Auto Financial Services Processes are crucial for both consumers and businesses in the automotive industry. Whether you’re buying a new car, financing a used vehicle, or managing a dealership’s finances, understanding these processes is essential for making informed decisions and navigating the complexities of the auto market. This article will delve into the various aspects of auto financial services, providing a comprehensive overview of the key processes involved.

Decoding the Auto Financial Services Processes

Auto financial services encompass a wide range of activities, from loan origination and underwriting to collections and repossessions. These processes are designed to facilitate the purchase and financing of vehicles, as well as to manage the associated risks for lenders and borrowers. A clear understanding of these processes can empower consumers to negotiate better deals and avoid potential pitfalls. For businesses, this knowledge is vital for optimizing operations and maintaining a healthy financial standing.

For consumers, understanding auto financial services processes begins with researching loan options and comparing interest rates. This involves understanding concepts like APR (Annual Percentage Rate), loan terms, and down payments. It’s important to shop around and compare offers from different lenders, including banks, credit unions, and online lenders.

Businesses within the auto industry, such as dealerships and finance companies, must be well-versed in the intricacies of loan processing, compliance regulations, and risk management. They need to efficiently manage loan applications, verify customer information, and assess creditworthiness. Additionally, they must adhere to strict regulatory requirements to ensure fair lending practices. Check out our insights into the auto financial services industry.

Loan Origination and Underwriting: A Closer Look

Loan origination is the initial stage of the auto financing process, where the borrower applies for a loan and provides the necessary documentation. The lender then evaluates the borrower’s creditworthiness and determines the loan terms, including the loan amount, interest rate, and repayment period. This process involves verifying employment, income, and credit history.

Underwriting is the next step, where the lender assesses the risk associated with lending to the borrower. This assessment considers factors such as credit score, debt-to-income ratio, and employment stability. The underwriter’s decision determines whether the loan is approved, and if so, under what conditions.

Loan Origination and Underwriting Process in Auto Finance

Loan Origination and Underwriting Process in Auto Finance

Managing Auto Loan Repayments: Key Strategies

Once the loan is approved and the vehicle is purchased, the borrower begins making regular payments according to the agreed-upon terms. Managing loan repayments effectively is crucial for maintaining a good credit score and avoiding financial difficulties. This involves setting up automatic payments, budgeting for monthly expenses, and understanding the consequences of late or missed payments.

For businesses, managing loan portfolios requires efficient tracking of payments, handling delinquencies, and ensuring compliance with regulatory requirements. Implementing robust systems for loan servicing and collections is essential for minimizing financial losses and maintaining a healthy bottom line. Need help with your business? Explore our auto dealer consulting services near me.

Navigating the Complexities of Auto Lease Agreements

Leasing a vehicle is another option within the auto financial services landscape. Lease agreements involve different terms and conditions compared to traditional loans, and understanding these nuances is vital for making an informed decision. Lease agreements typically specify the lease term, mileage limits, and end-of-lease options. Consumers should carefully review the terms and conditions of a lease agreement before signing.

Businesses that offer leasing options must effectively manage lease portfolios, handle lease terminations, and remarket leased vehicles. This requires specialized knowledge and expertise in lease accounting and regulatory compliance. Consider our auto consulting services for expert advice.

