Auto loan services are an essential part of the car buying process for many people. But what exactly do they mean? Essentially, auto loan services refer to the various financial institutions and processes involved in helping individuals borrow money to purchase a vehicle. This comprehensive guide will delve into the intricacies of auto loan services, covering everything from understanding different loan types to navigating the application process.

Understanding Auto Loan Services

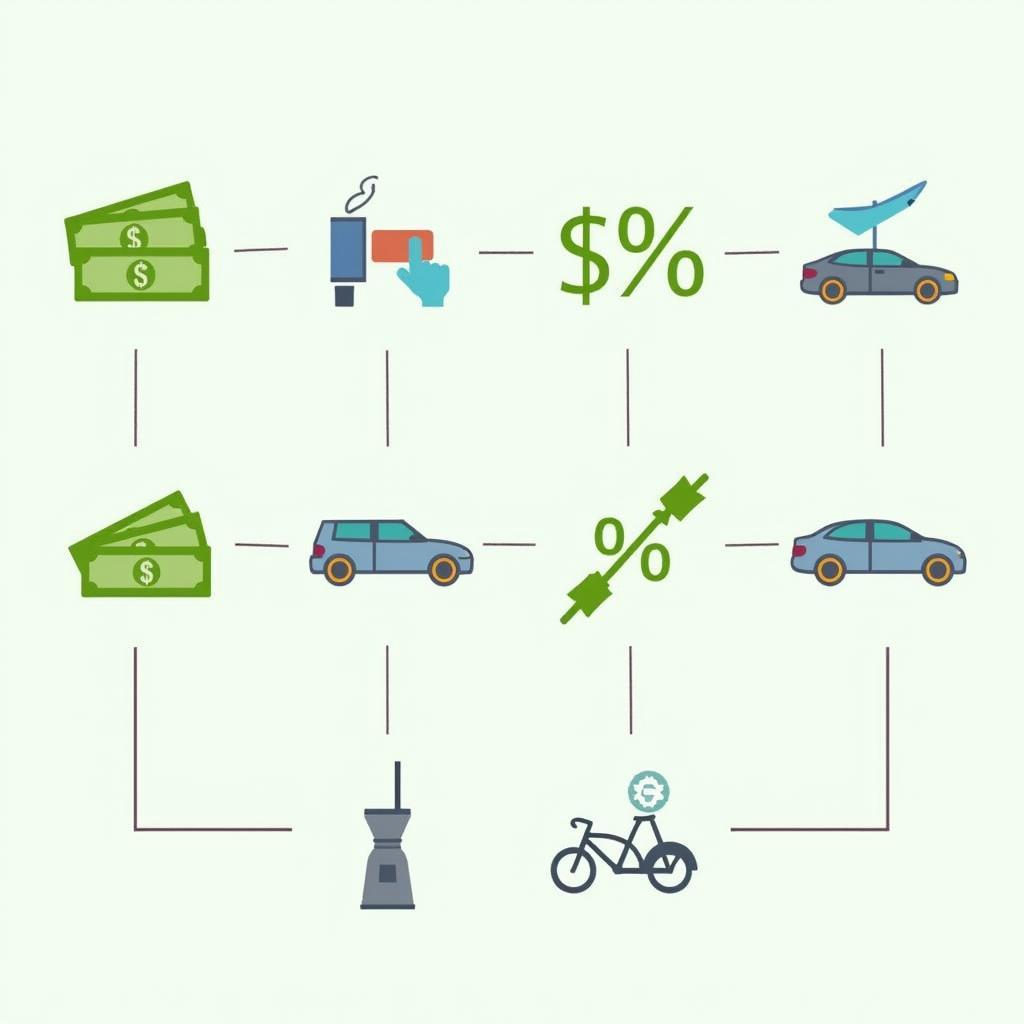

Auto loan services explained: A visual guide with icons representing loans, interest rates, and car purchases

Auto loan services explained: A visual guide with icons representing loans, interest rates, and car purchases

When you decide to buy a car, you might not have the full amount upfront. This is where auto loan services come in. These services connect you with lenders who are willing to provide you with the funds needed to purchase your desired vehicle. In return, you agree to repay the loan amount plus interest over a specified period.

Types of Auto Loans

There are various types of auto loans available, each catering to different needs and financial situations. Some common types include:

- New Car Loans: These loans are specifically designed for purchasing brand-new vehicles from dealerships.

