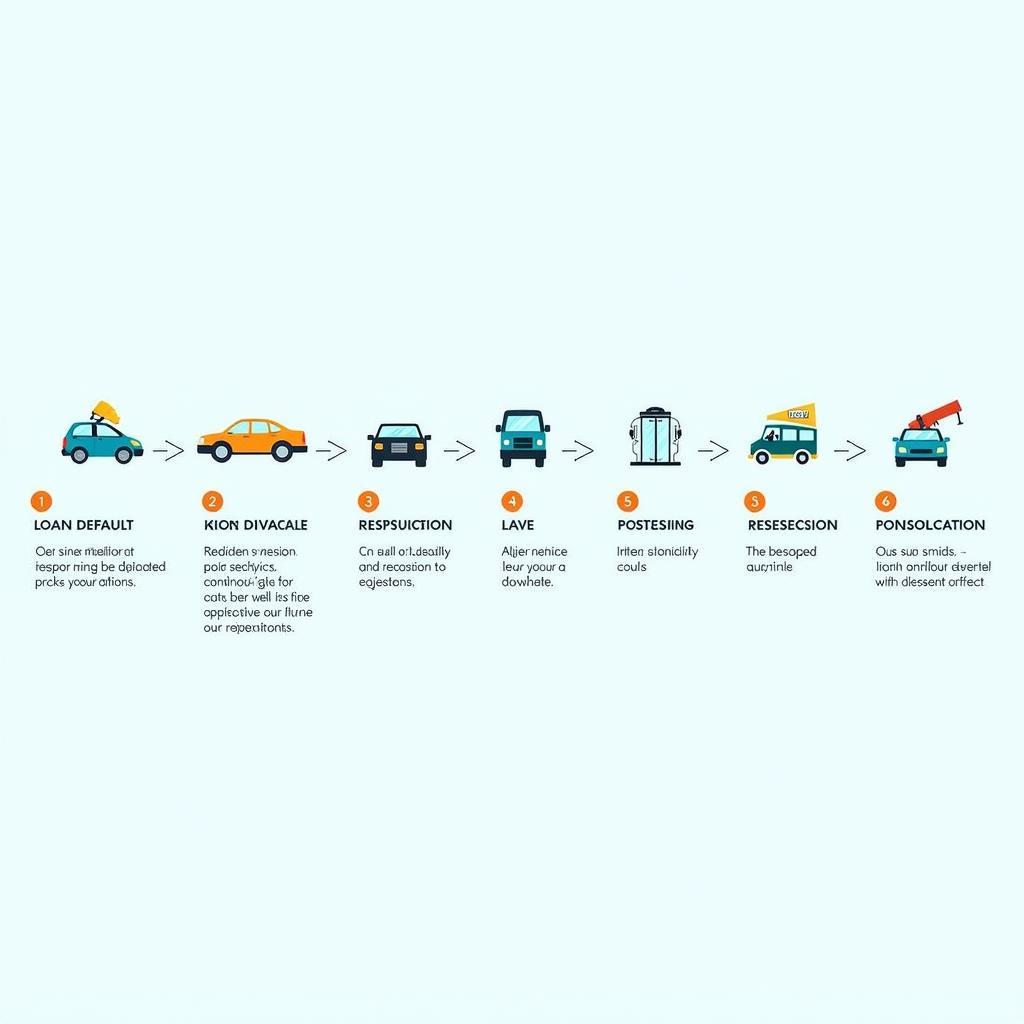

Auto Collateral Recovery Services are a critical component of the auto finance industry. They ensure that lenders can recoup losses when borrowers default on their auto loans. This guide will delve into the intricacies of auto collateral recovery, exploring the process, legalities, and best practices involved.  Image depicting the auto collateral recovery process

Image depicting the auto collateral recovery process

Understanding Auto Collateral Recovery Services

Auto collateral recovery, often referred to as repossession, is the legal process of seizing a vehicle when the borrower fails to make payments as agreed in the loan contract. This process is governed by specific laws and regulations designed to protect both the lender and the borrower. Reputable recovery agencies prioritize compliance and ethical practices throughout the entire procedure. They work closely with lenders to minimize disruptions and ensure a smooth recovery process.

What happens when a borrower defaults? Lenders typically send multiple notices and attempt to contact the borrower before initiating repossession. If these efforts are unsuccessful, they engage a licensed recovery agency. aces auto collateral recovery services indeed These agencies specialize in locating and retrieving vehicles while adhering to all legal requirements.

The Legalities of Repossession

Repossession laws vary by state, but some general principles apply across the board. For instance, recovery agents generally cannot breach the peace during repossession. This means they cannot use force, threats, or create a disturbance. They also typically cannot enter a closed garage or other secured structure without permission. Understanding these legal nuances is crucial for both lenders and borrowers.

The Role of Technology in Auto Collateral Recovery

Modern technology plays a significant role in streamlining the recovery process. GPS tracking devices installed in vehicles allow for easier location and recovery. Specialized software helps manage the entire workflow, from assigning cases to tracking recovered assets. This enhances efficiency and transparency for all parties involved. Furthermore, digital communication tools enable seamless information exchange between lenders, recovery agencies, and even borrowers.

Choosing the Right Auto Collateral Recovery Service

Selecting a reputable and reliable recovery service is crucial. Lenders should look for agencies with a proven track record of compliance, ethical practices, and efficient operations. auto site recovery services inc Key factors to consider include licensing, insurance coverage, and the use of advanced technology.

What are Auto Collateral Enforcement Services?

Auto collateral enforcement services encompass the entire process of managing defaulted auto loans, including repossession, remarketing, and legal proceedings. These services aim to minimize losses for lenders while adhering to all legal and ethical standards. auto collateral enforcement services They provide a comprehensive solution for lenders dealing with delinquent accounts.

How to Avoid Repossession

Communication is key. If you are struggling to make your car payments, contact your lender immediately. They may be able to work out a payment plan or offer other solutions to help you avoid repossession. Ignoring the problem will only make it worse.

Tips to prevent auto repossession

Tips to prevent auto repossession

“Proactive communication with borrowers is often the best way to prevent repossession,” says John Smith, Senior Vice President of Lending at National Auto Finance. “We always encourage our customers to reach out to us as soon as they anticipate any difficulty making their payments.”

Conclusion

Auto collateral recovery services are an essential part of the auto finance landscape. Understanding the process, legalities, and best practices is vital for both lenders and borrowers. By working together, lenders and borrowers can often find solutions that prevent repossession and minimize financial hardship. aces auto collateral enforcement services Remember, proactive communication is crucial in navigating the complexities of auto loan defaults.

FAQ

- What happens to my personal belongings in the car during repossession?

- Can I get my car back after it has been repossessed?

- How can I find a reputable auto collateral recovery service?

- What are my rights during the repossession process?

- What are the fees associated with repossession?

- Can I stop a repossession?

- How long does the repossession process take?

For support, please contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. We have a 24/7 customer service team.