Finding the right auto insurance in Silver City, New Mexico, can feel overwhelming. With so many options and providers, it’s important to understand what coverage you need and how to get the best rates. This guide will walk you through everything you need to know about auto insurance services in Silver City, NM, so you can drive with confidence and peace of mind.

Understanding Auto Insurance in New Mexico

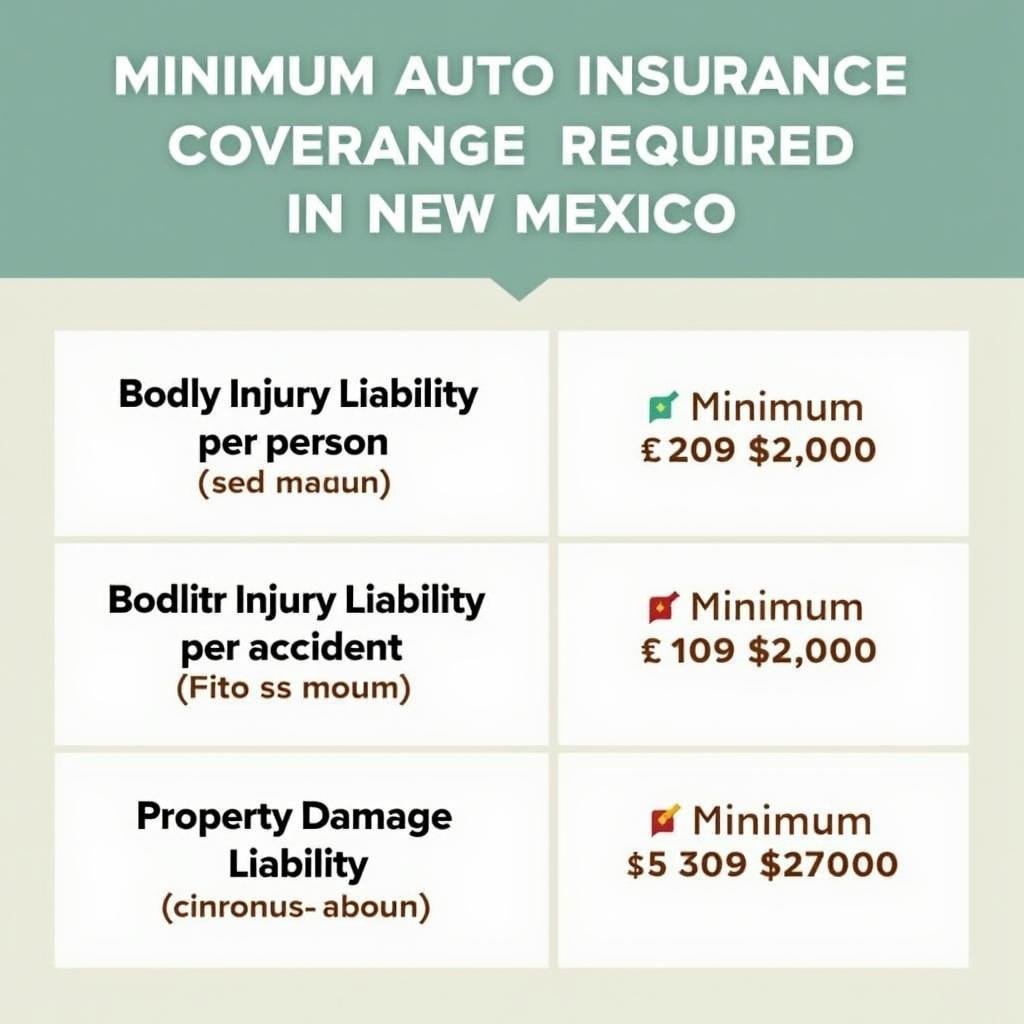

New Mexico requires all drivers to have a minimum level of liability insurance. This coverage protects you financially if you cause an accident that results in injuries or property damage to others. Here’s what that minimum coverage looks like:

- Bodily Injury Liability per person: $25,000

- Bodily Injury Liability per accident: $50,000

- Property Damage Liability: $10,000

While these are the state minimums, they may not be enough to protect you fully. It’s highly recommended that you consider purchasing more coverage to ensure you’re financially prepared for a serious accident.

New Mexico Minimum Auto Insurance Coverage

New Mexico Minimum Auto Insurance Coverage

Types of Auto Insurance Coverage Available in Silver City, NM

Besides the required liability coverage, several other types of auto insurance are available to provide you with more comprehensive protection.

- Collision Coverage: This covers damages to your vehicle resulting from a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: This protects your car from damages not caused by a collision, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for your damages or medical bills.

- Medical Payments Coverage (MedPay): This helps cover medical expenses for you and your passengers, regardless of fault, in case of an accident.

- Personal Injury Protection (PIP): Similar to MedPay, PIP can also cover lost wages and other expenses related to an accident.

Types of Auto Insurance Coverage in Silver City, NM

Types of Auto Insurance Coverage in Silver City, NM

Factors Affecting Your Auto Insurance Premiums in Silver City

Several factors influence how much you pay for auto insurance in Silver City, NM. Understanding these factors can help you find ways to potentially lower your premiums.

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance rates.

- Vehicle Type: The make, model, and year of your vehicle affect your insurance costs. Sportier and more expensive cars generally cost more to insure.

- Credit Score: In New Mexico, insurance companies can use your credit score to determine your insurance premiums. A good credit score can lead to lower rates.

- Location: Where you live in Silver City can affect your insurance rates. Areas with higher crime rates or more accidents may have higher premiums.

- Coverage Options: The types and amount of coverage you choose significantly impact your insurance costs. Higher coverage limits generally result in higher premiums.

Finding the Best Auto Insurance Services in Silver City

When looking for auto insurance in Silver City, NM, it’s essential to compare quotes from multiple insurance providers. Each company has its own way of calculating rates, so shopping around can help you find the most competitive price for the coverage you need.

Here are some tips for finding the best auto insurance services:

- Get Quotes from Multiple Insurers: Don’t settle for the first quote you receive. Get quotes from at least three different insurance companies to compare rates and coverage options.

- Ask About Discounts: Many insurance companies offer discounts that can help you save money on your premiums. Ask about discounts for things like good driving, multiple vehicles, bundling insurance policies (e.g., auto and home insurance), and safety features in your car.

- Read Reviews: Before committing to an insurance provider, take the time to read online reviews from other customers. This can give you insights into the company’s customer service, claims handling process, and overall reputation.

- Work with an Independent Insurance Agent: An independent agent can help you compare quotes from multiple insurers and find the best policy for your needs. They work for you, not a specific insurance company, so they can offer unbiased advice.

Auto Insurance Comparison Checklist

Auto Insurance Comparison Checklist

Driving with Confidence in Silver City

Securing the right auto insurance is a crucial step in protecting yourself and your vehicle while driving in Silver City, NM. By understanding your coverage options, factors affecting your rates, and tips for finding the best insurance services, you can make informed decisions and drive with confidence, knowing you’re well-protected on the road.

Remember: Auto insurance requirements and regulations can change. It’s always a good idea to stay updated on the latest New Mexico insurance laws and consult with a licensed insurance professional for personalized advice.