Navigating the world of auto financing can be daunting. Finding the right Auto Loan Services Company is crucial for securing a favorable interest rate and manageable monthly payments. This guide will walk you through the essential steps to finding a reputable auto loan services company that meets your specific needs. Let’s explore the key factors to consider and empower you to make an informed decision.

Understanding Auto Loan Services Companies

Auto loan services companies are financial institutions that specialize in providing loans specifically for purchasing vehicles. These companies can range from large national banks to smaller credit unions and online lenders. Each auto loan services company has its own criteria for loan approval, interest rates, and loan terms. westlake financial services auto loan can help you understand the intricacies of this process.

Different Types of Auto Loan Services Companies

There are several types of auto loan services companies to choose from:

- Banks: Traditional banks often offer auto loans, but their approval criteria can be stricter than other lenders.

- Credit Unions: Credit unions often offer competitive interest rates and personalized service to their members.

- Online Lenders: Online lenders provide a convenient way to shop for auto loans and compare rates from multiple lenders.

- Dealerships: Some dealerships offer in-house financing, but it’s important to compare their rates with other lenders before committing.

Key Factors to Consider When Choosing an Auto Loan Services Company

Finding the perfect auto loan services company requires careful consideration of several crucial factors.

Interest Rates and Fees

One of the most important factors is the interest rate offered by the auto loan services company. A lower interest rate will result in lower monthly payments and less interest paid over the life of the loan. Compare rates from multiple lenders to ensure you’re getting the best deal. Don’t forget to also consider any associated fees, such as origination fees or prepayment penalties.

Loan Terms

Loan terms, including the loan length and monthly payment amount, should align with your budget and financial goals. Longer loan terms result in lower monthly payments but more interest paid over time. Shorter loan terms result in higher monthly payments but less total interest paid.

Credit Score Requirements

Your credit score plays a significant role in your eligibility for an auto loan and the interest rate you’ll receive. auto funding services can provide further insight into this aspect.

Customer Service

Choosing an auto loan services company with excellent customer service can make the loan process smoother and less stressful. Look for lenders with responsive customer support and positive reviews.

Pre-Approval Process

Getting pre-approved for an auto loan can give you a clear idea of how much you can borrow and what interest rate you’ll qualify for. This can help you negotiate a better deal with a dealership.

How to Find a Reputable Auto Loan Services Company

Finding a reputable auto loan services company requires some research and due diligence.

Online Research

Start your search online by comparing rates and reading reviews of different lenders. Websites like Bankrate and NerdWallet offer helpful resources for comparing auto loan rates. You can also check the Better Business Bureau for ratings and reviews of auto loan services companies.

Check with Your Local Bank or Credit Union

Your local bank or credit union may offer competitive auto loan rates, especially if you have a good relationship with them. advantage auto insurance customer service might offer helpful resources as well.

Ask for Referrals

Ask friends, family, or colleagues for referrals to auto loan services companies they’ve had positive experiences with.

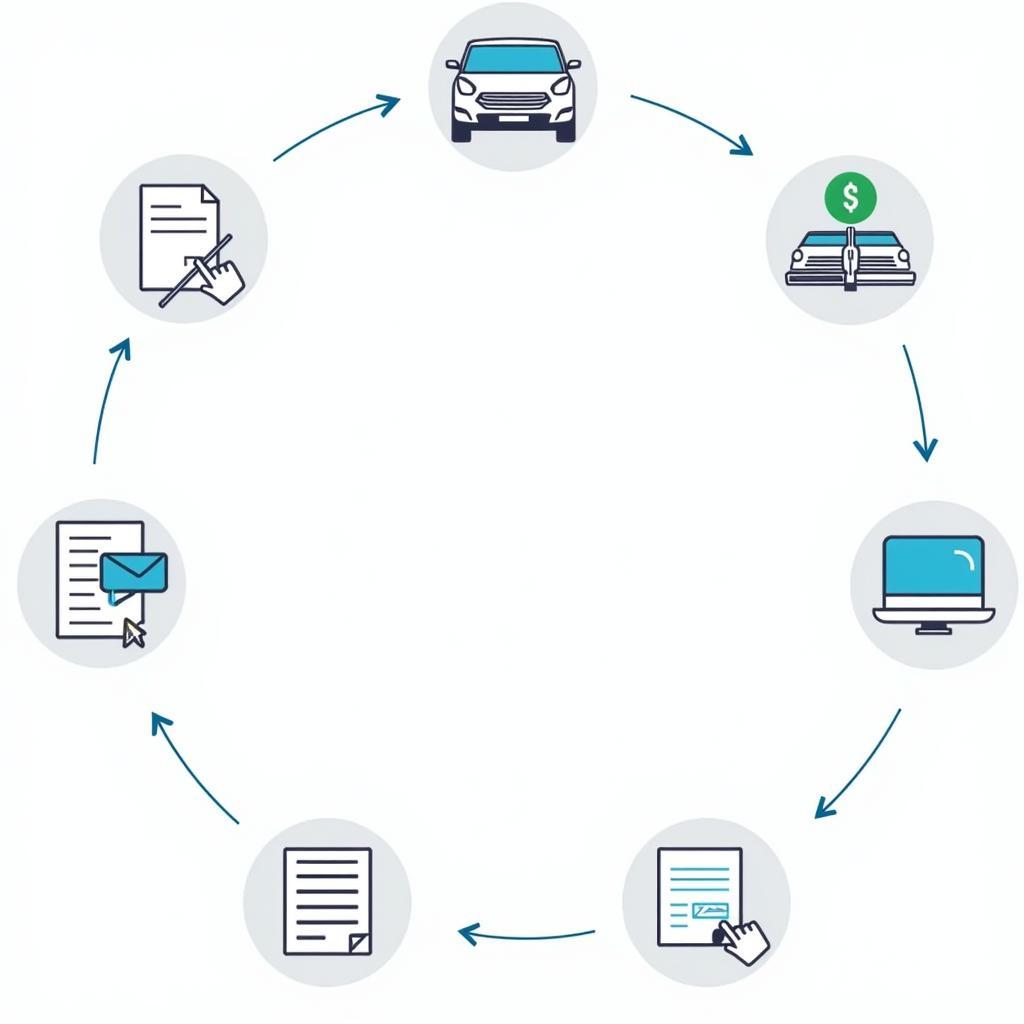

Auto Loan Application Process

Auto Loan Application Process

Conclusion

Finding the right auto loan services company is an essential step in purchasing a vehicle. By considering the factors discussed above and conducting thorough research, you can secure a favorable loan that fits your budget and financial goals. Remember, a well-chosen auto loan services company can make all the difference in your car buying experience.

FAQs

- What is the average auto loan interest rate?

- How does my credit score affect my auto loan rate?

- What documents do I need to apply for an auto loan?

- What is the difference between a secured and unsecured auto loan?

- Can I get pre-approved for an auto loan?

- What is the typical loan term for an auto loan?

- How can I improve my chances of getting approved for an auto loan?

You might also be interested in learning more about auto america service phone or auto repo service kennewick wa.

Need assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.