Choosing the right status for your auto business in France can be tricky, especially when deciding between “profession libérale” (liberal profession) and “prestation de service” (service provision) under the auto entrepreneur regime. This article clarifies the differences between these two classifications, helping you determine which best suits your auto business needs within the “Auto Entrepreneur Profession Libérale Ou Prestation De Service” framework.

One of the first things to consider when setting up as an auto entrepreneur is whether your activity qualifies as a liberal profession or a service provision. This distinction impacts how your business is categorized, taxed, and regulated. Making the right choice from the outset is crucial for smooth operations and avoiding future complications. Understanding the nuances of “auto entrepreneur profession libérale ou prestation de service” will empower you to make informed decisions.

Understanding the Difference: Profession Libérale vs. Prestation de Service

The core difference lies in the nature of the work. “Profession libérale” generally applies to intellectual activities requiring specific qualifications, a high degree of autonomy, and direct intellectual interaction with clients. Think of lawyers, doctors, or architects. Within the auto industry, this could apply to expert automotive consultants or specialized mechanics providing highly technical diagnoses.

“Prestation de service,” on the other hand, encompasses a broader range of activities focused on providing a specific service. This often involves manual or technical skills and less direct intellectual interaction. In the auto sector, this typically includes mechanics, bodywork specialists, car washers, and driving instructors. This is the more common categorization for those operating under “auto entrepreneur profession libérale ou prestation de service.”

Which Category Suits Your Auto Business?

Determining your category within “auto entrepreneur profession libérale ou prestation de service” requires careful consideration. Do you offer specialized expertise requiring advanced certifications, offering personalized consultations and diagnostic services? Then “profession libérale” might be appropriate. Are you primarily providing hands-on services like repairs, maintenance, or cleaning? Then “prestation de service” is likely the better fit.

“When advising auto entrepreneurs, I always emphasize the importance of accurately classifying their activity. Choosing the wrong category can lead to tax issues and legal complications down the line,” says Pierre Dubois, a seasoned business consultant specializing in the French auto sector.

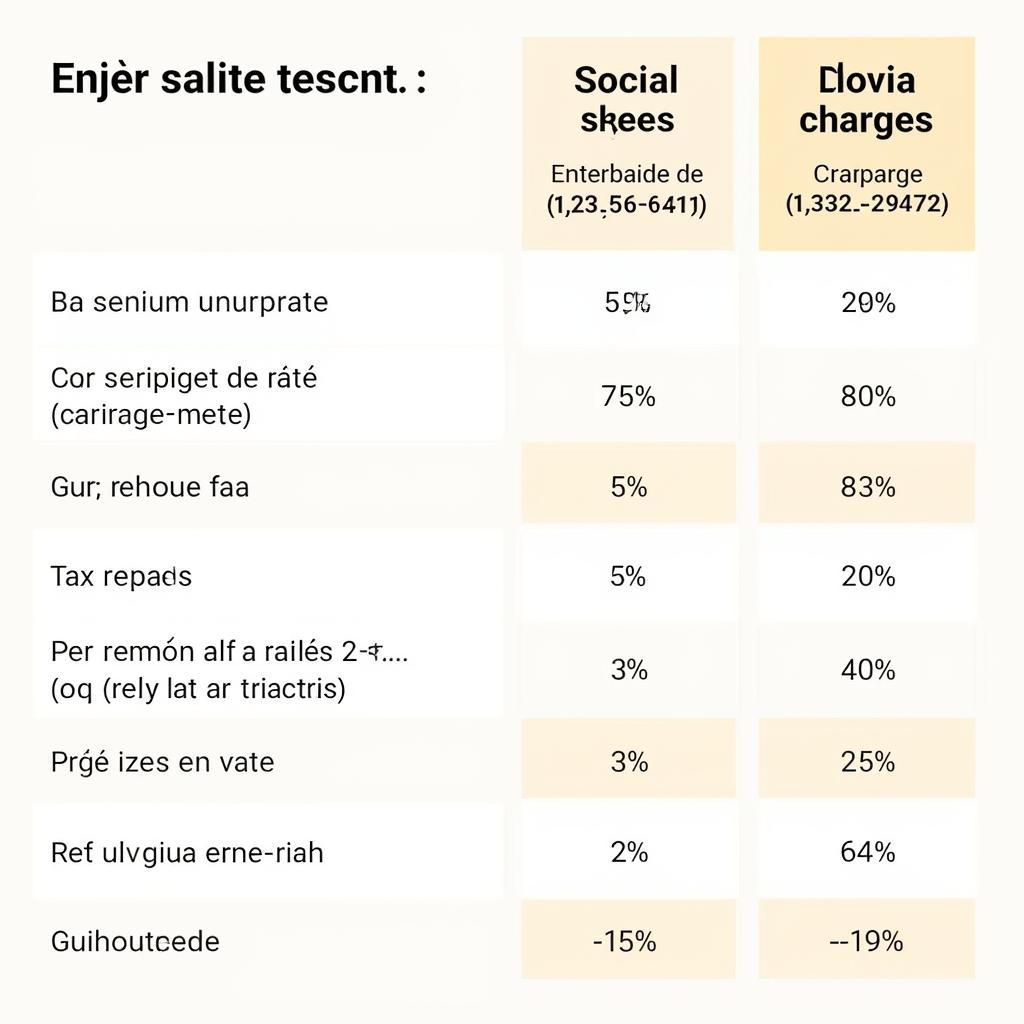

Tax Implications and Social Charges

The classification impacts your tax regime and social charges. While both “profession libérale” and “prestation de service” benefit from the simplified auto entrepreneur regime, the specific social charges rates and applicable taxes may vary slightly. Understanding these nuances is crucial for accurate accounting and tax compliance within the “auto entrepreneur profession libérale ou prestation de service” framework.

Tax Implications for Auto Entrepreneurs in France

Tax Implications for Auto Entrepreneurs in France

Making the Right Choice: Key Considerations

When deciding between “auto entrepreneur profession libérale ou prestation de service,” consider these questions:

- What are your core services?

- What qualifications do you hold?

- How do you interact with clients?

- What is the level of intellectual input required in your work?

“The key is to be honest with yourself about the nature of your work. It’s always best to consult with a professional if you’re unsure,” advises Sophie Martin, a legal expert specializing in auto entrepreneur regulations.

Conclusion

Choosing the right classification within the “auto entrepreneur profession libérale ou prestation de service” framework is a crucial first step for your auto business in France. Understanding the distinctions and carefully considering your activity will ensure compliance and help you build a successful enterprise. Take the time to research thoroughly, seek expert advice if needed, and make an informed decision that sets you up for success.

FAQ

- What is the difference between “profession libérale” and “prestation de service”?

- How do I determine the right category for my auto business?

- What are the tax implications of each classification?

- Where can I find more information on the auto entrepreneur regime?

- What are the social charge rates for auto entrepreneurs?

- Can I change my classification later if needed?

- Are there specific regulations for auto entrepreneurs in the automotive sector?

Need further assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. We have a 24/7 customer support team.