- Used Car Loans: If you’re considering a pre-owned vehicle, used car loans can help finance your purchase from dealerships or private sellers.

- Refinancing: Refinancing involves replacing your existing auto loan with a new one, potentially securing a better interest rate or loan term.

- Lease Buyouts: If you’re currently leasing a car and wish to own it at the end of the lease term, you might need a lease buyout loan.

How Auto Loan Services Work

- Loan Application: The process begins with you applying for a loan from a bank, credit union, or online lender. You’ll need to provide information about your income, credit history, and desired loan amount.

- Loan Approval: Once your application is reviewed, the lender decides whether to approve your request and determines the loan amount, interest rate, and repayment terms.

- Funding: After approval, the lender disburses the loan funds directly to the seller or to you (if buying from a private seller), allowing you to complete the car purchase.

- Repayment: You’ll make monthly payments to the lender over the agreed-upon loan term, typically ranging from 36 to 72 months.

Navigating the World of Auto Loan Services

A person looking at auto loan options on a laptop, comparing interest rates and loan terms.

A person looking at auto loan options on a laptop, comparing interest rates and loan terms.

Choosing the right auto loan service and navigating the application process can seem daunting. Here are some essential tips to help you make informed decisions:

- Shop Around and Compare: Don’t settle for the first loan offer you receive. Compare rates and terms from multiple lenders to find the most competitive option.

- Check Your Credit Score: Your credit score plays a crucial role in determining the interest rate you qualify for. Obtain a free credit report and address any inaccuracies before applying.

- Understand the Loan Terms: Carefully review all loan documents, paying close attention to the interest rate, loan term, fees, and any prepayment penalties.

- Budget Wisely: Determine a monthly payment that fits comfortably within your budget to avoid financial strain.

- Read Reviews: Research different auto loan services and read customer reviews to gain insights into their reputation and customer service.

Benefits of Utilizing Auto Loan Services

- Accessibility: Auto loans make car ownership attainable for those who cannot afford to purchase a vehicle outright.

- Credit Building: Making on-time payments on your auto loan can positively impact your credit score, paving the way for future financial opportunities.

- Convenience: Auto loan services streamline the financing process, connecting you with reputable lenders and simplifying paperwork.

Conclusion

Auto loan services play a pivotal role in facilitating car ownership by providing individuals with the financial resources they need. By understanding the different loan types, navigating the application process effectively, and being mindful of key considerations, you can secure a favorable auto loan that aligns with your financial goals. Remember to prioritize research, comparison, and informed decision-making throughout your auto loan journey.

Need help finding the best auto loan services in Fairfax County, VA? Check out our resources on auto loan services fairfax county va for comprehensive information and expert guidance.

Frequently Asked Questions about Auto Loan Services

1. What is the average interest rate for an auto loan?

Auto loan interest rates vary based on factors such as credit score, loan term, and market conditions. However, the average interest rates typically range from 3% to 7%.

2. How does my credit score affect my auto loan application?

Your credit score is a significant factor in determining your loan eligibility and interest rate. A higher credit score generally translates to more favorable loan terms.

3. Can I get pre-approved for an auto loan?

Yes, many lenders offer pre-approval, allowing you to know how much you can borrow and at what interest rate before visiting a dealership.

4. What is the difference between a fixed-rate and variable-rate auto loan?

Fixed-rate loans have an interest rate that remains constant throughout the loan term, while variable-rate loans have interest rates that can fluctuate based on market conditions.

5. Can I refinance my auto loan in the future?

Yes, refinancing your auto loan can be beneficial if you qualify for a lower interest rate or want to adjust your monthly payments.

6. What happens if I miss an auto loan payment?

Missing a payment can negatively impact your credit score and may result in late fees. It’s crucial to contact your lender immediately if you anticipate any difficulties making a payment.

7. Are there any tax benefits to having an auto loan?

Depending on your location and individual circumstances, you may be able to deduct certain auto loan interest payments on your taxes. Consult with a tax professional for specific guidance.

Explore More Auto Service Resources

A wide shot of a used car dealership lot with a variety of vehicles on display

A wide shot of a used car dealership lot with a variety of vehicles on display

Interested in exploring used car options? Visit abc auto sale & services forest hill used cars to find your next vehicle.

Need Assistance with Auto Loan Services?

Contact us today via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our dedicated customer support team is available 24/7 to answer your questions and provide personalized guidance on navigating the world of auto loan services.