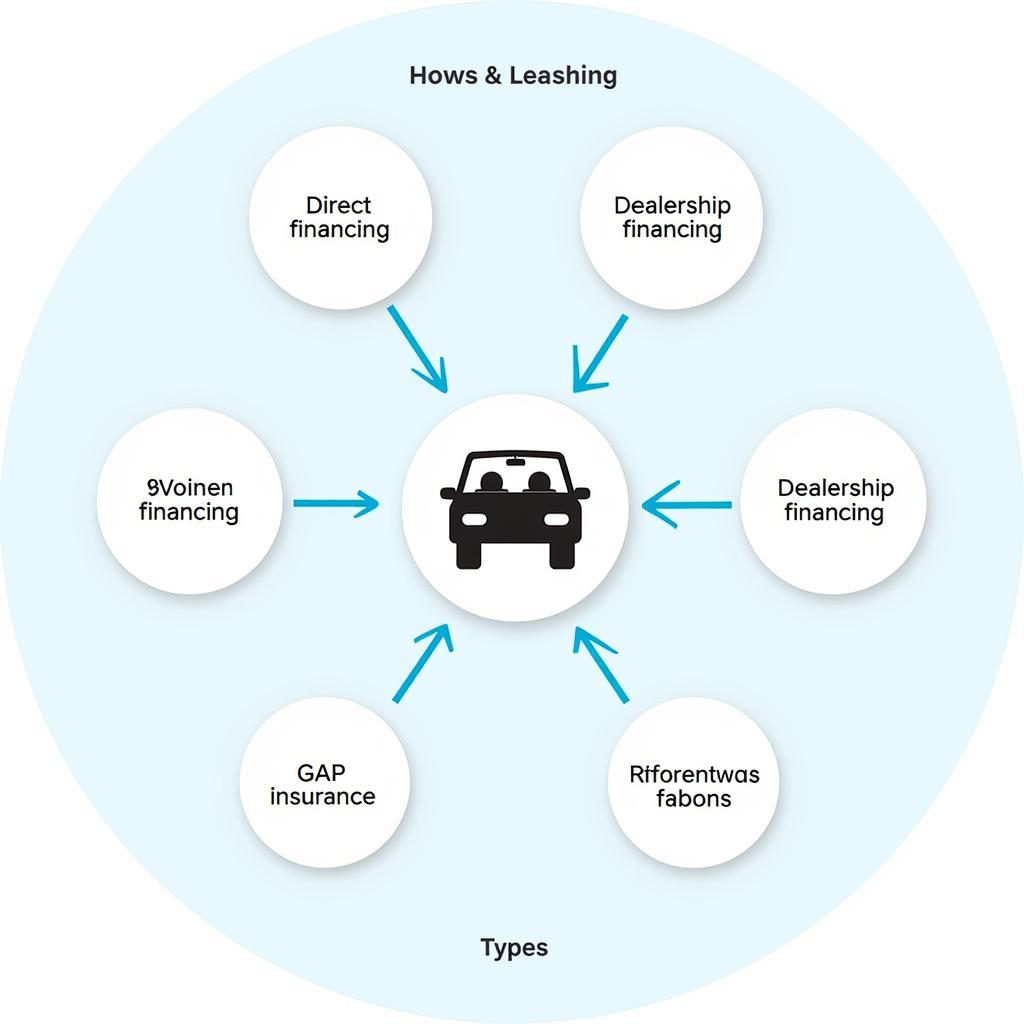

What are the different types of auto financial services?

Auto financial services encompass a variety of offerings, including:

- Direct financing: Loans obtained directly from banks, credit unions, or online lenders.

- Dealership financing: Loans facilitated by the dealership through their network of lenders.

- Leasing: A contractual agreement allowing the use of a vehicle for a specified period in exchange for regular payments.

- Refinancing: Obtaining a new loan to replace an existing auto loan, often with more favorable terms.

- GAP insurance: Covers the difference between the actual cash value of a vehicle and the outstanding loan balance in case of total loss.

“Understanding the nuances of each type of auto financial service is paramount for both consumers and businesses,” says John Smith, Senior Financial Analyst at Auto Finance Solutions. “This knowledge empowers consumers to make informed decisions that align with their individual needs and financial goals.”

Different Types of Auto Financial Services Explained

Different Types of Auto Financial Services Explained

Conclusion

Auto financial services processes play a vital role in the automotive industry. Understanding these processes is essential for consumers seeking to finance or lease a vehicle, as well as for businesses operating within the auto sector. By grasping the key concepts and procedures involved in auto financing, individuals and businesses can make informed decisions, manage their finances effectively, and navigate the complexities of the auto market with confidence. For specialized assistance with title services, explore our Alabama auto title service. Understanding auto financial services processes empowers you to take control of your automotive financial journey.

FAQ

-

What is APR?

APR stands for Annual Percentage Rate and represents the total cost of borrowing, including interest and fees, expressed as a yearly percentage. -

What is a good credit score for auto financing?

A credit score above 700 is generally considered good for auto financing, potentially qualifying you for lower interest rates. -

What is the difference between a loan and a lease?

A loan involves purchasing a vehicle and making monthly payments until the loan is paid off, while a lease involves paying for the use of a vehicle for a specific period. -

How can I improve my chances of getting approved for an auto loan?

Improving your credit score, maintaining a stable income, and making a larger down payment can increase your chances of loan approval. -

What is GAP insurance?

GAP insurance covers the difference between the actual cash value of your vehicle and the outstanding loan balance in case of total loss. -

What are the common fees associated with auto financing?

Common fees include origination fees, processing fees, and documentation fees. -

How can I refinance my auto loan?

You can refinance your auto loan by applying for a new loan with a different lender, often to obtain a lower interest rate or better terms.

Common Scenarios in Auto Financial Services

- Scenario 1: A young professional is looking to purchase their first car and needs to understand the auto loan application process.

- Scenario 2: A family is considering leasing a minivan and wants to compare the costs and benefits of leasing versus buying.

- Scenario 3: A business owner needs to finance a fleet of vehicles for their company and is exploring different financing options.

- Scenario 4: A consumer wants to refinance their existing auto loan to lower their monthly payments.

- Scenario 5: An individual is concerned about the gap between their auto insurance coverage and the outstanding loan balance and wants to explore GAP insurance.

Further Reading & Related Resources

- Explore more about auto lending practices.

- Learn about the latest trends in the auto finance industry.

- Discover tips for managing your auto loan effectively.

Need help? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7. We also have a dedicated auto lenders service department.