Claiming GST input tax credit on car repairs can be a confusing area for many. This article aims to clarify whether you can claim GST on car repair expenses, the conditions that apply, and how to maximize your potential claims. Understanding the nuances of GST on car repair is crucial for both individuals and businesses.

Understanding GST Input on Car Repair

GST, or Goods and Services Tax, is a consumption tax levied on most goods and services sold in many countries. When you purchase a taxable good or service, you pay GST to the seller, who then remits it to the government. However, businesses registered for GST can claim back the GST they paid on their business expenses, known as input tax credit. This mechanism ensures that businesses only pay GST on the value they add to goods or services.

Whether or not you can claim GST input on car repairs depends heavily on how the vehicle is used. If the vehicle is used exclusively for business purposes, you can generally claim the full GST input tax credit. However, if the vehicle is used for both business and private purposes, the claim becomes more complex and you can typically only claim a portion of the GST paid. is gst available on car repair provides more details on this specific topic.

Conditions for Claiming GST Input on Car Repair

Several conditions must be met to successfully claim GST input tax credit on car repair expenses:

- Registered for GST: You must be a registered GST business.

- Tax Invoice: A valid tax invoice from the repairer is essential, specifying the GST amount separately.

- Business Purpose: The car repairs must relate directly to your business operations.

- Accurate Records: Maintain meticulous records of car usage, including logbooks for vehicles used for both business and private purposes.

Maximizing Your GST Input Claim on Car Repairs

To effectively maximize your GST claim, consider the following:

- Accurate Logbooks: Maintain detailed logbooks, recording all trips and the purpose (business or private) for each. This provides a clear basis for apportioning the GST claim.

- Separate Invoices: Request separate invoices for repairs relating to business and private use if possible.

- Consult a Tax Professional: If you’re unsure about your eligibility or the correct apportionment method, seek expert advice. A tax professional can provide tailored guidance to ensure compliance and maximize your claims.

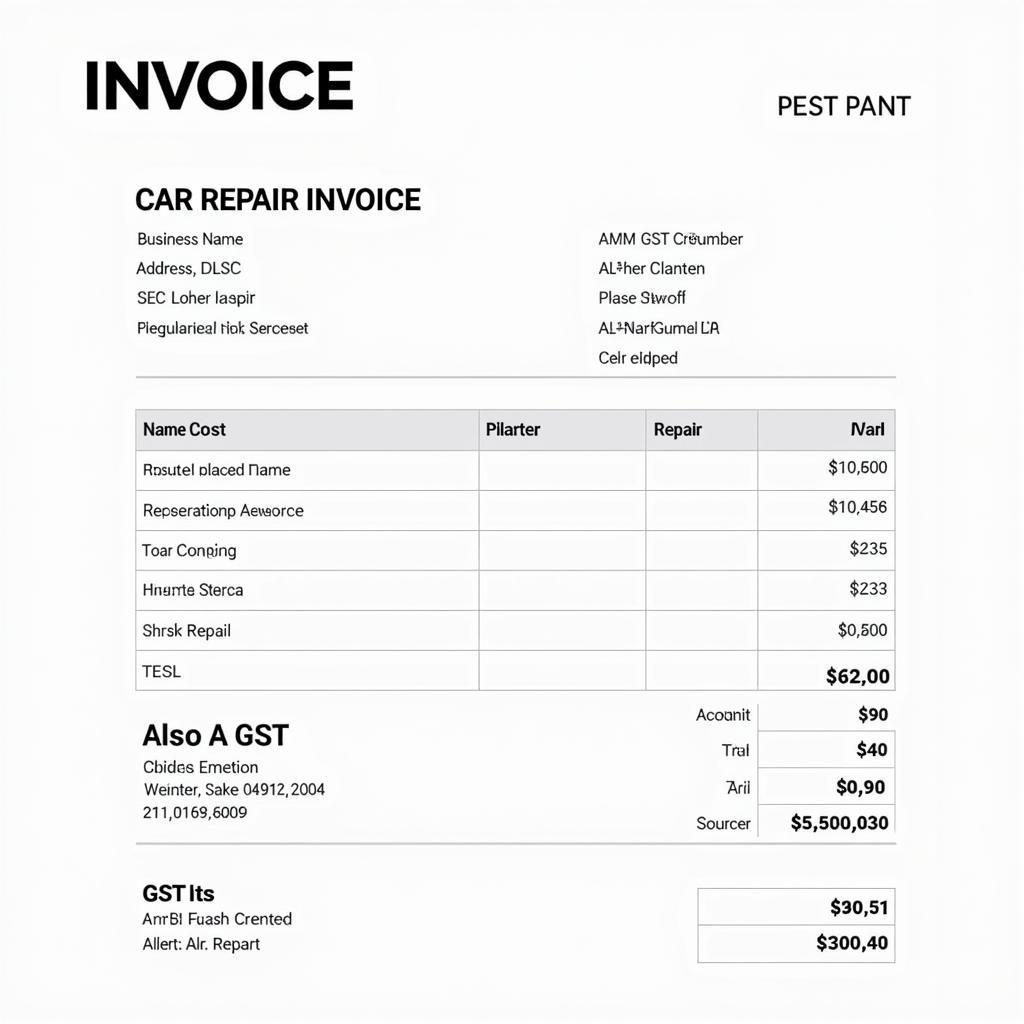

GST Input Tax Credit on Car Repair Invoice

GST Input Tax Credit on Car Repair Invoice

Can Private Individuals Claim GST Input on Car Repairs?

Generally, private individuals cannot claim GST input on car repairs. The input tax credit mechanism is designed for businesses registered for GST. However, there can be exceptions, especially for individuals running small businesses or using their vehicles for ride-sharing services. Consulting with a tax professional is advisable to determine eligibility in specific situations.

