Auto Service Credit Cards can be a valuable tool for managing unexpected car repairs or planned maintenance. They often offer special financing options, discounts, and rewards specifically for automotive services. Understanding the benefits and drawbacks of these cards can help you make informed decisions about your car care expenses. Let’s delve into the world of auto service credit cards and explore how they can benefit you. After the introduction, we’ll explore some important considerations when choosing an auto service credit card.

Understanding the Benefits of Auto Service Credit Cards

Auto service credit cards can provide a financial safety net for unexpected repairs. Imagine your car breaking down unexpectedly, leaving you with a hefty repair bill. An auto service credit card can provide the necessary funds to cover the costs without depleting your savings. These cards often come with promotional periods offering 0% APR for a certain timeframe, allowing you to pay for repairs over time without accruing interest. Some cards even offer exclusive discounts on parts and labor at participating auto service centers.

For planned maintenance, auto service credit cards can help you budget and manage the costs of regular upkeep. Using a dedicated credit card for car maintenance allows you to track your spending easily and take advantage of any rewards or cashback programs offered by the card. This can be especially helpful for budgeting larger maintenance expenses like tire replacements or brake jobs.

Check out service tire and auto moss bluff for more information on tire and auto services.

Choosing the Right Auto Service Credit Card: Key Considerations

Several factors should be considered when selecting an auto service credit card. First, evaluate the APR and any associated fees. While promotional 0% APR periods can be attractive, understanding the regular APR after the promotional period ends is crucial. Look for cards with low fees, including annual fees, late payment fees, and balance transfer fees.

Next, consider the acceptance network. Ensure the card is accepted at the auto service centers you frequent. Some cards are affiliated with specific brands or networks, while others have wider acceptance. Check if the card offers any rewards programs, such as cashback, points, or miles, that can offset the cost of your auto service expenses.

Finally, examine any special financing options offered by the card. Some cards provide deferred interest plans or promotional financing for larger purchases. Understanding these options can help you manage significant repair costs more effectively.

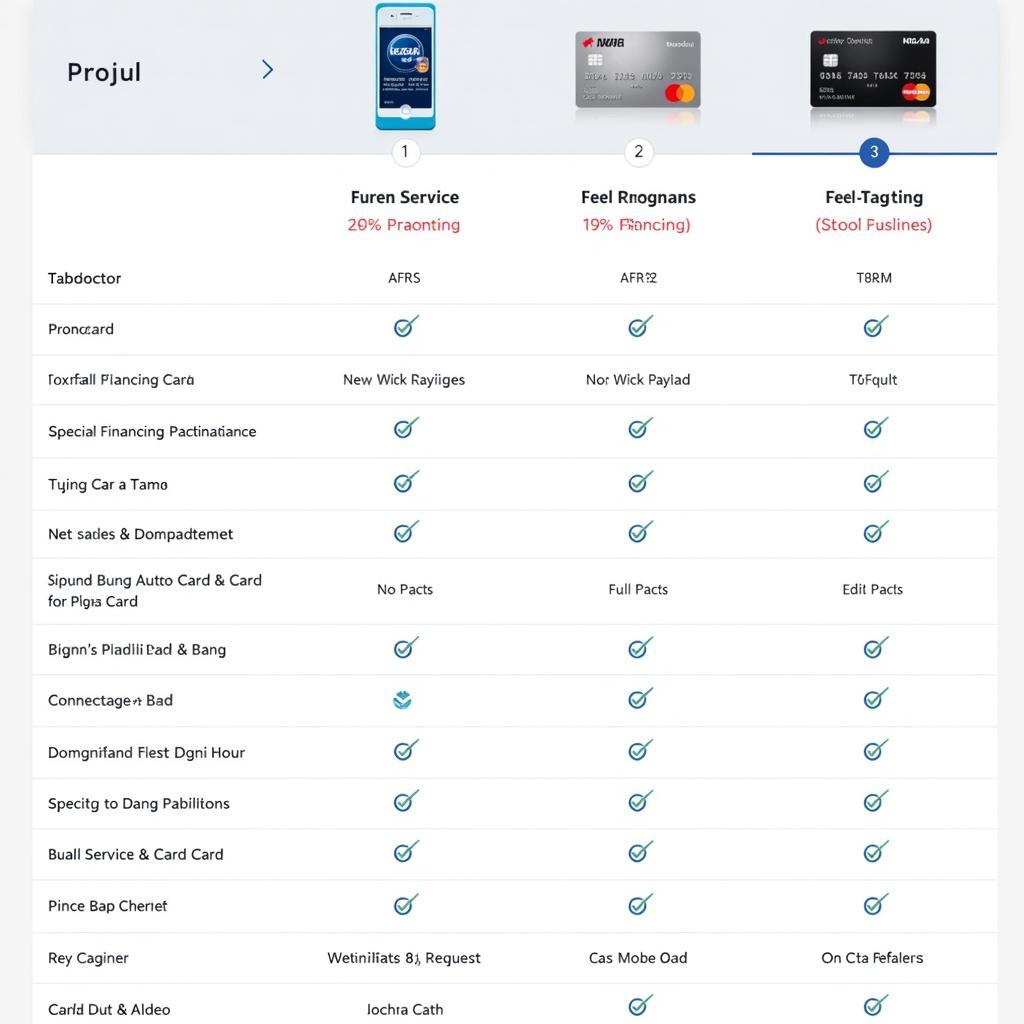

Comparison of Different Auto Service Credit Cards

Comparison of Different Auto Service Credit Cards

You might find the reviews for tuffy tire & auto service center north port reviews helpful when choosing a service center.

