Is Car Repair Insurance Worth It? That’s a question many car owners grapple with. Repair costs can be a significant financial burden, and insurance offers a sense of security. But is it always the right choice? This article will delve into the pros and cons of car repair insurance, helping you make an informed decision for your individual needs.

Car repair insurance, also known as mechanical breakdown insurance, covers the costs of repairing your vehicle due to mechanical or electrical failures. It differs from your standard auto insurance policy, which typically covers damages from accidents or collisions. Understanding this key distinction is crucial in determining whether this type of coverage aligns with your budget and risk tolerance. Having a comprehensive understanding of what’s covered, what’s not, and the associated costs will empower you to make the best decision for your circumstances.

What Does Car Repair Insurance Typically Cover?

Car repair insurance policies can vary, but they generally cover repairs to essential components like the engine, transmission, steering, brakes, electrical system, and air conditioning. Some plans even offer roadside assistance and rental car reimbursement. However, routine maintenance like oil changes, tire rotations, and brake pad replacements are typically excluded. Understanding these exclusions is crucial when evaluating the true value of a car repair insurance policy. If you’re regularly maintaining your vehicle, the coverage might not be as necessary as it would be for someone who neglects routine upkeep. You can learn more about whether AC repair is covered under your car warranty in this article: is ac repair covered car warranty.

Understanding Exclusions and Limitations

Before signing up for any car repair insurance policy, meticulously review the terms and conditions, paying particular attention to the exclusions and limitations. These often include pre-existing conditions, wear and tear, and damage caused by negligence or misuse.

Car Repair Insurance Coverage Explained

Car Repair Insurance Coverage Explained

Weighing the Pros and Cons of Car Repair Insurance

Benefits of Having Coverage

- Financial Protection: The primary advantage is protection from unexpected and potentially high repair costs.

- Peace of Mind: Knowing you’re covered can alleviate stress and provide peace of mind.

- Budgeting: Regular premiums can make car repairs more predictable and easier to budget for.

Potential Drawbacks

- Cost: Premiums can add up, especially for older vehicles or those with a history of mechanical problems.

- Limited Coverage: Policies often have specific exclusions and limitations, so not all repairs will be covered. Are you wondering about repairing a totaled car? Check out our article on can a totaled car be repaired.

- Overlap with Warranty: If your car is still under warranty, car repair insurance might be redundant.

