Auto Repair And Financial Services are intertwined aspects of car ownership. Maintaining your vehicle requires financial planning, whether it’s for routine maintenance or unexpected repairs. Understanding how these two areas intersect can empower you to make informed decisions and avoid financial strain.

Budgeting for Auto Repair and Maintenance

One of the most effective ways to manage auto repair costs is to establish a dedicated budget. This involves setting aside a specific amount of money each month to cover anticipated expenses like oil changes, tire rotations, and other routine services. Having a budget helps you avoid unexpected financial burdens and ensures you can address necessary repairs promptly.

- Estimate annual costs: Research the average maintenance costs for your specific make and model.

- Set a monthly savings goal: Divide the estimated annual cost by 12 to determine your monthly contribution.

- Track your spending: Monitor your auto repair expenses to ensure you stay within budget.

- Adjust as needed: Re-evaluate your budget periodically and make adjustments based on your vehicle’s age and condition.

At All Pro Auto Service Chicago, we understand the importance of preventative maintenance and offer comprehensive service packages to help you stay within your budget.

Exploring Financial Services for Auto Repairs

When faced with major repairs, many car owners turn to financial services to cover the costs. Options range from personal loans and credit cards to specialized auto repair financing programs.

- Personal loans: Offer fixed interest rates and repayment terms, making budgeting predictable.

- Credit cards: Provide convenient access to funds but may have higher interest rates.

- Auto repair financing: Some repair shops offer in-house financing plans, often with promotional rates or deferred interest options.

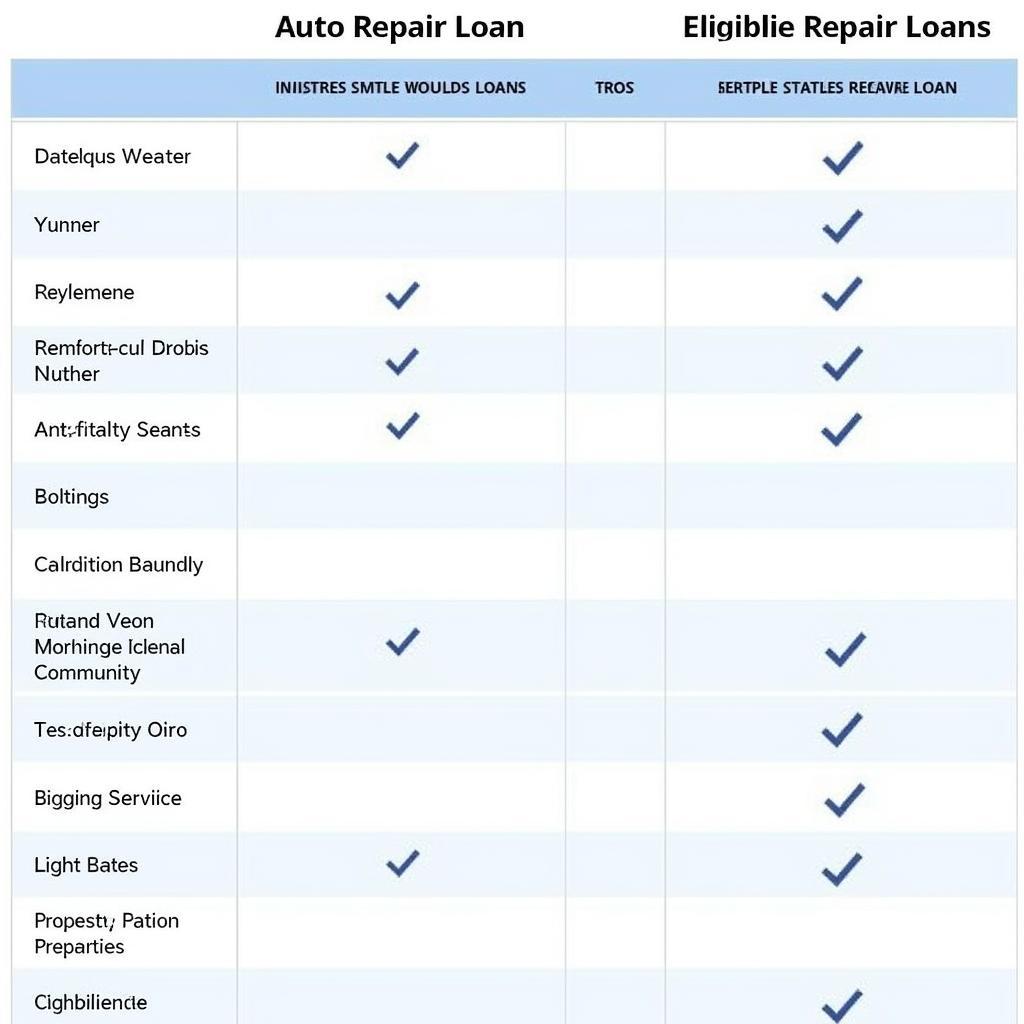

Comparing Auto Repair Loan Options

Comparing Auto Repair Loan Options

Understanding the Terms and Conditions

Before committing to any financing option, carefully review the terms and conditions, including interest rates, fees, and repayment schedules. Understanding these details will help you avoid unexpected costs and choose the most suitable option for your financial situation.

“Transparency in financial agreements is crucial,” says John Smith, Senior Financial Advisor at Automotive Finance Solutions. “Consumers should feel empowered to ask questions and understand all aspects of the loan before signing.”

Negotiating Repair Costs and Finding Affordable Options

Don’t hesitate to negotiate repair costs with your mechanic. Ask for a detailed breakdown of the charges and inquire about potential discounts or alternative repair solutions. Comparing quotes from multiple repair shops can also help you secure the best price. You might find affordable options like Affordable Auto Services Freeport Road New Kensington PA.

Leveraging Auto Service Coupons and Deals

Another strategy for reducing repair costs is to look for auto service coupons and deals. Many repair shops offer discounts on specific services or promotional rates for new customers. Websites like Auto Service Coupons Hamburg are great resources for finding current deals in your area. “Utilizing coupons and discounts can significantly reduce your out-of-pocket expenses,” advises Maria Garcia, Certified Auto Mechanic and owner of Garcia’s Auto Repair. “Small savings can add up over time.”

Planning for the Unexpected: Emergency Repair Funds

Establishing an emergency fund specifically for car repairs can provide peace of mind. This fund acts as a safety net, allowing you to handle unexpected breakdowns or accidents without jeopardizing your overall financial stability.

Creating an Emergency Fund for Car Repairs

Creating an Emergency Fund for Car Repairs

Even visiting a seemingly trusted garage like Hollywood Auto Service can lead to unexpected repair costs. It is wise to be prepared.

Conclusion

Auto repair and financial services are essential components of responsible car ownership. By proactively budgeting, exploring financing options, and negotiating repair costs, you can effectively manage the expenses associated with maintaining your vehicle. Remember, being informed and prepared is key to avoiding financial stress and enjoying a smooth driving experience. Consider services like J’s Auto Sales and Service Manchester Cars for maintenance to prevent large repair costs down the line.

FAQ

- What are the most common types of auto repair financing?

- How can I improve my car’s fuel efficiency to save money on gas?

- What are some signs that my car needs immediate repair?

- How often should I get my car serviced?

- Is it better to repair or replace an older car?

- What are the benefits of preventative maintenance?

- How can I find a reputable auto repair shop?

For assistance, contact us via WhatsApp: +1(641)206-8880, Email: [email protected], or visit our office at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.