What if the Car is Used for Both Business and Personal Use?

When a vehicle is used for both business and personal purposes, you can claim a portion of the GST paid on repairs proportionate to the business use. This requires meticulous record-keeping through logbooks to substantiate the claim. is gst available on car repair offers further insights into the complexities of dual-purpose vehicle usage and GST claims.

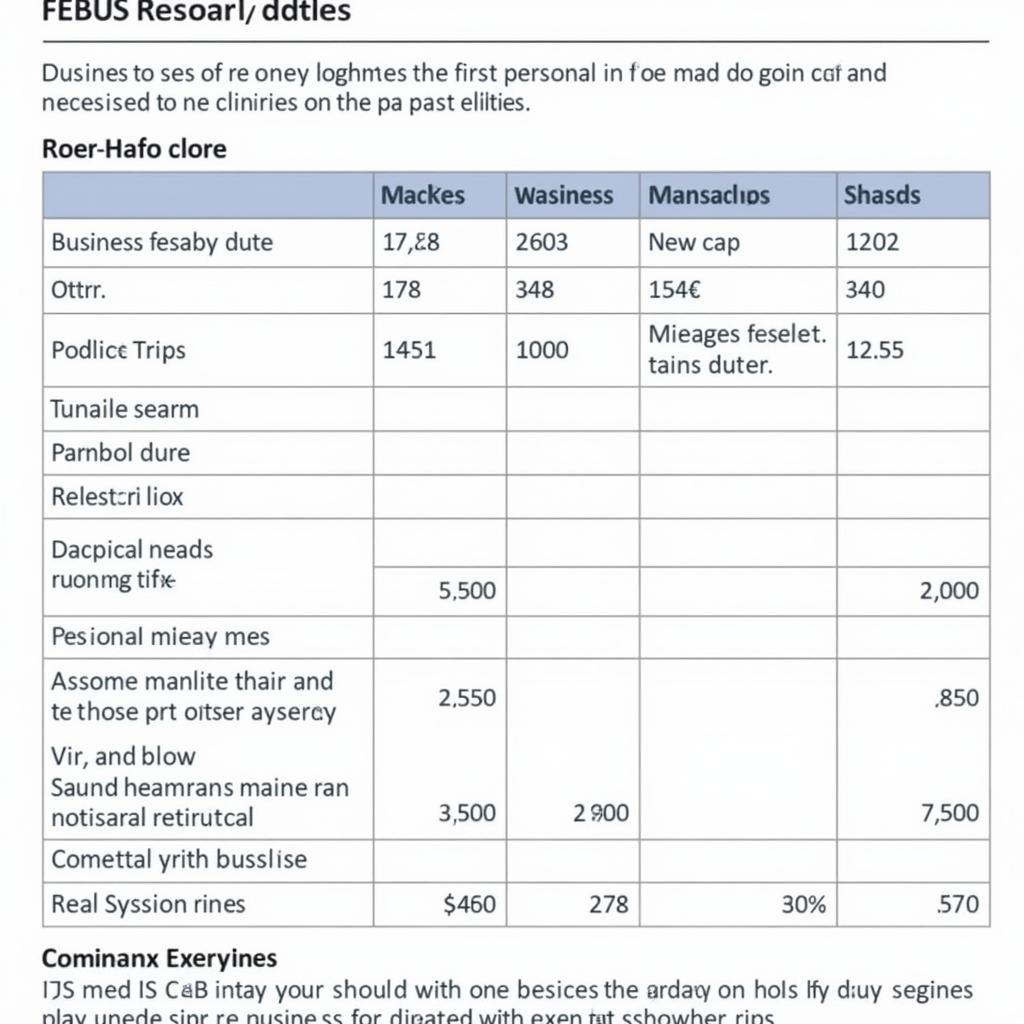

Car Logbook for GST Claim

Car Logbook for GST Claim

Common Issues with Claiming GST Input on Car Repairs

One common issue is insufficient documentation. Without proper tax invoices and accurate logbooks, substantiating the claim becomes challenging. Another common problem is incorrect apportionment of GST for dual-purpose vehicles. Understanding the specific rules and regulations in your jurisdiction is vital for accurate apportionment and avoiding penalties.

John Smith, Senior Tax Consultant at TaxWise Solutions, advises, “Maintaining accurate and detailed records is paramount for successful GST claims. A well-maintained logbook can save you significant time and potential disputes with tax authorities.”

GST on Car Repair: Different Scenarios

The application of GST on car repairs varies based on the nature of the repair and the type of vehicle. For example, repairs to commercial vehicles used solely for business purposes generally allow for a full GST input claim. However, repairs related to modifications or enhancements might have different implications.

Maria Garcia, Automotive Accountant at AutoFinance Pro, adds, “Understanding the specific regulations related to your type of vehicle and the nature of the repair is crucial for optimizing your GST claims. Consulting an expert can help navigate these complexities.”

Conclusion

Claiming GST input on car repair can offer significant tax benefits for businesses. Understanding the eligibility criteria, maintaining accurate records, and consulting a tax professional when needed can ensure you maximize your claims and remain compliant with GST regulations. Remember, accurate documentation and a thorough understanding of the rules are key to a smooth and successful claim process. Don’t hesitate to further explore the details on is gst available on car repair.

FAQ

- What is a valid tax invoice for car repairs?

- How do I maintain a logbook for car usage?

- Can I claim GST on car repairs if I am a sole trader?

- What happens if I am audited for my GST input claims?

- Where can I get more information on GST regulations for car repairs?

- Can I backdate my logbook if I haven’t been keeping one?

- What are the penalties for incorrectly claiming GST input?

For further assistance, please contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our customer support team is available 24/7.