Auto Financing Services are the backbone of the car buying process for many. Whether you’re eyeing a new ride or a used vehicle, understanding how auto financing works can save you money and headaches. This guide dives deep into the world of auto loans, helping you navigate the process with confidence.

Financing a car can feel overwhelming, with various loan types, interest rates, and lenders to consider. But, armed with the right information, you can secure the best possible deal and drive away in your dream car without breaking the bank. We’ll explore everything from pre-approval to loan terms, empowering you to make informed decisions. Just after your first car service, understanding your financing options is crucial. Thinking about auto transmission repair service can be costly so having a financial plan is wise.

Types of Auto Financing Services

There are several ways to finance a vehicle, each with its own set of pros and cons. Let’s break down the most common types:

- Direct Lending: Borrowing directly from banks, credit unions, or online lenders. This often offers competitive interest rates and pre-approval options.

- Dealership Financing: Securing financing through the car dealership. This can be convenient, but rates may be higher than direct lending.

- Lease-to-Own: Leasing a car with the option to purchase it at the end of the lease term. This can be a good option if you want a new car every few years.

- Personal Loans: Using a personal loan to purchase a car. This can be a viable option if you have good credit and want flexibility.

Understanding the nuances of each type is crucial for selecting the best fit for your financial situation. For instance, direct lending might offer better rates, while dealership financing might offer special promotions.

