Auto finansas services provided by Banco del Austro can be a great way to finance your dream car. This guide explores everything you need to know about auto financing through Banco del Austro, from loan options and interest rates to application requirements and repayment terms. We’ll delve into the details, providing valuable insights to help you navigate the process with confidence.

Understanding Auto Financing Options with Banco del Austro

Banco del Austro likely offers a variety of auto financing options tailored to different needs and budgets. These could include traditional auto loans, leasing options, and potentially specialized programs for new or used vehicles. Understanding the nuances of each option is crucial for making an informed decision. Factors like loan terms, down payment requirements, and interest rates can significantly impact the overall cost of your vehicle.

Exploring Loan Terms and Interest Rates

Loan terms, typically ranging from 12 to 72 months, determine the length of your repayment period. Shorter loan terms result in higher monthly payments but lower overall interest paid. Conversely, longer loan terms lead to lower monthly payments but a higher total interest cost. Interest rates, which can be fixed or variable, depend on factors like your credit score, loan term, and the type of vehicle you’re purchasing. Banco del Austro likely has specific criteria for determining interest rates, so understanding these factors is essential.

Navigating Down Payment and Other Requirements

A down payment, a portion of the vehicle’s purchase price paid upfront, can reduce your loan amount and potentially lower your interest rate. Banco del Austro may have specific down payment requirements depending on the loan type and vehicle. Other requirements might include proof of income, residency, and a valid driver’s license. Understanding these prerequisites beforehand can streamline the application process.

Applying for Auto Financing with Banco del Austro

The application process for auto financing typically involves completing an application form, providing necessary documentation, and undergoing a credit check. Banco del Austro likely has a dedicated team to guide you through this process, either online or in person at their branches. Being prepared with all the required documents can expedite the approval process.

Tips for a Smooth Application Process

Gather all required documents beforehand, including proof of income, identification, and vehicle details. Review your credit report and address any discrepancies before applying. Having a clear understanding of your budget and desired loan terms can also help you communicate effectively with Banco del Austro representatives.

Approved Auto Loan from Banco del Austro

Approved Auto Loan from Banco del Austro

Understanding Repayment Options

Banco del Austro likely offers various repayment options, such as online payments, automatic bank transfers, and in-person payments at their branches. Understanding these options and choosing the one that best suits your financial habits can simplify the repayment process.

Benefits of Choosing Banco del Austro for Auto Financing

Choosing Banco del Austro for your auto financing needs might offer several benefits, including competitive interest rates, flexible loan terms, and personalized customer service. Their established presence and expertise in the financial sector can provide peace of mind throughout the process.

Expert Insights

“Choosing the right auto financing partner is crucial. Banco del Austro’s commitment to customer service and flexible loan options sets them apart,” says Maria Sanchez, a Senior Financial Advisor at Apex Financial Consulting.

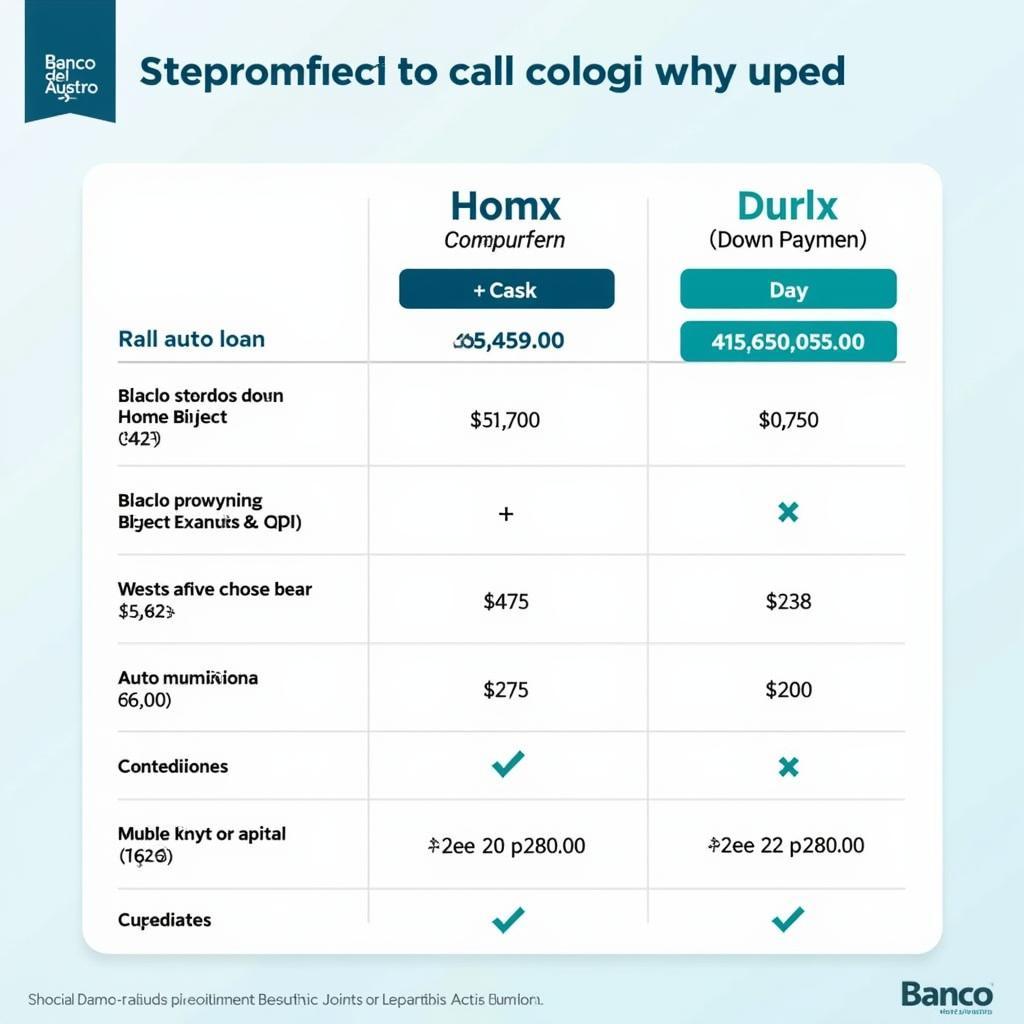

Comparing Auto Loan Options at Banco del Austro

Comparing Auto Loan Options at Banco del Austro

Conclusion

Auto finansas services through Banco del Austro provide a viable pathway to owning your desired vehicle. By understanding the various loan options, requirements, and repayment terms, you can navigate the process efficiently and make informed decisions that align with your financial goals. Choose Banco del Austro for a reliable and potentially advantageous auto financing experience.

FAQ

- What are the typical loan terms offered by Banco del Austro for auto financing?

- What documents are required to apply for an auto loan with Banco del Austro?

- How can I check my auto loan application status with Banco del Austro?

- What are the different repayment options available for auto loans with Banco del Austro?

- Does Banco del Austro offer special financing programs for new or used vehicles?

- How does my credit score impact my auto loan interest rate with Banco del Austro?

- What is the process for pre-approval for an auto loan with Banco del Austro?

Need support? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.

Leave a Reply