Decoding Auto & General Insurance Services

Auto insurance, a critical component of auto & general insurance services, protects you financially in case of accidents, theft, or other vehicle-related damages. It’s not just a legal requirement in most places; it’s a smart investment that provides peace of mind on the road. General insurance, on the other hand, encompasses a broader spectrum of coverage, including home, health, and travel insurance. Together, they form a safety net for your various assets and well-being.

Types of Auto Insurance Coverage

Understanding the different types of coverage is crucial for selecting the right auto & general insurance services for your needs. Here’s a breakdown of the key coverage options:

- Liability Coverage: This covers bodily injury and property damage you may cause to others in an accident. It’s the most basic and often mandatory type of coverage.

- Collision Coverage: This covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: This protects your car from non-collision related damages, such as theft, vandalism, fire, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have enough insurance or any insurance at all.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers, regardless of fault.

andersons auto service can provide valuable advice on choosing appropriate auto insurance for your specific vehicle and driving habits.

Choosing the Right Auto & General Insurance Services

Selecting the right auto & general insurance services involves careful consideration of your individual needs and budget. Factors such as your driving history, vehicle type, and location play a significant role in determining your premiums.

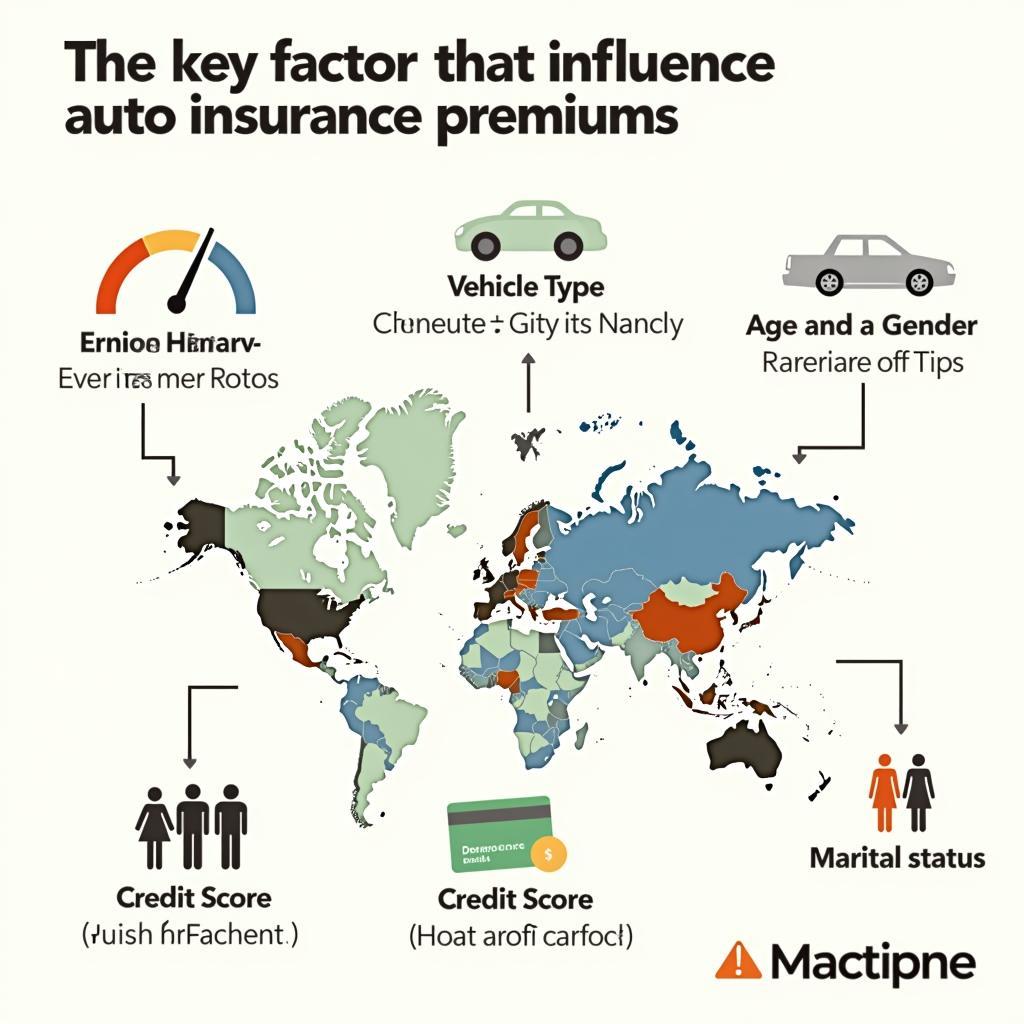

Factors Affecting Insurance Premiums

- Driving History: A clean driving record translates to lower premiums. Accidents and traffic violations can significantly increase your insurance costs.

- Vehicle Type: The make, model, and year of your vehicle influence insurance rates. Sports cars and luxury vehicles generally cost more to insure than standard sedans.

- Location: Where you live can impact your insurance premiums due to varying risk factors like traffic density and crime rates.

Factors Affecting Auto & General Insurance Premiums

Factors Affecting Auto & General Insurance Premiums

Tips for Saving on Insurance

- Compare Quotes: Shopping around and comparing quotes from different insurers can help you find the best rates.

- Bundle Policies: Bundling your auto insurance with other types of insurance, such as home insurance, can often lead to discounts. all about auto service towing & r can also be a valuable resource in these instances.

- Maintain a Good Credit Score: In many states, your credit score can affect your insurance premiums. Maintaining a good credit score can help you secure lower rates.

- Take Advantage of Discounts: Many insurers offer discounts for things like safe driving, anti-theft devices, and good student status.

“Understanding your coverage needs and comparing quotes are essential steps in finding the right auto insurance,” advises John Smith, a seasoned insurance broker with over 20 years of experience.

auto service in athens ga might also be relevant to your search depending on location.

The Importance of Auto & General Insurance

Having adequate auto & general insurance provides financial security and peace of mind. Knowing you’re protected in case of unexpected events allows you to focus on what matters most.

Benefits of Having Insurance

- Financial Protection: Insurance covers the costs of repairs, medical bills, and legal fees associated with accidents or other covered events.

- Peace of Mind: Knowing you’re financially protected provides peace of mind and reduces stress.

- Legal Compliance: Auto insurance is a legal requirement in most states.

Benefits of Auto & General Insurance Services

Benefits of Auto & General Insurance Services

“Comprehensive coverage provides the most extensive protection, safeguarding you from a wider range of potential risks,” says Sarah Jones, a leading insurance consultant.

auto detailing mobile service near me can be a great resource for maintaining your vehicle and potentially reducing insurance costs.

Conclusion

Auto & general insurance services are vital for protecting yourself, your vehicle, and your financial well-being. By understanding the different types of coverage, factors affecting premiums, and tips for saving money, you can make informed decisions and choose the best policy for your needs. Remember to compare quotes from multiple insurers and review your coverage regularly to ensure it continues to meet your changing needs.

auto transporter car carriers & towing services can also be a valuable service in certain insurance claim scenarios.

FAQ

- What is the difference between liability and collision coverage?

- How can I lower my insurance premiums?

- What is comprehensive coverage and why do I need it?

- How do I file an insurance claim after an accident?

- What factors determine my insurance rates?

- What is uninsured/underinsured motorist coverage?

- How much auto insurance do I need?

Need assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.