Understanding the auto entrepreneur plafond for prestation de service in 2018 is crucial for managing your business finances effectively. This guide will delve into the specifics of the 2018 limits, providing clarity on what they meant for service providers operating under the auto-entrepreneur regime.

Navigating the 2018 Auto Entrepreneur Plafond for Service Providers

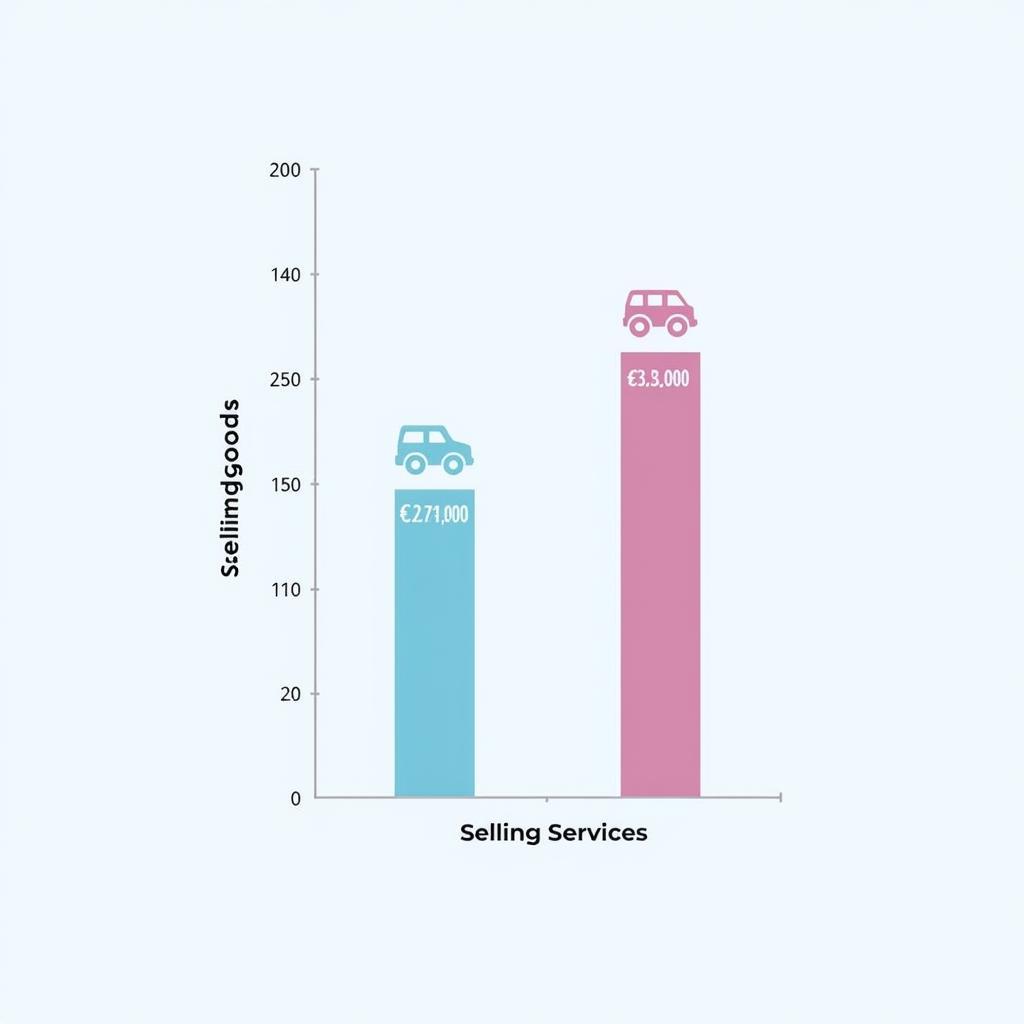

The auto entrepreneur regime, designed to simplify business administration for freelancers and small businesses, operates with specific turnover limits, known as the “plafond.” In 2018, these limits differed depending on the nature of your activity – selling goods or providing services (prestation de service). For service providers, the auto entrepreneur plafond in 2018 was €32,900. Exceeding this threshold had significant implications, affecting your tax obligations and administrative requirements.

2018 Auto Entrepreneur Plafond for Service Providers Chart

2018 Auto Entrepreneur Plafond for Service Providers Chart

Why Understanding the Plafond is Essential for Service Businesses

The plafond wasn’t just a number; it played a vital role in determining your tax liability and administrative burden. Staying below the limit allowed you to benefit from simplified accounting and tax procedures. However, exceeding it meant transitioning to a standard business regime, involving more complex VAT declarations and potentially higher social security contributions.

Impact of Exceeding the 2018 Plafond

If your turnover surpassed €32,900 for prestation de service in 2018, you became liable for VAT the following year. This meant collecting VAT from your clients and remitting it to the tax authorities. It also meant complying with more stringent bookkeeping and reporting requirements.

Practical Tips for Managing Your Turnover

Managing your turnover effectively was key to staying within the 2018 plafond. This involved careful monitoring of your income, accurate invoicing, and strategic planning. For businesses nearing the threshold, understanding the implications and planning accordingly was crucial.

Strategic Planning for Businesses Approaching the Limit

If your business was projected to exceed the plafond, you had several options, such as adjusting your pricing strategy, limiting your client base, or even considering incorporating your business under a different legal structure. Consulting with a tax advisor was highly recommended in such situations.

“Understanding the nuances of the auto entrepreneur plafond was paramount for success under this regime,” explains John Smith, a seasoned financial advisor specializing in small business taxation. “Strategic planning and proactive management of turnover were crucial for maximizing the benefits and avoiding unexpected tax liabilities.”

The Evolution of the Auto Entrepreneur Plafond

The auto entrepreneur plafond has evolved over the years, reflecting changes in economic conditions and government policies. Understanding these changes is important for businesses operating under this regime.

Conclusion: Mastering the Auto Entrepreneur Plafond for 2018 Prestation de Service

Navigating the auto entrepreneur plafond in 2018 for prestation de service required a thorough understanding of the limits, implications, and strategic planning. By staying informed and proactive, service providers could leverage the benefits of this regime while ensuring compliance and minimizing tax liabilities.

FAQ

- What was the auto entrepreneur plafond for service providers in 2018? (€32,900)

- What happened if I exceeded the plafond in 2018? (Became VAT liable the following year)

- How could I manage my turnover to stay within the limit? (Monitor income, accurate invoicing, strategic planning)

- What options did I have if I was approaching the limit? (Adjust pricing, limit clients, consider incorporation)

- Where can I find more information about the auto entrepreneur regime? (Consult a tax advisor or official government resources)

- How has the auto entrepreneur plafond changed over time? (Varied based on economic conditions and policies)

- Why is understanding the plafond important? (Affects tax liability and administrative requirements)

“Proactive management of your turnover within the auto entrepreneur framework is essential for long-term success,” adds Maria Garcia, a senior tax consultant with extensive experience advising auto entrepreneurs. “Don’t wait until you exceed the limit to start planning. Early preparation and informed decision-making are key.”

Need support? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. We have a 24/7 customer support team.