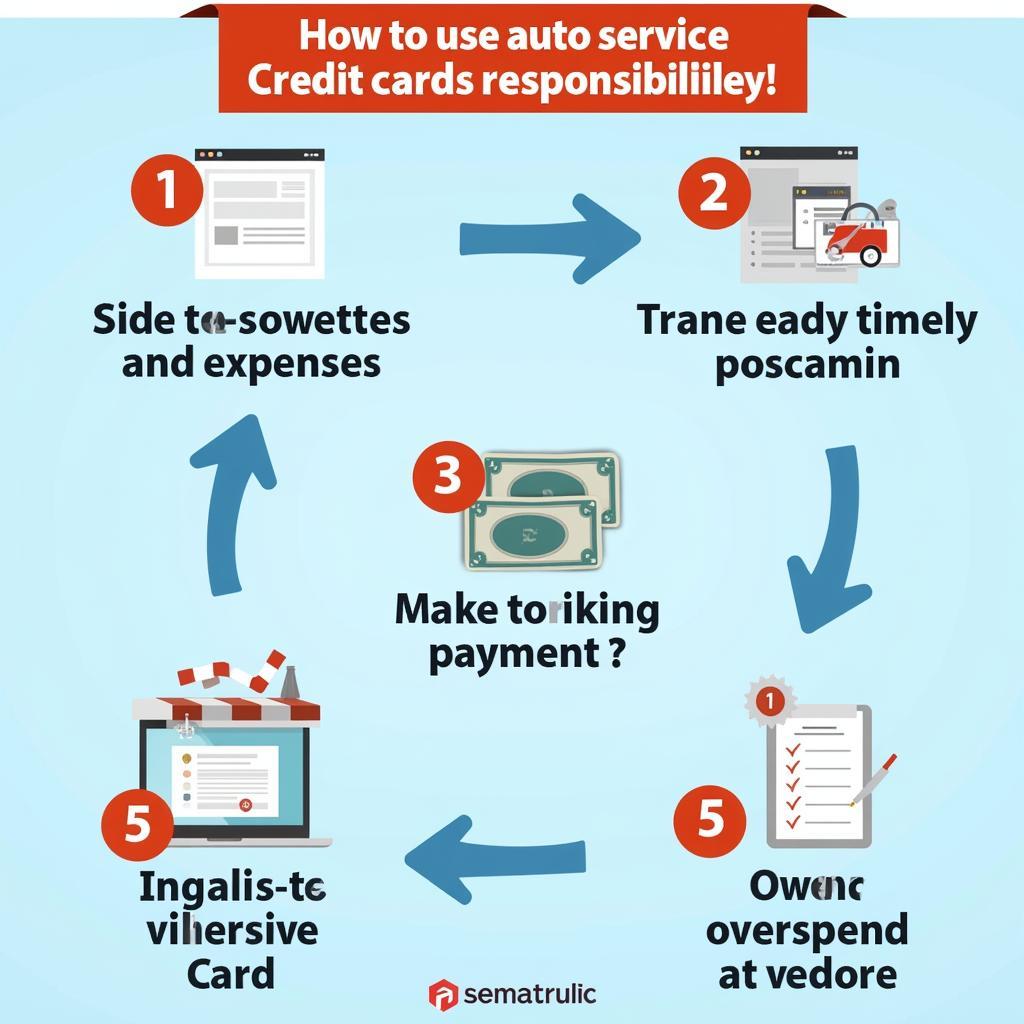

How Auto Service Credit Cards Work: A Step-by-Step Guide

Applying for an auto service credit card is generally a straightforward process. First, research and compare different cards to find one that suits your needs. Next, complete the application process, providing the required personal and financial information. Once approved, you’ll receive your card and can begin using it for eligible auto service expenses.

When using the card, be mindful of your credit limit and payment due dates. Making timely payments and keeping your credit utilization low can help you maintain a good credit score. If you utilize promotional financing offers, be sure to pay off the balance before the promotional period expires to avoid accruing interest.

How to Use Auto Service Credit Cards Responsibly

How to Use Auto Service Credit Cards Responsibly

Learn more about auto service centers at napa auto parts service center.

Conclusion

Auto service credit cards can offer a convenient and flexible way to manage car repair and maintenance expenses. By carefully considering the APR, fees, acceptance network, rewards programs, and special financing options, you can choose the right card to meet your needs and keep your car running smoothly. Understanding how these cards work and using them responsibly can help you take control of your car care budget and avoid financial strain from unexpected repairs. So, explore the available options and choose the auto service credit card that best fits your automotive needs.

FAQs

- What are the typical APRs for auto service credit cards? APRs vary depending on the card and your creditworthiness, but they can range from 15% to 25% or higher.

- Are there any annual fees associated with auto service credit cards? Some cards have annual fees, while others do not. Be sure to check the card’s terms and conditions.

- Can I use an auto service credit card for any type of car repair? Most auto service credit cards can be used for a wide range of repairs, including routine maintenance, major repairs, and even tire purchases. However, some cards may have restrictions.

- How can I avoid paying interest on purchases made with an auto service credit card? Take advantage of promotional 0% APR periods and pay off the balance before the promotional period expires.

- Do auto service credit cards offer any rewards programs? Many auto service credit cards offer rewards programs such as cashback, points, or miles.

- What should I do if my auto service credit card is lost or stolen? Contact the card issuer immediately to report the loss or theft and request a replacement card.

- How can I improve my chances of getting approved for an auto service credit card? Maintaining a good credit score and having a stable income can increase your chances of approval.

You can also find information on auto trust services at ats auto trust services. For auto service in Richmond, visit auto service richmond.

Need assistance? Contact us via WhatsApp: +1(641)206-8880, Email: cardiagtechworkshop@gmail.com, or visit us at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.