Direct Lending vs Dealership Financing: A Comparison

Direct Lending vs Dealership Financing: A Comparison

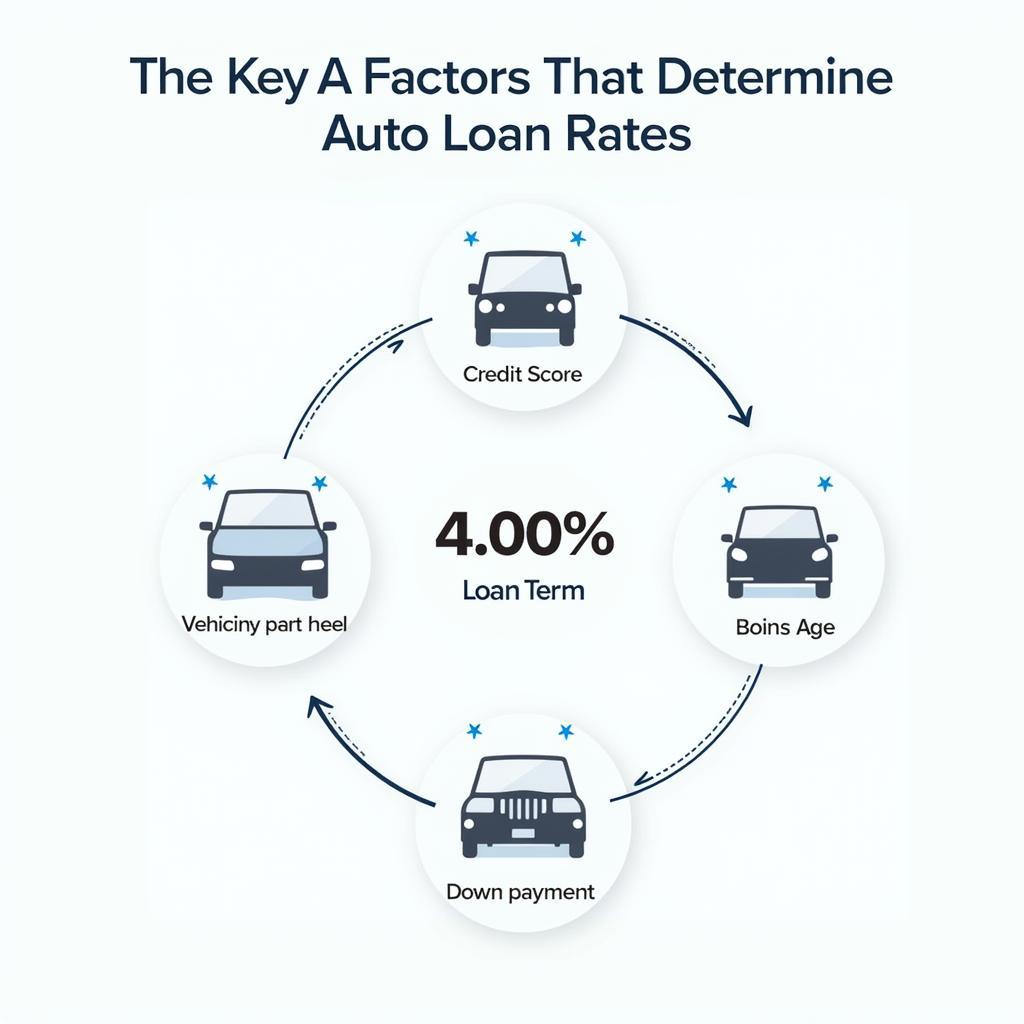

Key Factors Affecting Auto Loan Rates

Several factors influence the interest rate you’ll receive on an auto loan. These include:

- Credit Score: A higher credit score generally translates to lower interest rates.

- Loan Term: Longer loan terms often have lower monthly payments but higher overall interest costs.

- Vehicle Age: Loans for new cars typically have lower interest rates than those for used cars.

- Down Payment: A larger down payment can lead to a lower interest rate and a smaller loan amount.

Knowing how these factors impact your loan terms can help you prepare and negotiate effectively. For example, improving your credit score before applying can significantly reduce your interest rate.

Key Factors Influencing Auto Loan Rates

Key Factors Influencing Auto Loan Rates

The Auto Financing Process: A Step-by-Step Guide

Navigating the auto financing process can be simplified by following these steps:

- Determine Your Budget: Figure out how much you can comfortably afford to spend on car payments.

- Check Your Credit Score: Obtain your credit report and address any errors.

- Get Pre-Approved: Secure pre-approval from multiple lenders to compare rates and terms. Auto repair services raleigh can be a great resource when considering a pre-owned vehicle.

- Shop for a Car: Once pre-approved, start shopping for your desired vehicle.

- Negotiate the Price: Don’t be afraid to negotiate the price of the car with the dealer.

- Finalize the Loan: Review the loan terms carefully before signing.

- Make Timely Payments: Ensure you make your car payments on time to maintain a good credit history.

Following these steps can streamline the process and ensure you secure a favorable loan. Auto repair auto repair services offered are also important considerations after purchase.

Navigating the Auto Financing Process: A Step-by-Side Guide

Navigating the Auto Financing Process: A Step-by-Side Guide

If you’re looking for reliable auto glass repair charlotte i85 service road is a good place to check out. Remember, six stars auto service is a great goal when choosing your mechanic.

Conclusion

Auto financing services are essential for many car buyers. Understanding the different types of loans, the factors affecting interest rates, and the overall financing process empowers you to make informed decisions and secure the best possible deal. By following the steps outlined in this guide, you can confidently navigate the world of auto financing and drive away in your dream car. Considering auto financing services early in your car buying journey is a wise move.

FAQ

- What is the difference between pre-qualification and pre-approval?

- How does my credit score affect my auto loan rate?

- What is the typical loan term for auto financing?

- Can I refinance my auto loan?

- What are the penalties for late payments?

- What is GAP insurance?

- How can I improve my chances of getting approved for an auto loan?

Common Auto Financing Scenarios

- Scenario 1: A young professional with good credit seeking to finance their first new car.

- Scenario 2: A family looking to upgrade their vehicle with a larger loan.

- Scenario 3: A retiree with limited income seeking an affordable used car.

Related Resources

For more information on auto repair, check out our article on auto transmission repair service.

Need Help?

Contact us via WhatsApp: +1(641)206-8880 or Email: [email protected] for 24/7 support.