Car Repair Insurance Cost vs. Benefit

Car Repair Insurance Cost vs. Benefit

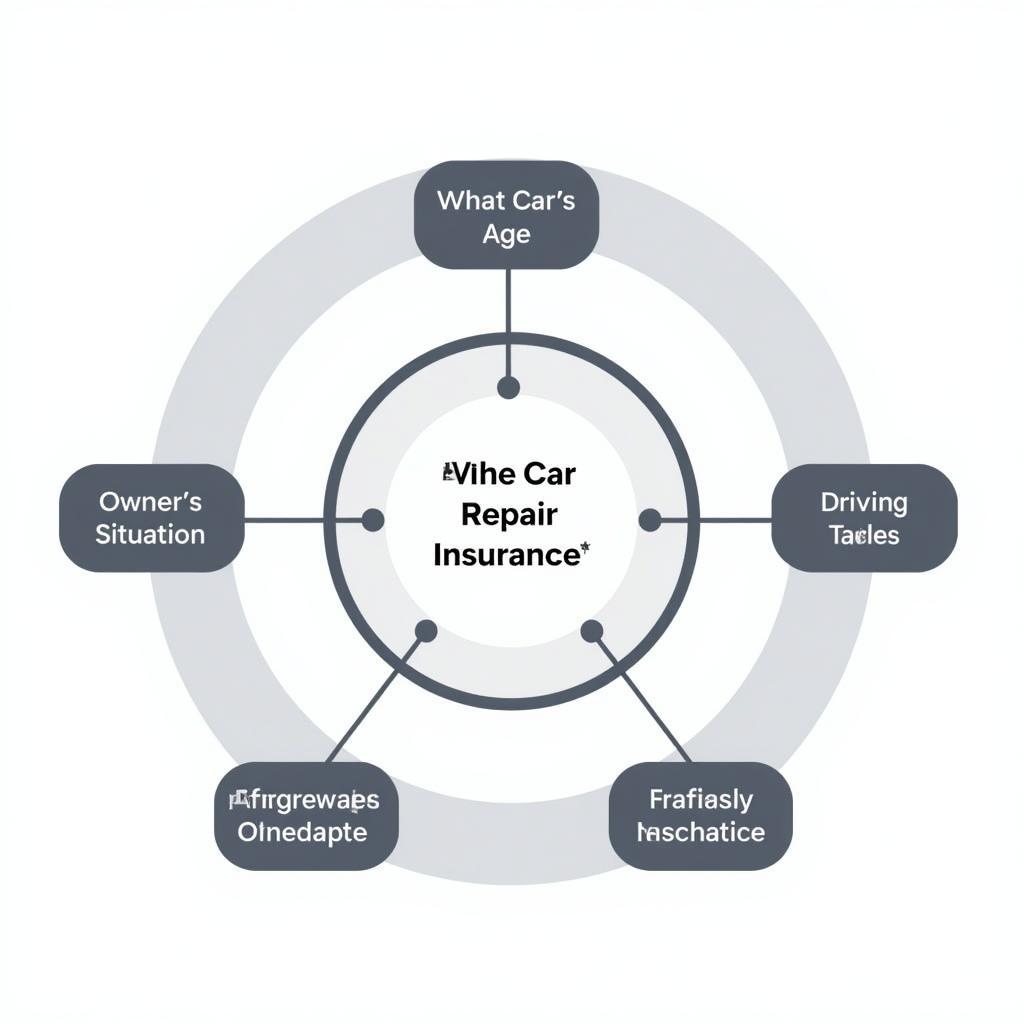

Is Car Repair Insurance Right for You?

Determining whether car repair insurance is a good investment depends on several factors:

- Age and Condition of Your Vehicle: Older cars are more prone to breakdowns, making insurance potentially more valuable.

- Your Financial Situation: If you have limited savings, insurance can protect you from unexpected expenses. You can also read more on how to claim car insurance for repairs: can i claim car insurance for repairs.

- Your Driving Habits: If you drive frequently or in harsh conditions, your car may require more repairs.

- Your Risk Tolerance: If you prefer to avoid financial risks, insurance can provide a safety net. Consider the cost of repairing scratches, as discussed in how much does it cost for scratches on car repair.

“Car repair insurance is a crucial consideration for those with older vehicles or limited savings,” says automotive expert John Smith, Senior Mechanic at Smith Automotive Solutions. “It’s about weighing the cost of premiums against the potential for significant repair bills.”

Factors Affecting Car Repair Insurance Need

Factors Affecting Car Repair Insurance Need

“Remember to thoroughly research and compare different policies to find the best coverage for your specific needs,” adds Smith. “Don’t just focus on the price; consider the coverage limits, exclusions, and the reputation of the insurance provider.” Another critical factor to consider is whether a flooded engine can be repaired, as detailed in our article can the flooded engine of car be repaired.

Conclusion

Is car repair insurance worth it? The answer depends on your individual circumstances. Carefully weigh the pros and cons, consider your personal needs and financial situation, and compare different policies before making a decision. Ultimately, car repair insurance can provide valuable peace of mind and protection against unexpected repair costs.

FAQ

- What is car repair insurance?

- What does car repair insurance cover?

- How much does car repair insurance cost?

- Is car repair insurance the same as a warranty?

- What are the exclusions in car repair insurance?

- How do I choose the right car repair insurance policy?

- When is car repair insurance most beneficial?

For any assistance or inquiries, feel free to contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our customer support team is available 24/7.

Leave a Reply