Understanding Goods and Services Tax (GST) implications on car repairs can be confusing. This article aims to clarify whether you can claim GST on car repair expenses and under what circumstances.

Decoding GST on Car Repairs: Who Can Claim?

GST, a consumption tax, applies to most goods and services in many countries. When it comes to car repairs, the ability to claim back the GST component often depends on how the vehicle is used. Generally, businesses registered for GST can claim back the GST paid on repairs and maintenance if the vehicle is used for business purposes. is gst input available on car repairs can provide more specific insights into this process. However, if the car is used solely for personal purposes, claiming GST on repairs is typically not allowed. This distinction is crucial for understanding your entitlements.

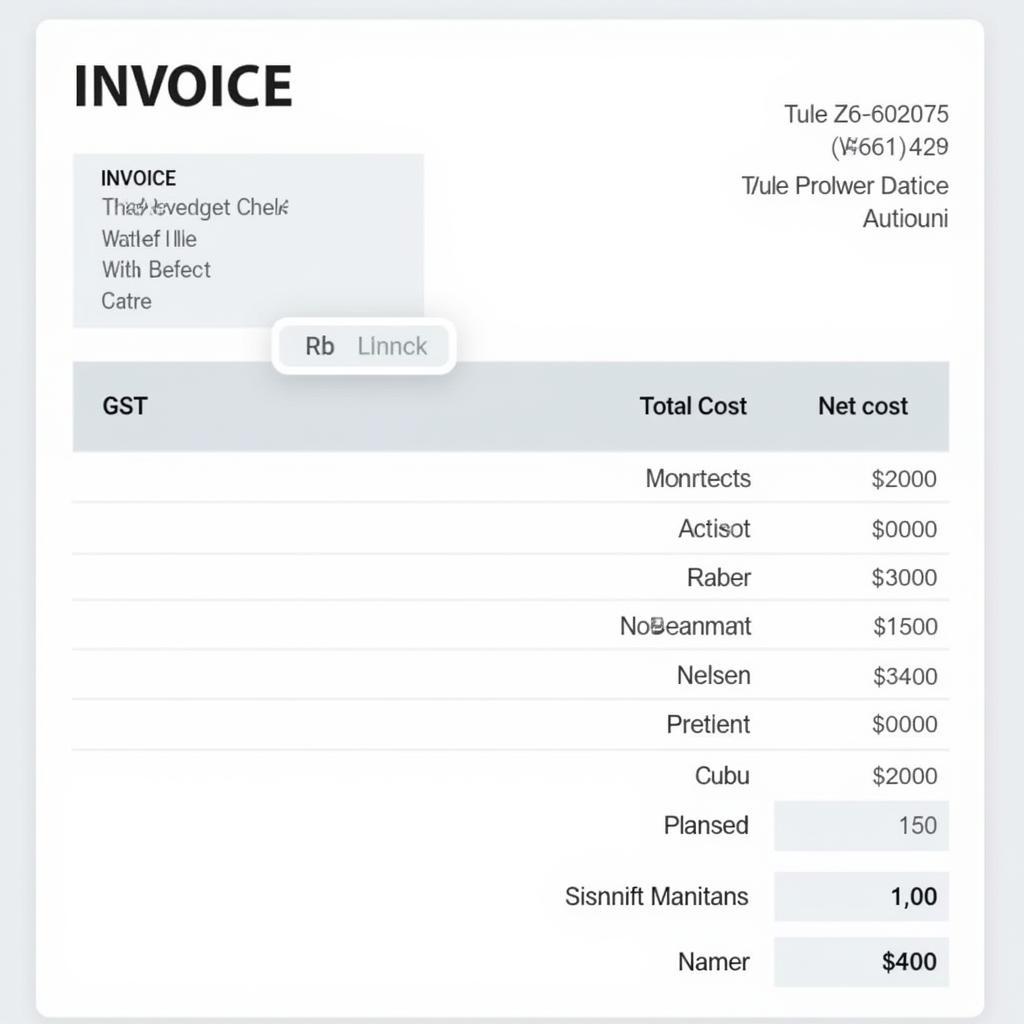

For businesses, claiming GST on car repairs can significantly reduce operating costs. Accurate record-keeping is essential for supporting your claims. Keep all invoices and receipts related to car repairs and maintenance, clearly indicating the GST amount.

