Navigating the world of auto insurance can be overwhelming. With so many providers and policy options available, it’s essential to understand your needs and how to find the best fit. This guide will cover key aspects of true auto insurance services, from understanding different coverage types to choosing a reputable provider and making a claim. We will also discuss the importance of comparing quotes and understanding the fine print of your policy.

Decoding True Auto Insurance Services: Coverage Types Explained

Understanding the various coverage types available is crucial for selecting true auto insurance services that meet your specific requirements. Liability coverage is mandatory in most states and covers damages you cause to others in an accident. Collision coverage pays for repairs to your vehicle after a collision, regardless of fault. Comprehensive coverage protects your car from non-collision incidents, such as theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage protects you if you’re hit by a driver without sufficient insurance. Medical payments coverage helps pay for medical expenses related to an accident, regardless of fault.

It’s important to remember that the minimum required coverage may not be sufficient to protect you fully. Consider your financial situation and the value of your vehicle when choosing your coverage limits. Higher coverage limits offer greater financial protection in the event of a serious accident.

Choosing the Right Auto Insurance Provider

Choosing a reputable insurance provider is as important as selecting the right coverage. Look for companies with a strong financial rating, excellent customer service, and a clear claims process. Compare quotes from multiple providers to ensure you’re getting the best price for the coverage you need.

Comparing True Auto Insurance Quotes Online

Comparing True Auto Insurance Quotes Online

Don’t hesitate to ask questions and clarify any doubts before signing a policy. You might find resources like auto appraisal services near me useful when determining your car’s value. Understanding your policy thoroughly is crucial for ensuring you’re adequately protected.

Filing an Auto Insurance Claim: A Step-by-Step Guide

Knowing how to file a claim is crucial when you need your true auto insurance services. First, gather all necessary information, including the date, time, and location of the accident, the contact information of the other driver(s) involved, and any witness information. Contact your insurance company as soon as possible to report the incident and start the claims process. Cooperate with your insurance adjuster and provide all requested documentation. You can explore resources like true auto insurance services letter for guidance on communicating effectively with your insurance provider. For those in Texas, true auto insurance services fort worth tx can provide localized information and assistance.

How Much Does True Auto Insurance Cost?

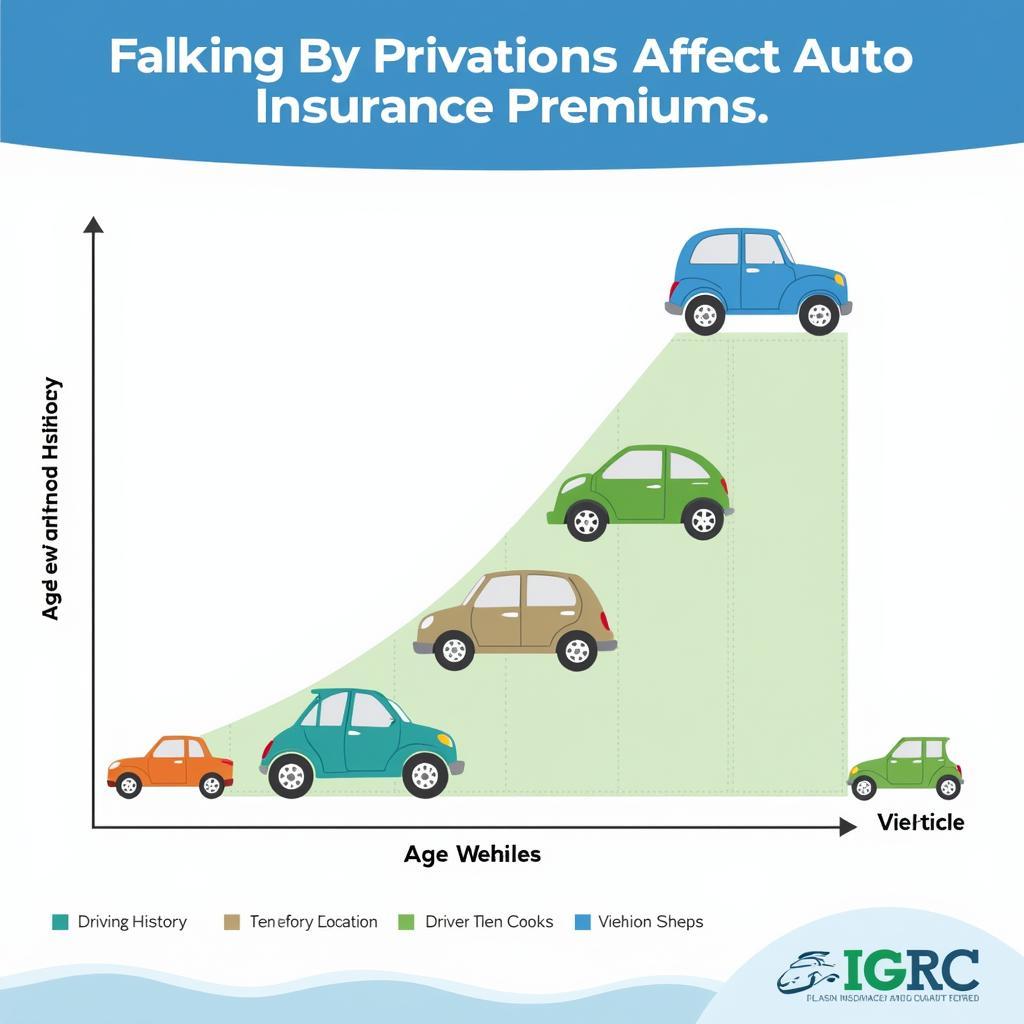

Several factors influence auto insurance costs. Your driving record, age, location, and the type of vehicle you drive all play a role. Comparing quotes from different providers is the best way to find the most affordable rates.

Factors Affecting True Auto Insurance Costs

Factors Affecting True Auto Insurance Costs

Conclusion

Finding the right true auto insurance services involves understanding your needs, researching coverage options, choosing a reputable provider, and understanding the claims process. By taking the time to research and compare, you can secure the best protection for yourself and your vehicle.

FAQs

- What is the minimum auto insurance coverage required? (This varies by state, check your local regulations.)

- How can I lower my auto insurance premiums? (Maintain a clean driving record, consider a higher deductible, and shop around for quotes.)

- What information do I need to file a claim? (Date, time, and location of the accident, other drivers’ information, and witness information.)

- What is the difference between collision and comprehensive coverage? (Collision covers accidents, while comprehensive covers non-collision incidents like theft or natural disasters.)

- How do I choose the right auto insurance deductible? (Balance your budget and risk tolerance. A higher deductible lowers premiums but increases out-of-pocket expenses in case of a claim.)

- What is gap insurance? (Covers the difference between the actual cash value of your car and the amount you owe on your loan.)

- How can I compare auto insurance quotes? (Use online comparison tools or contact multiple insurance providers directly.)

For further assistance, you can refer to our articles on auto appraisal services phoenix arizona.

Need help with true auto insurance services? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected] or visit our office at 321 Birch Drive, Seattle, WA 98101, USA. Our customer service team is available 24/7.