Auto enrolment services in Derbyshire are crucial for businesses seeking to comply with UK legislation and provide their employees with valuable pension schemes. Choosing the right provider can be a complex process, but understanding your options and legal obligations will simplify the task and ensure you’re making the best decision for your business and your staff.

Navigating Auto Enrolment in Derbyshire

Staying compliant with auto enrolment regulations is non-negotiable for any business operating in Derbyshire with eligible employees. Failure to comply can result in significant penalties. This guide will walk you through the essential aspects of auto enrolment, including choosing a provider, staging dates, and ongoing management.

Understanding Your Auto Enrolment Obligations

As an employer in Derbyshire, you’re legally required to automatically enrol eligible workers into a workplace pension scheme and contribute to it. Eligibility is based on age, earnings, and employment location. Understanding these criteria is the first step towards seamless auto enrolment implementation.

- Age: Employees aged between 22 and State Pension age are typically eligible.

- Earnings: Employees must earn above a certain threshold.

- Employment Location: The employee must work in the UK.

Choosing the Right Auto Enrolment Provider in Derbyshire

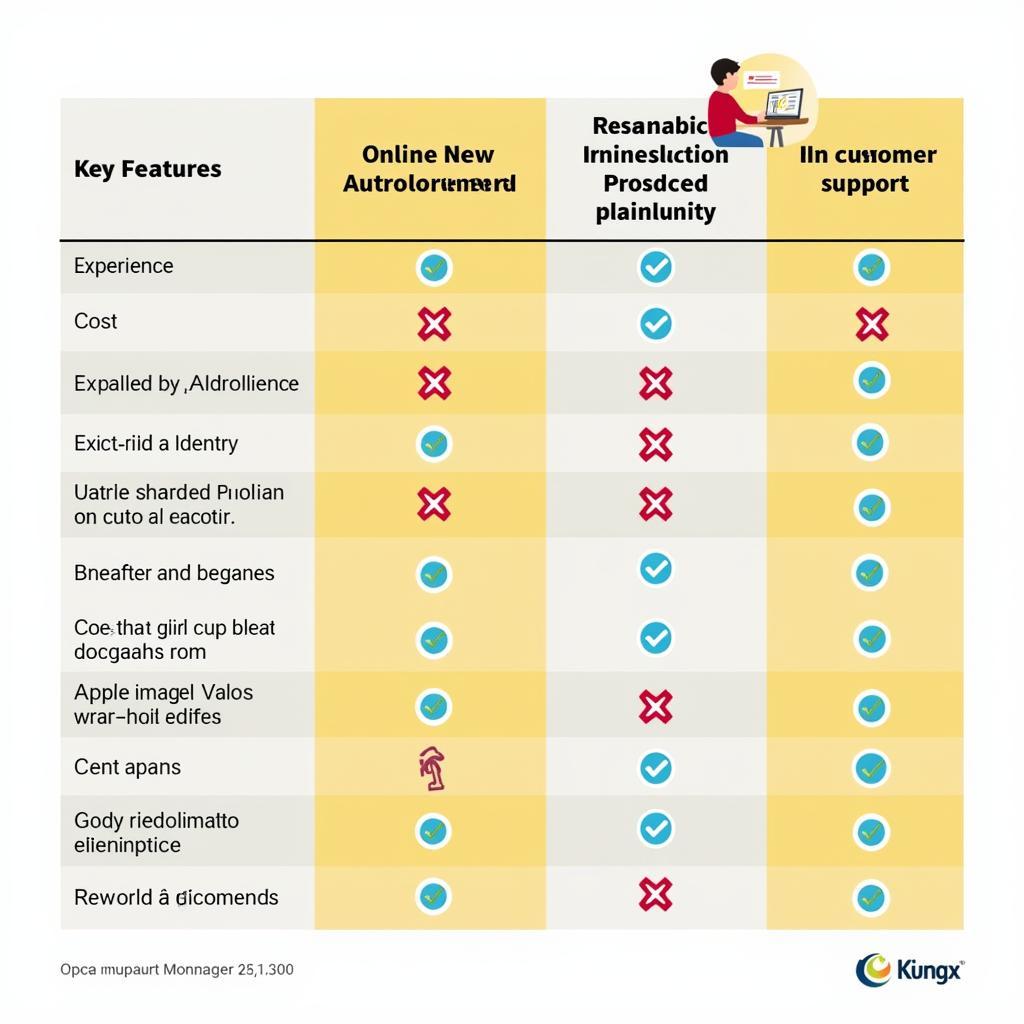

Selecting the right auto enrolment services provider is paramount for a smooth and efficient process. Consider these factors when making your decision:

- Experience and Expertise: Look for providers with a proven track record in Derbyshire and a deep understanding of the local market.

- Cost-Effectiveness: Compare pricing structures and ensure the services offered align with your budget.

- Technology and Support: A user-friendly online portal and dedicated support staff can simplify administration.

Comparing Auto Enrolment Providers in Derbyshire

Comparing Auto Enrolment Providers in Derbyshire

Ongoing Management of Auto Enrolment

Auto enrolment isn’t a one-time setup. Ongoing management is essential to ensure continued compliance. This includes:

- Monitoring employee eligibility: Regularly assess employee eligibility based on changes in age and earnings.

- Managing contributions: Ensure accurate and timely contributions are made to employee pension schemes.

- Staying updated on legislation: Keep abreast of any changes in auto enrolment regulations.

Key Considerations for Derbyshire Businesses

Derbyshire businesses should be aware of the specific challenges and opportunities related to auto enrolment in the region. Understanding the local landscape can help you tailor your approach and maximize the benefits for your employees.

Local Support and Resources

Several resources are available to help Derbyshire businesses navigate auto enrolment. These include:

- The Pensions Regulator: Provides comprehensive guidance and support on auto enrolment legislation.

- Business Support Organisations: Offer advice and resources on various aspects of running a business, including auto enrolment.

Conclusion

Auto enrolment services in Derbyshire are vital for businesses seeking to comply with legislation and provide employees with valuable pension schemes. By understanding your obligations and choosing the right provider, you can streamline the process and ensure a positive outcome for your business and your staff. Start planning your auto enrolment strategy today to avoid penalties and provide your employees with the financial security they deserve.

FAQs

- What is the minimum contribution for auto enrolment?

- What happens if I miss my staging date?

- Can I choose any pension scheme for my employees?

- How do I monitor employee eligibility for auto enrolment?

- What are the penalties for non-compliance with auto enrolment?

- How often do I need to reassess employee eligibility?

- Where can I find more information about auto enrolment in Derbyshire?

For support, contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.