GST Car Repair Invoice Example

GST Car Repair Invoice Example

GST on Car Repair: Business vs. Personal Use

The key factor determining GST reclaim eligibility is whether the vehicle is used for business or personal purposes. Businesses using vehicles for business activities, such as transporting goods or clients, can generally claim the GST paid on repairs. The logic is that the repair cost is a business expense directly related to generating income. Conversely, if the car is used solely for personal commuting or leisure activities, claiming GST is usually not permissible. is gst available on car repair explores this distinction in greater detail.

It’s important to note that even for business vehicles, private use needs to be considered. If there’s a mixed-use scenario, you may need to apportion the GST claim based on the percentage of business use. This requires accurate record-keeping of business and private mileage.

“Accurate mileage logs are crucial for justifying your GST claims on mixed-use vehicles. Don’t underestimate the importance of meticulous record-keeping,” advises John Miller, a certified public accountant at Miller & Associates.

Navigating the Complexities of ITC on Car Repairs

Input Tax Credit (ITC) is a mechanism that allows registered businesses to reduce their GST liability by offsetting the GST paid on inputs used in their business. is itc allowed on repair and maintenance of car delves into the specifics of ITC applicability on car repairs. While ITC is generally available for business-related car repairs, certain restrictions and conditions may apply. For instance, luxury cars or vehicles used primarily for personal purposes may not qualify for full ITC.

ITC Claim Documentation for Car Repair

ITC Claim Documentation for Car Repair

Specific Circumstances and Exceptions

While the general rules regarding GST on car repairs are relatively straightforward, certain exceptions and specific circumstances can add complexity. For example, the rules may differ for leased vehicles or vehicles purchased under a specific financing arrangement. Additionally, certain types of repairs, like those related to accidents or modifications, may have different GST implications.

“Understanding the specific regulations related to your vehicle type and usage is paramount for ensuring accurate GST claims,” adds Sarah Johnson, a senior tax consultant at Johnson Tax Advisory.

Conclusion: Claiming GST on Car Repair – A Summary

Claiming GST on car repair expenses is largely dependent on whether the vehicle is used for business or personal purposes. Businesses using vehicles for business activities can generally claim the GST, whereas private vehicle owners typically cannot. Accurate record-keeping is crucial, especially for mixed-use vehicles, to justify and support your claims. Consulting with a tax professional is recommended for navigating complex scenarios or specific exceptions.

FAQ

- Can I Claim Gst On Car Repairs if I’m a sole trader?

- What records do I need to keep to claim GST on car repairs?

- Are there any limitations on the amount of GST I can claim?

- How do I calculate the GST component of my car repair bill?

- What happens if I use my car for both business and personal purposes?

- Can I claim GST on car repairs if I lease my vehicle?

- Where can I find more information about GST regulations related to car repairs?

Common Scenarios for Claiming GST on Car Repairs

- Scenario 1: A business owner uses their vehicle solely for business purposes, such as deliveries. They can claim the full GST paid on repairs.

- Scenario 2: An employee uses their personal vehicle for work-related travel and receives reimbursement from their employer. The employer can claim the GST on the reimbursed expenses.

- Scenario 3: A freelancer uses their car for both personal and business purposes. They need to apportion the GST claim based on the percentage of business use.

Further Exploration

Explore these related articles for more insights: “Understanding GST on Vehicle Purchases” and “Maximizing Tax Benefits for Your Business Vehicle.”

Need assistance? Contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our customer service team is available 24/7.