer organizations provide information and tools to compare different auto service protection plans.

customer service progressive auto insurance

Need More Information?

Do you have other questions about Auto Service Protection? Explore our website for additional resources and articles. Ready to get a quote? Contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our team is available 24/7 to assist you.